Advertisement|Remove ads.

Nio Stock Rises After-Hours Following 10 Straight Losses As EV Maker Opens Its Autonomous-Driving Chip To External Buyers

- Nio has begun licensing its Shenji NX9031 autonomous-driving chip to an external buyer as part of its cost-cutting and revenue diversification push.

- The company is restructuring its chip unit and expanding partnerships as it works toward Q4 profitability.

- Some traders on Stocktwits expect clarity after the company's Nov. 25 earnings and others anticipate a bounce once profitability improves.

Nio, Inc.’s U.S.-listed shares rose in after-hours trading on Wednesday after the company reportedly began licensing its autonomous-driving chip technology to external buyers, marking the first commercial step for one of its most capital-intensive businesses.

The company’s U.S.-listed stock ended 3.9% lower at $5.75 on Wednesday, extending their losing streak to 10 sessions, before ticking up 1.3% to $5.83 in after-hours trading.

The company has reportedly started supplying its in-house high-end smart-driving chip, the Shenji NX9031, to another automotive chip company under a technology licensing arrangement. Contract values vary based on licensing structure, with single intellectual property licenses typically priced in the millions of yuan and system-on-a-chip (SoC) licensing deals potentially reaching hundreds of millions of yuan, according to industry estimates, according to a report by CnEVPost.

Cost Pressures And Profitability Goals

The licensing activity comes as Nio accelerates cost-cutting and pushes to diversify revenue sources amid ongoing cash flow pressure and a goal to meet fourth-quarter (Q4) profitability commitments.

Nio introduced the Shenji NX9031 in December 2023. The ET9 sedan, which began deliveries in late March, uses two NX9031 chips, while other new Nio models integrate one. Nio has said a single NX9031 chip offers computing power equivalent to four mainstream autonomous-driving chips, while earlier Nio vehicles relied on four Nvidia Orin X chips for similar workloads.

Openness To Industry Adoption

Earlier this year, Nio founder and CEO William Li said the company’s chip and operating system would be open to the wider industry and encouraged peers to adopt them. “If you want to buy the best chips, you can come to Nio,” he said at the time.

Nio has been restructuring its chip operations throughout the year, including establishing an independent project entity, Anhui Shenji Technology, which was registered in June, with Nio vice president Bai Jian listed as its legal representative. The entity’s business scope includes chip design and sales, and its creation paved the way for it to accept orders from other automakers.

Nio Strengthens Chip Ecosystem

In November, Anhui Shenji formed a joint venture with Axera Semiconductor and OmniVision Integrated Circuits Group. Axera holds the largest stake and has expanded rapidly in the automotive chip segment, having completed a Series C funding round exceeding 1 billion yuan earlier this year. The company has mass-produced its M55 and M76 driver-assistance chips, with higher-end products for urban navigation on autopilot still under development.

Earnings In Focus

Investors are also watching closely ahead of Nio’s quarterly results, which are scheduled for release before the U.S. market opens on Nov. 25. Estimates compiled by Koyfin point to revenue of $3.14 billion for the period, up from $2.65 billion a year earlier. EBITDA is forecast at a loss of $414.99 million, while EBIT is expected to come in at a loss of $519.77 million, compared with a loss of $685.22 million last year. GAAP EPS is estimated at a loss of $0.23, with adjusted EPS projected at a loss of $0.22.

Stocktwits Traders Look To Earnings For A Turn

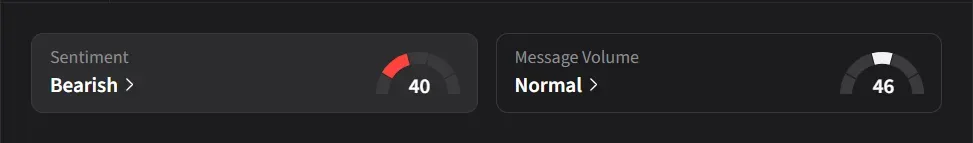

On Stocktwits, retail sentiment for Nio was ‘bearish’ amid ‘normal’ message volume.

One user said, “Only a few more trading days, the clouds will clear on November 25 and the future progress of NIO will be more understood.”

Another user said a bounce was likely at some point, arguing that if shareholders stopped the knee-jerk selling and waited for Nio to turn profitable, the share price would climb.

Nio’s U.S.-listed stock has risen 32% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2235337192_jpg_56c00409cf.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_marvell_logo_OG_jpg_dfc748dd9b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2232147590_jpg_a31aecbfad.webp)