Advertisement|Remove ads.

Madrigal Pharma Stock Sees Buyout Hype – Retail Predicts ‘Huge’ Deal On Liver Disease Drug Momentum

- Retail traders on Stocktwits drove a surge in takeover speculation amid Madrigal’s strong momentum around its liver-disease drug Rezdiffra.

- Fresh analyst target hikes followed new two-year clinical data showing sustained improvements in key liver-health measures.

- Broader interest in metabolic and liver-disease treatments intensified after major breakthroughs across the obesity and inflammation drug space.

Madrigal Pharmaceuticals Inc. trended on Stocktwits early Monday as retail traders fueled a burst of takeover speculation following weeks of positive clinical updates for its NASH drug Rezdiffra and rising analyst price targets.

Takeover Buzz Builds On Stocktwits

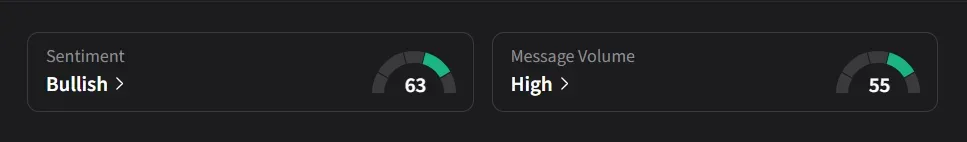

On Stocktwits, retail sentiment for Madrigal was ‘bullish’ amid ‘high’ message volume.

One user said the stock “could easily get bought out for 800+ a share,” while another argued that Madrigal’s valuation is “only 12B market cap for the first ever NASH drug that’s been doing crazy numbers.” Others posted that a “buyout [is] coming up,” while another user said any potential “Buy will be huge here.”

Analysts Lift Targets As New Rezdiffra Data Rolls Out

The retail surge followed another round of analyst upgrades. Earlier this month, Canaccord raised its price target on Madrigal to $587 from $526 and maintained a ‘Buy’ rating. H.C. Wainwright lifted its target to $568 from $500 following positive two-year data, and then again on Friday to $620 after speaking with key opinion leaders who reported “robust real-world uptake” across F2, F3 and F4c data.

Oppenheimer raised its target to $650 from $600 last Thursday while keeping an ‘Outperform’ rating, noting that new Rezdiffra updates strengthened confidence in commercial opportunities. Truist increased its target last Wednesday to $640 from $580 and reiterated a ‘Buy’ rating, citing increased conviction in Rezdiffra’s potential in MASH F4 patients.

Rezdiffra Data Shows Sustained Improvements

Madrigal presented new two-year data at the AASLD Liver Meeting this month, reporting that Rezdiffra improved liver stiffness, fibrosis biomarkers and markers associated with clinically significant portal hypertension risk. The company also reported sustained improvements in disease-specific quality-of-life measures in both cirrhotic and non-cirrhotic patients.

Metabolic Drugs Draw Market Attention

The broader metabolic-health category remained in focus after Eli Lilly surpassed a $1 trillion valuation on Friday, underscoring the rapid expansion of obesity and metabolism-related therapies. The surge in global demand for newer treatments has helped intensify investor attention on companies developing drugs for liver disease, metabolic dysfunction, and inflammation.

Obesity Developments Keep The Space In Focus

Updates from other obesity-related programs also kept the category in the spotlight. Altimmune recently reported AI-based biopsy findings from its Phase 2b IMPACT trial, which is being tested in obesity and MASH and showed fibrosis reductions in select pemvidutide groups.

Viking Therapeutics continued to draw retail interest earlier this month as its obesity pipeline gained momentum following recent sector dealmaking. Last month, Ventyx Biosciences posted positive Phase 2 data for its oral anti-inflammatory drug VTX3232 in participants with obesity and cardiovascular risk factors, reporting reductions in multiple inflammation biomarkers.

Madrigal Pharmaceuticals’ stock has risen 78% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227231004_jpg_0de480c6f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254924041_jpg_892ccf911d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1234736300_jpg_881ee00045.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218899763_jpg_5d8b51f97d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump_golden_dome_resized_jpg_38d699de1f.webp)