Advertisement|Remove ads.

Nio Stock Dips Premarket As China EV Slowdown Overshadows Shorter ES8 Delivery Wait Times

- Nio shortened delivery wait times for its third-generation ES8 to 13-14 weeks, down from more than 24 weeks at launch in September.

- The improvement comes as China’s auto market enters a seasonal slowdown tied to new purchase taxes and delayed trade-in subsidies.

- ES8 demand strengthened through late 2025, with the model becoming China’s best-selling large SUV in December.

Nio Inc. shares slipped 1% in premarket trading on Tuesday, despite the company cutting delivery wait times for its third-generation ES8 SUV as China’s auto market enters a slower seasonal period.

Customers ordering the ES8 now face an estimated delivery window of 13-14 weeks, roughly half the 24–26 weeks seen at launch in September, according to a report by CnEVPost. The wait time has steadily declined over recent months, easing from more than 20 weeks in October to 15–16 weeks last week.

ES8 Demand Strengthens Through Late 2025

Deliveries of the updated ES8 began on Sept. 21, with about 40,000 units delivered through the end of 2025. On Sunday, Nio announced the 50,000th delivery of the third-generation model.

Retail sales jumped in the fourth quarter of 2025, rising from 2,803 units in September to 6,703 units in October and 10,689 units in November before surging to 22,258 units in December, making the ES8 China’s best-selling large SUV for the month.

Nio Stands Out Amid China EV Slowdown

The delivery improvements come as China’s broader auto market weakens early in the year. From Jan. 1 to Jan. 11, new energy vehicle retail sales fell 38% year on year and 67% month on month, while total passenger vehicle sales declined 32% year on year, according to data from the China Passenger Car Association.

The slowdown comes as buyers adjust to a new vehicle purchase tax and wait for trade-in subsidies to kick in, with demand also expected to stay muted ahead of the Spring Festival holiday in mid-February.

However, Macquarie struck a more optimistic tone last week, upgrading Nio shares to 'Outperform' from 'Neutral' and raising its price target to $6.10 from $5.30, citing stronger-than-expected demand for the ES8 and Firefly models. The firm said volume growth of nearly 40% remains achievable in 2026, even as it trimmed targets for several peers.

Growth Outlook And 2026 Plans

Earlier this month, CEO William Li said the company is targeting 40%–50% annual sales growth across its three brands and remains confident it can reach profitability in the fourth quarter of 2026.

The automaker delivered 326,028 vehicles in 2025, up 47% year on year, driven by demand for the ES8 and Onvo L90. Looking ahead, Nio plans to shift its 2026 lineup fully to its third-generation platform, launch new models including the ES9 SUV, and expand further in domestic and overseas markets through a distributor-led approach.

How Did Stocktwits Users React?

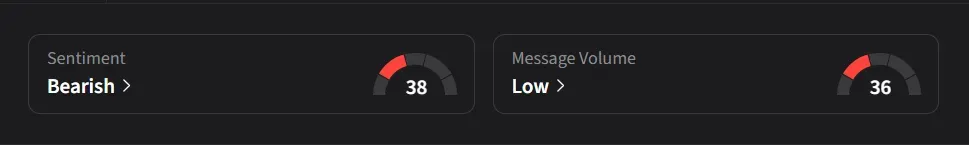

On Stocktwits, retail sentiment for Nio was ‘bearish’ amid ‘low’ message volume.

Nio’s stock has risen 13% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1813801150_jpg_9e452258fa.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2190302521_jpg_796f64970e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194612888_1_jpg_5f7b7f6186.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1384896168_jpg_87fab3f04d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263571605_jpg_f769289486.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233719278_jpg_46dfac21ee.webp)