Advertisement|Remove ads.

Nvidia, Chip Stocks Tumble As Alibaba’s AI Model Adds To Market Jitters – Retail More Concerned About Trump’s Tariffs

Nvidia (NVDA) and other chip stocks plummeted on Thursday as concerns over tightening U.S. trade policies and rising competition in artificial intelligence (AI) applications from China pressured the sector.

Alibaba Group (BABA) unveiled a new artificial intelligence (AI) reasoning model, QwQ-32B, claiming it matches the capabilities of DeepSeek’s R1.

In a post on X (formerly Twitter), Alibaba’s AI unit claimed its new model, with 32 billion parameters, delivers performance comparable to DeepSeek’s R1, which operates on 671 billion parameters.

It said the model is now accessible through its chatbot service, Qwen Chat, where users can select different Qwen variants, including Qwen2.5-Max, the most powerful in the series.

The AI rollout followed the Chinese government’s pledge on Wednesday to expand support for key industries, including artificial intelligence, humanoid robots, and 6G telecommunications.

The announcement added to investor concerns that Chinese firms are closing the technology gap with U.S. chipmakers.

Nvidia’s shares declined more than 5% in afternoon trading, while Taiwan Semiconductor Manufacturing Co. (TSMC) (TSM), ASML Holdings (ASML), and Texas Instruments (TXN) lost over 3%.

Qualcomm (QCOM) and Advanced Micro Devices (AMD) also slipped more than 2%.

Broadcom (AVGO), set to report earnings after the bell, dropped more than 6%, dragging the iShares Semiconductor ETF (SOXX) down 4%.

Sentiment was also dented by jitters over new U.S. tariffs and increasing restrictions on chip exports to China, which could curb growth for companies heavily reliant on global demand.

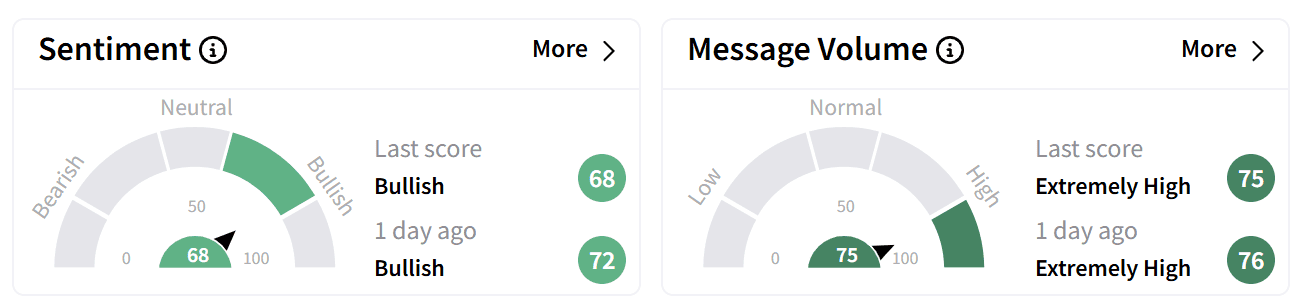

Retail sentiment on Stocktwits around Nvidia’s stock dipped slightly but remained in the ‘bullish’ zone. The message volume stayed at ‘extremely high’ levels.

Many traders expressed frustration over the Trump administration’s tariffs and their potential impact on markets.

Investors are also looking forward to Nvidia hosting Quantum Day at its GTC conference on March 20, an event expected to showcase its advancements in quantum computing.

Despite posting strong earnings, Nvidia’s stock has traded below its 200-day simple moving average (SMA) since Feb. 27. Analysts have flagged concerns about gross margins coming under pressure.

The stock has gained 26% in the past year but is down 18% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read also: On Semi Stock Tumbles To 3-Year Lows As Allegro Microsystems Jumps After Rejecting Buyout Offer

/filters:format(webp)https://news.stocktwits-cdn.com/large_jamie_dimon_jpmorgan_jpg_cbdd07fa63.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Git_Lab_resized_49b70b74d0.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_So_Fi_new_6d7889a863.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_2026_4_jpg_bb96bc484b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2249860610_jpg_2888fdef75.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_novo_nordisk_ozempic_wegovy_jpg_786cdf3b34.webp)