Advertisement|Remove ads.

Oppenheimer Sees Higher DoorDash Profits This Year And Next On Strong Order Growth, Ad Unit Ramp Up

Oppenheimer has raised its estimates for DoorDash's earnings for this and next year, citing its projection of strong order volumes as well as an expected ramp-up in advertising revenue.

The brokerage upgraded the food delivery company's earnings-per-share projection by $0.07 to $1.93 for 2025 and by $0.17 to $2.94 for 2026. It also raised estimates for EBITDA by 2% and 4%, respectively, and the total order growth estimate by nearly 1% for 2025.

Oppenheimer kept its 'Buy' rating on the company's shares and raised the price target to $280 from $220. The new target indicates a 14% upside from current levels.

Earlier this month, DoorDash announced new artificial intelligence-powered tools and the acquisition of the ad tech platform Symbiosys. At the time, it stated that the company's ad business, which also includes Wolt Ads, had crossed an annualized revenue run rate of $1 billion in 2024.

The $1 billion advertising disclosure "suggests further profitability ramp," said Oppenheimer.

Meanwhile, third-party data gathered by the brokerage shows strong order volume in the ongoing Q2, which would lead to higher projections for the quarters through Q4.

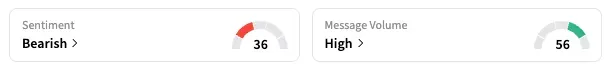

On Stocktwits, the retail sentiment for the company, however, shifted to 'bearish' from 'neutral.'

DASH shares are up 47% year-to-date, with the stock ranking among the top five gainers in the S&P 500 in the first half of the year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227231004_jpg_0de480c6f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254924041_jpg_892ccf911d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1234736300_jpg_881ee00045.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218899763_jpg_5d8b51f97d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump_golden_dome_resized_jpg_38d699de1f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222922178_jpg_42dd8f319f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)