Advertisement|Remove ads.

Nvidia’s Gains Cut Nearly In Half From Year’s Peak: Time To Buy The Dip?

- High-profile critics, including Michael Burry, questioned hyperscaler capital expenditures, accounting practices, and valuation discipline.

- Despite these concerns, analysts highlighted improving relative valuations, upcoming product cycles, potential China policy relief, and strong long-term demand drivers supporting Nvidia’s growth outlook.

- Retail traders remain largely bearish on Nvidia, citing intensifying competition, China-related uncertainty, and fears that the AI trade is becoming increasingly crowded.

Nvidia Corp.’s (NVDA) stature as the flagship artificial intelligence play wasn’t enough to keep the stock ahead of its megacap tech peers this year. Meanwhile, several lesser-known companies with only indirect exposure to AI delivered outsized returns for shareholders.

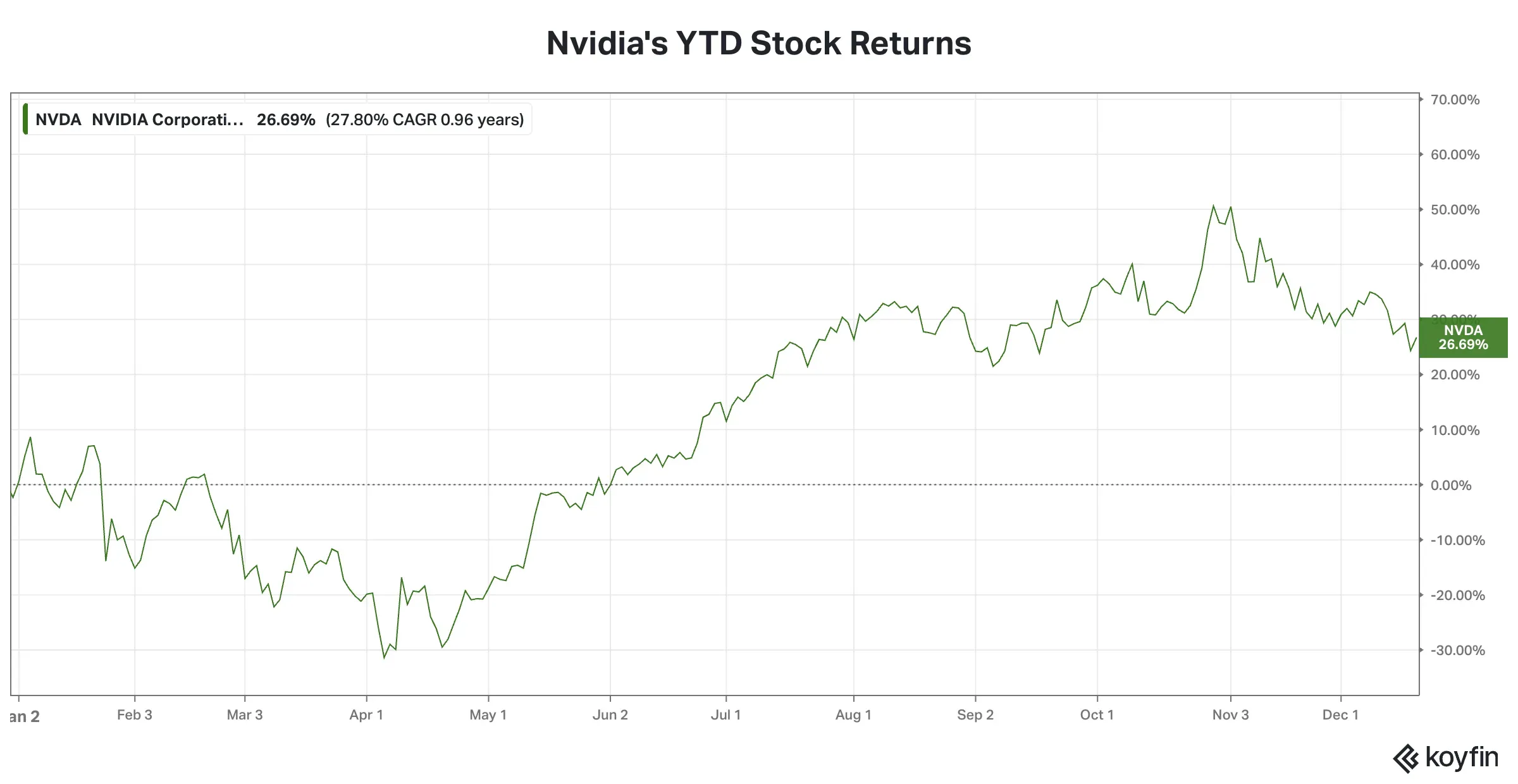

At one point this year, Nvidia’s stock was cruising along fine, after recovering from the DeepSeek and Trump tariff-related sell-offs seen early in the year. The returns peaked at 64% in late October. After completing a double-top formation in early November, the stock began a broader downtrend.

Even after the recent pullback, the stock is still up about 27% year-to-date (YTD).

Source: Koyfin

Source: Koyfin

The volatility in the back end of the year was primarily due to skeptical comments regarding a potential AI bubble. Scion Asset Management’s Michael Burry and Seaport Research’s Jay Goldberg are among those who led the bearish chatter on Nvidia, denting investor sentiment. In a recent note, Goldberg said, “It’s just getting harder and harder for their (Nvidia) customers to afford” the company’s offering.

Burry, for instance, placed a sizable bearish bet against Nvidia just before his firm moved to deregister. He also raised questions about the substantial capital expenditures by hyperscalers, though he did not call out Nvidia. However, after the Jensen Huang-led company reported its third-quarter results, Burry suggested that the company may have inflated its earnings through questionable stock-based compensation accounting practices.

Market watchers have also expressed uneasiness about the circular financing deals involving Nvidia and partners, including hyperscalers and data center infrastructure companies that were customers of the chipmaker.

Another key headwind the company had to contend with is the U.S. ban on high-performance chip exports to China. Nvidia’s China revenue has steadily declined amid successive export restrictions. China and Hong Kong accounted for 7.6% of total revenue in the first nine months of 2025, down from 26% in 2021. The China-specific H20 chip generated roughly $50 million in the latest quarter, a small fraction of Nvidia’s broader business.

Despite lobbying by the company and President Donald Trump’s bonhomie with Huang, the U.S. government hasn’t yet given a clear signal to resume exports to China. A Reuters report, citing sources, said the Trump administration has launched a review that could lead to granting Nvidia the go-ahead to export H200 AI chips to China in exchange for a 25% share of sales.

Nvidia - Pricey or Attractive?

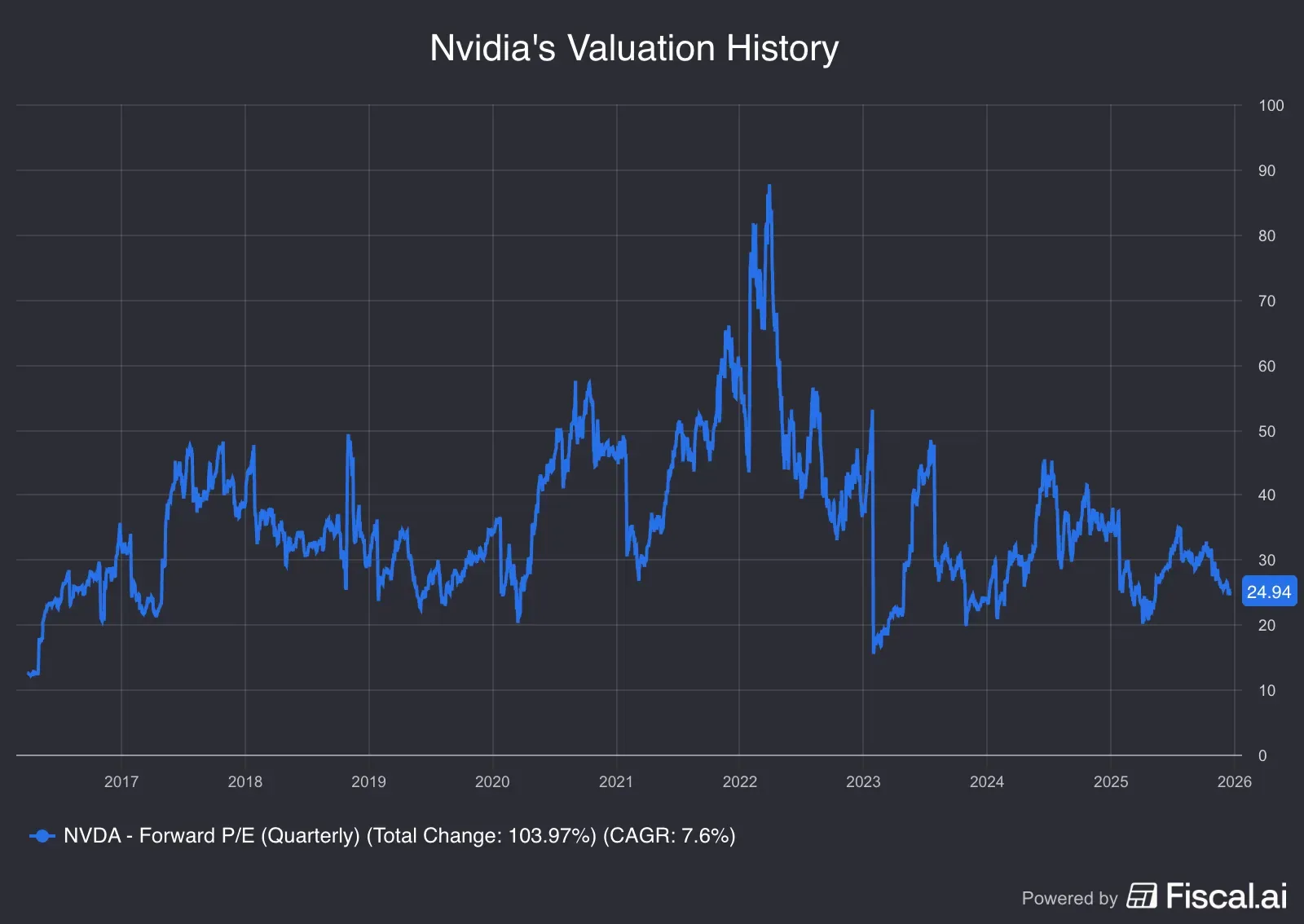

The stock decline seen since November has reduced Nvidia’s valuation multiples. In terms of the forward price-earnings (P/E) multiple, the stock’s multiple is about 25, notably lower than its peak valuation of 80+ in early 2022.

Source: Fiscal.ai

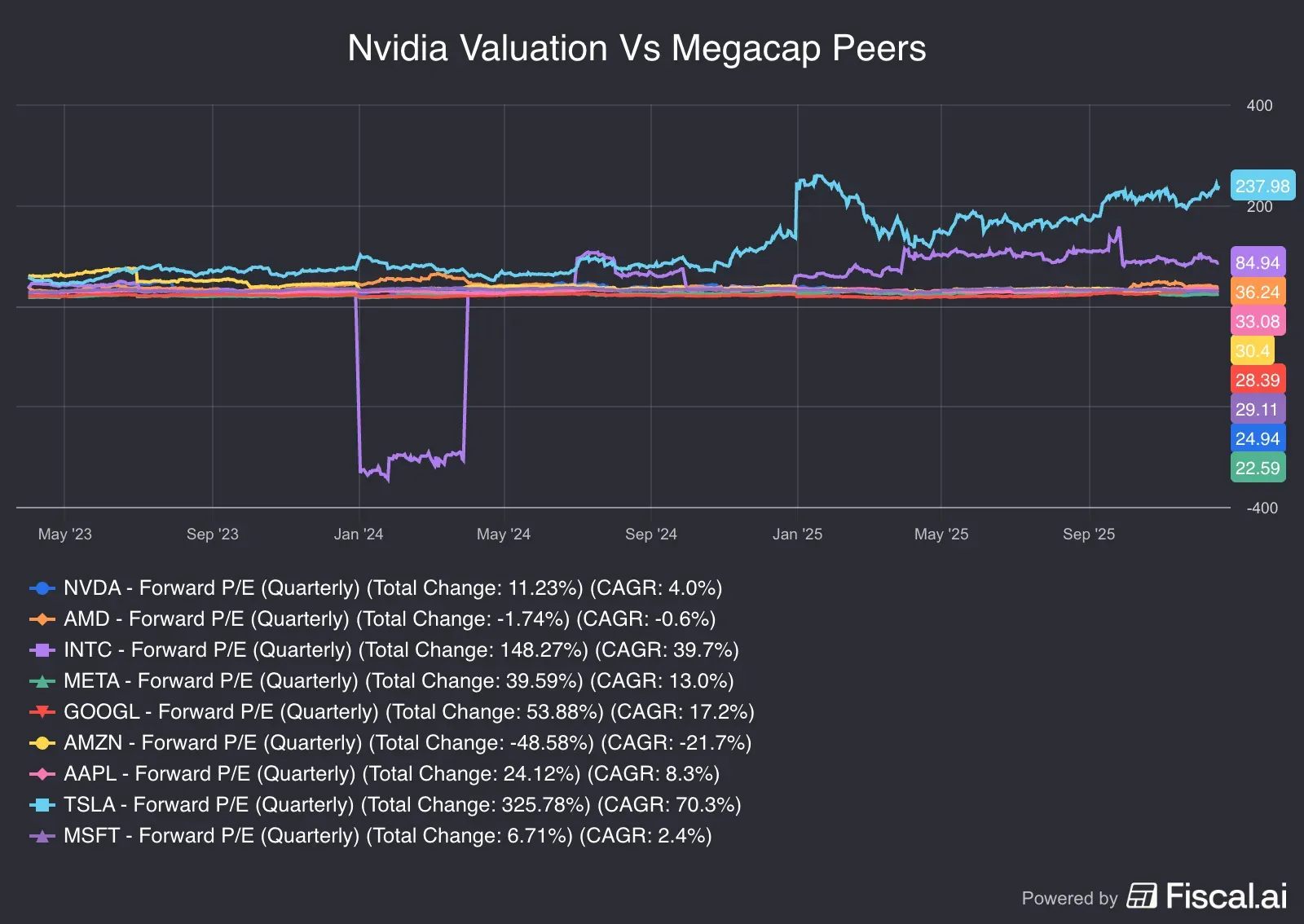

Nvidia also has a reasonable valuation relative to its chip peers and the rest of the Magnificent Seven companies. Only Meta in the Mag 7 group currently has a more attractive valuation. According to Yardeni Research, the S&P 500’s forward P/E multiple is 21.9, and that of the S&P 500 IT industry is 26.3.

Source: Fiscal.ai

What Retail Traders & Analysts Feel About Stock

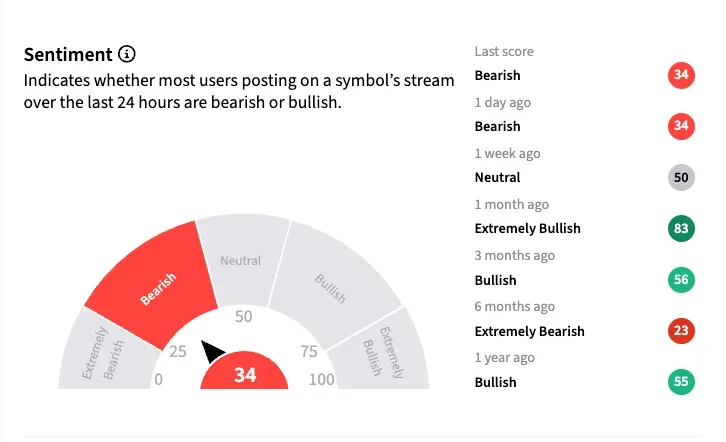

On Stocktwits, retail sentiment toward Nvidia stock is ‘bearish, with most attributing their negative stance to the competition posed by Alphabet, Inc. (GOOGL) and the China headwinds. Rumors that Google was selling its in-house TPU AI chips to external customers pressured Nvidia stock earlier this month.

In an interview with CNBC, Finance Professor Aswath Damodaran, known as the “Dean of Valuation”, said earlier this week that he had recently dumped the last lot of Nvidia shares he held. He suggested that he won’t be lured by the stock even if it goes up.

“I gained enough from its rise that it would be greedy for me to hang in there and say ‘give me more’”

Wall Street, however, is very upbeat. According to Koyfin, about 84% of the analysts covering the stock have a ‘Buy’ or ‘Strong Buy’ rating. The average analyst price target for the stock ($252.67) implies more than 45% upside potential.

As recently as Friday, Bernstein analysts reiterated an ‘Outperform’ rating and $275 price target for the stock, noting that it is now attractively valued, Investing.com reported. The firm also flagged several potential catalysts ahead, including the upcoming Rubin architecture, the CES and GTC events, the possible H200 approval from the Trump administration for China sales, and overall financial projections that appear conservative relative to the company’s $500 billion-plus Blackwell/Rubin guidance.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_LUV_Southwest_bags_jpg_0c65f623c2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_micahel_saylor_OG_3_jpg_4f304c479d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_rivian_automotive_jpg_e356c1abe5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2252871865_jpg_74865c27a7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_OG_3_jpg_94334765ec.webp)