Advertisement|Remove ads.

Is Snap Buyout Target: Nearly 50% Of Stocktwits Users Say Snapchat Parent Will Likely Be Acquired In Next 2 Years

Santa Monica, California-based Snap, Inc. (SNAP) will likely be bought out in the near- to medium term, according to a poll of platform users by Stocktwits.

The social media and camera company’s shares came under selling pressure last week after the company reported better-than-expected fourth-quarter results and issued positive first-quarter sales guidance.

The adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) guidance was soft, as the company signaled increased investment ahead.

Snap shares have been trading sideways in a consolidative move around depressed levels since the middle of 2022. The stock trades way off its all-time high of $83.34, hit on Sept. 24, 2021.

The main reason for the stock weakness is the company’s inability to grow advertising revenue as much as some of its bigger social media peers such as Meta Platforms, Inc. (META). The uncertainty over the fate of Chinese short-video app TikTok is also serving as an overhang on the stock.

Following the fourth-quarter print, the stock received a slew of price target cuts as sell-side analysts braced for a "re-investment period" ahead.

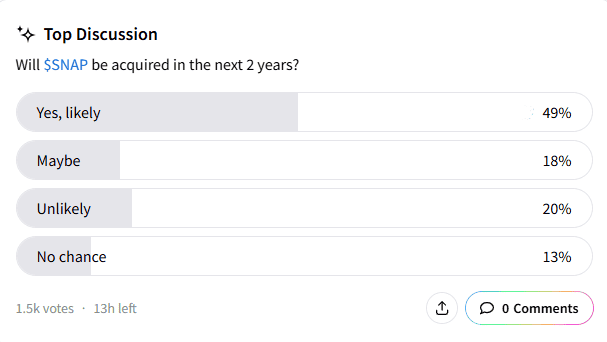

Responses to an ongoing Stocktwits poll showed that 49% of the platform users think the company will likely be acquired in the next two years. Eighteen percent said the company guessed it may be, while the remaining respondents do not see it as a possibility.

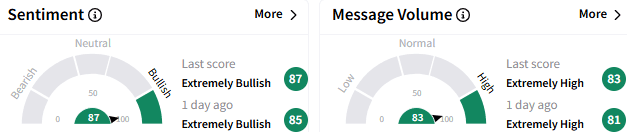

Sentiment toward Snap stock remained ‘extremely bullish’ on Stocktwits platform, with the buoyant mood accompanied by ‘extremely high’ message volume.

A platform user predicted a move higher for Snap stock this week, potentially burning the shorts.

Snap shares ended Friday’s session up 2.15% at $10.92. The stock is up 1.4% so far this year after its 36% slide in 2024.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Apple_Siri_jpg_30dce91b4f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2257248307_jpg_6720435e43.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2248586785_jpg_9c6ef18a07.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_btc_x_96cc54b79b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_brian_armstrong_coinbase_2_jpg_59a44ebea9.webp)