Advertisement|Remove ads.

Nifty Ends Below 24,600 As Pharma, IT, And Realty Sectors Lead Weekly Losses

Indian equity markets ended the week in the red amid heavy selling pressure, brought on by U.S. President Donald Trump’s proposed 25% tariff on Indian exports.

The Nifty 50 closed 0.82%, or 203 points, lower at 24,565.35, while the Sensex ended 0.72% lower at 80,599.91 on Friday.

Broader market indices closed in the negative, with the Nifty Midcap 50 and the Nifty Smallcap closing 1.54% and 1.77% lower, respectively.

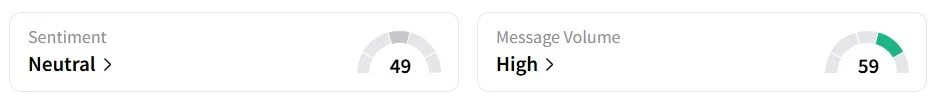

Retail chatter surrounding the Nifty 50 increased on Stocktwits, but investor sentiment remained ‘neutral’ at market close. It was ‘bearish’ a week ago.

Stock Moves

Barring FMCG’s 0.7% gains, all sectors ended in the red. The Nifty Pharma index (-3.33%) was the biggest laggard, while IT (-1.85%), realty (-1.78%), metals (-1.97%), and PSU banks (-1.13%) also dragged the markets.

Trent was the top gainer on the Nifty 50 index, closing 3.2% higher. Royal Enfield motorcycle maker Eicher Motors rose 2.2% after posting a 9% increase in quarterly net profit and a 15% revenue growth.

Sun Pharma was the biggest laggard on the Nifty 50 index after closing 4.5% lower. The pharmaceutical company reported a 20% drop in consolidated net profit to ₹2,279 crore for Q1FY26.

Other pharma stocks, including Cipla (-3.19%) and Dr. Reddy’s Laboratories (-3.85%), were also among the top decliners on the Nifty 50.

Adani Group’s flagship company, Adani Enterprises, closed 3.67% lower after its profits halved in the first quarter of FY26.

Global View

European markets were bleeding on Friday, with Germany’s DAX down 1.55%, the FTSE 100 0.6% lower, and the AEX Amsterdam Index falling by 1.2%.

Apart from Malaysia’s FTSE Bursa Malaysia KLCI Index, major Asian markets closed in the red.

For updates and corrections, email newsroom[at]stocktwits[dot]com

/filters:format(webp)https://news.stocktwits-cdn.com/incyte_resized_jpg_4f94b32a2f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_lantheus_jpg_e10c71c486.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_battery_swap_jpg_de98f34bea.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_anthropic_OG_jpg_51bd14bc5d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2233516954_jpg_72241a7246.webp)