Advertisement|Remove ads.

Mind Medicine's Net Losses Swell In Q4, But Retail Finds At Least 3 Reasons To Stay Bullish

Shares of Mind Medicine Inc. climbed 3.6% on Thursday and extended gains after hours, with retail sentiment improving following the company's fourth-quarter earnings report.

The psychedelics treatment developer reported a net loss of $34.7 million for the quarter ended Dec. 31, 2024, widening from a $23.8 million loss a year earlier, largely due to higher research and development costs tied to its MM120 and MM402 programs.

MM120, MindMed's lead drug candidate, is designed to treat generalized anxiety disorder (GAD), while MM402 is being developed to address core symptoms of Autism Spectrum Disorder (ASD).

However, the company's adjusted Q4 loss per share of $0.41 narrowed from $0.59 a year ago, though it missed analyst expectations of a $0.28 loss.

CEO Rob Barrow remained upbeat, stating that 2024 was a "year of significant progress" and that the company had achieved key milestones leading into multiple Phase 3 clinical readouts for MM120, which he expects to drive MindMed's next growth phase.

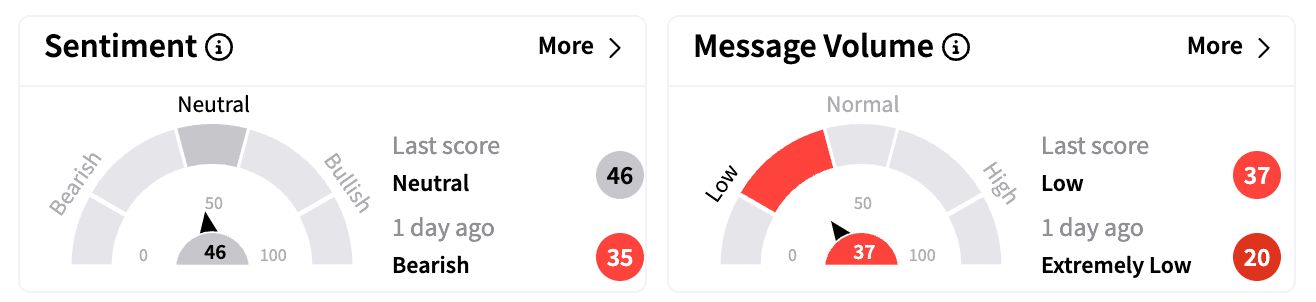

On Stocktwits, sentiment for MNMD shifted from 'bearish' to 'neutral' in the 24 hours leading up to Thursday, with message volume surging 250%.

One user expressed confidence in MM120's potential, saying, "Once Phase 3 [of the MM120 study] passes, this is going to blow up."

Another key factor boosting optimism was MindMed's strong cash reserves. The company ended 2024 with $273.7 million in cash and cash equivalents, up from $99.7 million a year earlier, which the company expects to be sufficient to support operations into 2027.

One user wrote, "We won't have to do any more reverse splits. MNMD has cash reserves until approvals."

Additionally, traders pointed to potential government support under new Health and Human Services chief Robert F. Kennedy Jr., who has previously advocated for the decriminalization of psychedelics for therapeutic use.

The company also plans regulatory and pre-commercialization activities for MM120's orally disintegrating tablet (ODT) version.

One watcher pointed out that although MNMD lags behind competitor Compass Pathways in clinical progress, its broader drug pipeline gives it an edge.

Mind Medicine shares remain down over 7% year-to-date but have gained over 10% in the past 12 months.

According to Koyfin, of the 11 analysts covering the stock, seven rate it a 'buy,' while four have a 'strong buy' rating.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227231004_jpg_0de480c6f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254924041_jpg_892ccf911d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1234736300_jpg_881ee00045.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218899763_jpg_5d8b51f97d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump_golden_dome_resized_jpg_38d699de1f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222922178_jpg_42dd8f319f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)