Advertisement|Remove ads.

Klarna Stock Edges Higher Premarket — What's Driving Gains?

Klarna stock (KLAR) ticked up in premarket trading on Thursday after the buy-now, pay-later firm launched a flexible debit card and digital wallet in the UK.

“This launch marks a significant step forward in Klarna’s mission to disrupt retail banking and become an everyday spending partner to the UK’s consumers,” the Sweden-based firm said in a statement.

The firm said that through the Klarna balance digital wallet, customers can store their e-money, add funds from a payment card, transfer funds to a connected card, and use their Klarna balance to settle Klarna payments.

The Klarna card is expected to offer dual benefits of debit and credit. The company said that the card’s purchases are debit by default, but consumers can apply for a spending plan for purchases when “credit makes sense.”

After its initial launch in the U.S. in July, the Klarna Card quickly garnered one million sign-ups within 11 weeks. Klarna's card portfolio now accounts for 10% of its global transactions.

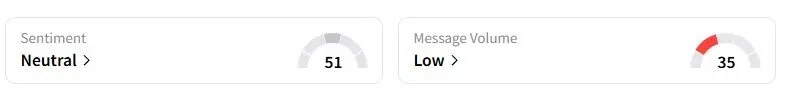

Retail sentiment on Stocktwits about Klarna was in the ‘neutral’ territory at the time of writing.

The latest move by the Swedish firm comes amid intense competition in the BNPL space. Earlier this week, Klarna announced its support for Google's (GOOG) Agent Payments Protocol, an open standard designed to enable secure, agent-led payments across digital environments.

Earlier this month, several brokerages initiated coverage of the stock with a ‘Buy’ rating. Goldman Sachs analysts noted that Klarna is the market leader in BNPL solutions, with a powerful franchise in Europe. The firm said the company offers a new closed-loop payment scheme, similar to American Express in the United States. Goldman analysts also expected the company to gain market share over time.

Klarna's stock has fallen 5.6% since its listing in September, when it raised $1.37 billion in IPO proceeds.

Also See: Bitcoin Dips Below $111,000 On Mounting China-US Trade Tensions

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_x_0d62438a6d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Circle_Internet_jpg_add0182c9c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1227710498_jpg_fbb12d04bf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)