Advertisement|Remove ads.

Lockheed CEO Flags Impairment Charges After Program Review, But Retail Investors Signal Bullish Take

Lockheed Martin (LMT) CEO Jim Taiclet stated on Tuesday that an ongoing program review process has identified new developments, resulting in the company taking an impairment charge to address these newly identified risks, mainly in its Aeronautics business segment and certain international helicopter programs at its Sikorsky unit.

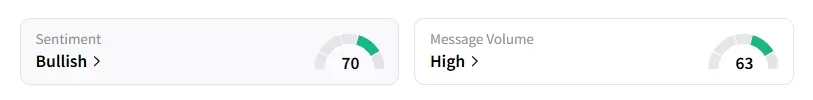

Retail sentiment on the stock improved to ‘bullish’ from ‘bearish’ with ‘high’ levels of chatter, according to Stocktwits data. The user message count on Lockheed Martin jumped over 800% on Stocktwits in the last 24 hours.

Shares of Lockheed Martin were down 7.3% in early trading after the company flagged an impairment charge and also missed quarterly revenue estimates.

The company recorded pre-tax losses of $1.6 billion on these programs, primarily driven by challenges on a classified program in its Aeronautics segment, which encountered design, integration, and testing challenges. These trends are expected to continue into 2025.

Lockheed Martin said this has had a greater impact on schedule and costs than previously estimated. It also stated that it is having ongoing discussions with the customer regarding a potential restructure of certain contractual terms and conditions, as well as expanding the scope of work to be beneficial to both parties in its Canadian Maritime Helicopter Program.

The company now expects its 2025 annual profit to be between $21.70 and $22.00 per share, compared to its previous forecast of $27.00 to $27.30 per share.

Lockheed Martin’s second-quarter total sales came in at $18.16 billion, compared with Wall Street expectations of $18.54 billion, according to data compiled by Fiscal AI.

The stock has fallen 12% year-to-date and was down nearly 15% over the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Also See: Philip Morris’ Strong Smoke-Free Products Demand Ignites Retail Hype

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1005541622_jpg_8079d8d434.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137832_jpg_1de3e68131.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bmnr_OG_jpg_83d4f3cc27.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_us_iran_jpg_753ef9f5af.webp)