Advertisement|Remove ads.

Michael Burry Digs Up ‘One Chart To Refute Them All’ As He Sounds Fresh AI Bubble Alarm

- Burry warned that history might repeat itself, citing three previous booms and busts.

- Some social media users view the AI bubble as a correlation, rather than a cause, of the current bull run in the market.

- Wedbush’s Daniel Ives said this tech bull market is likely to persist for at least another two years.

Michael Burry has issued another warning about a potential artificial intelligence (AI) bubble waiting to burst, even as the market has experienced considerable volatility in recent sessions. Burry accurately predicted the housing market bubble well ahead and profited from its collapse in 2008.

The Invesco QQQ Trust (QQQ) ETF, which tracks the Nasdaq 100 Index, has shed more than 3% since the start of November, as concerns about an AI bubble have mounted. The ETF, however, is up about 19.5% this year.

Chart Tracking Historic Booms

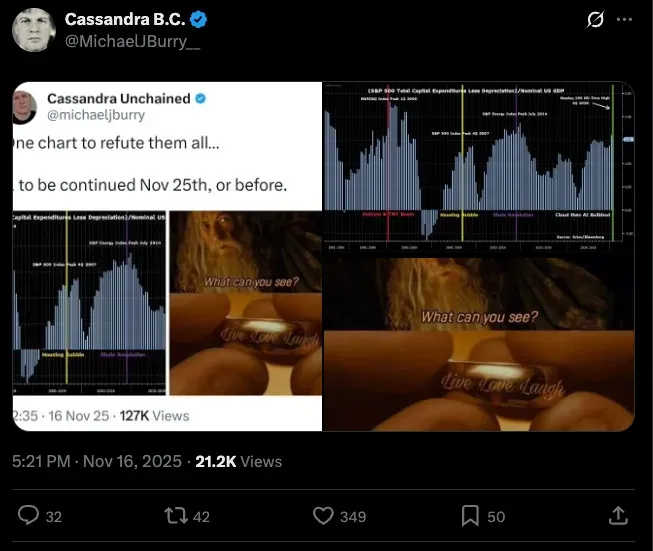

Burry shared a chart showing market plunges after three past bubbles, leaving his followers to guess what could follow the current surge in cloud and AI capital spending.

The chart showed the Nasdaq 100 peaking in 2000, driven by the dot-com mania and increased investment in the technology, media, and telecom (TMT) sectors, followed by its subsequent collapse. The housing market bubble of the early 2000s, driven by aggressive subprime lending, led the S&P 500 Index to a high in 2007, before the bubble burst, causing the index to drop sharply.

The Shale revolution, spearheaded by hydraulic fracturing and horizontal drilling in the mid-2000s, boosted U.S. oil production by 7 million barrels per day. It helped assert the country’s energy independence and also provided the nations around the world with an alternative supply source. The chart Burry shared showed the S&P Energy Index peaking around July 2014, followed by a sharp pullback.

The chart also underscored rising spending on Cloud and AI currently, and the Nasdaq 100, an index comprising 100 non-financial tech companies, hitting all-time highs in the fourth quarter. The index scaled a new peak of 26,182.10 on Oct. 29, and it has since lost about 4.5%.

Burry's post on X also carried the text “One chart to refute them all….” The short-seller may have been referring to those who are optimistic about the AI revolution unfolding over multiple years.

His followers held mixed views about his post. One of them suggested another bubble may arise after the AI wave. “AI is probably bigger than the DOT.com bubble, but who knows. What comes after will be the money maker - humanoid robots. Keep money for that,” they said. Another argued that “It’s not necessarily bubble. They look more like correlation instead of causation.”

A user also took a jibe at Burry and said, “Closed fund to become [a] content creator.”

Burry’s AI Skepticism

After a nearly two-year hiatus, Burry reappeared on X in late October, flagging a bubble and advising investors not to play it. Later, he posted about rising TMT capital expenditure and the circular deals occurring in the AI industry.

The “Big Short” fame hedge fund manager also warned about big techs, including Meta, Alphabet, Oracle, Microsoft, and Amazon, using a higher useful life for networking/computing assets, thereby artificially boosting profits. He stated that Meta and Oracle may be overstating earnings by over 20% each by 2028 due to this.

In a separate post, Burry took a potshot at Palantir, another AI darling, and against which his hedge fund Scion Asset Management had taken a massive short bet in the third quarter. His firm has since deregistered with the SEC.

All through his social media return, he has been flagging a venture, the nature of which he hasn’t clarified yet. He issued another teaser toward it in his latest post. “To be continued Nov 25th, or before,” he said in the post.

AI Evangelist Stays Bullish

Wedbush analyst Daniel Ives has dismissed the AI bear chatter circulating on the Street. In a note released on Friday, the analyst said, “While the bears will continue to yell ‘AI Bubble' from their hibernation caves, we continue to point to this tech capex supercycle that is driving this 4th Industrial Revolution into the next few years.”

Citing field checks, the analyst stated that AI use cases are expected to drive trillions of dollars in spending over the next few years, adding that this tech bull market is likely to persist for at least another two years.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264020227_jpg_4d7420bef3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)