Advertisement|Remove ads.

Billionaire Paul Tudor Jones Reportedly Says Markets Far Less Stable During Trump’s Second Term: ‘There’s No Room For Mistakes’

Billionaire hedge fund manager Paul Tudor Jones reportedly said that financial markets are far less stable during President Donald Trump’s second term compared to his tenure back in 2017.

“There’s so many moving parts, and there’s so many things that are cross currents. The one thing that I would say is this is a completely, totally different landscape than Trump 1.0,” Jones told CNBC.

Jones noted that the Treasury is issuing a record amount of debt, over double the number in 2017, while foreigners take up twice as much the ownership of U.S. equities, debt, and real estate than in 2017 as a percentage of GDP.

The investor also noted the relative surge in valuation and pointed out that the price-to-earnings ratio of the S&P 500 has risen to 25 in the current times compared to 19 in January 2017.

“We could have a 30% correction in the stock market and just be back to slightly overvalued,” Jones said. “I think Trump being Trump, I don’t know if it will play as well as it did in 1.0 because there’s no room for mistakes.”

The S&P 500 has been down nearly 0.2% since Trump took office as the 47th President of the United States, while the Nasdaq Composite has lost over 1%.

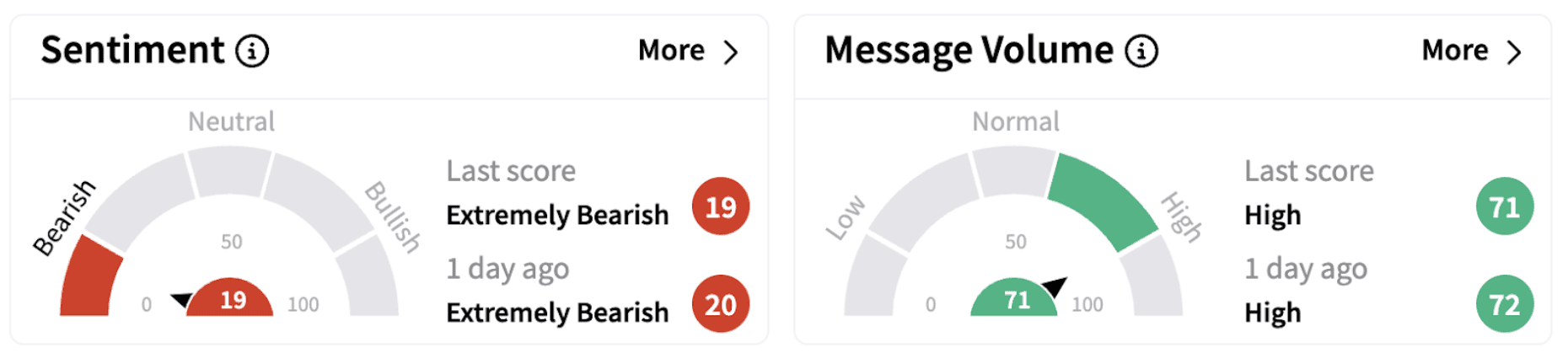

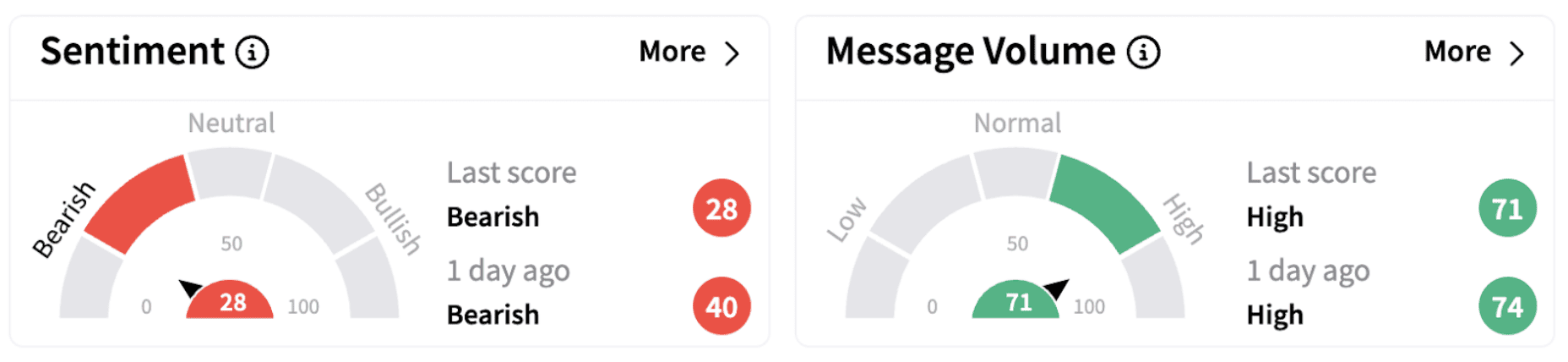

On Stocktwits, retail investors are bearish on the SPDR S&P 500 ETF Trust (SPY) and the Invesco QQQ Trust, Series 1 (QQQ) ETFs.

On Monday, Trump reportedly said he’s pausing the decision to impose tariffs on Mexico for a month after the Mexican President agreed to immediately send 10,000 soldiers to the U.S. border to prevent drug trafficking from Mexico.

Meanwhile, Jones said he hopes Trump makes all the right decisions because “we are precariously perched from a macro standpoint.”

“I don’t think we’ve ever had as many things that are connected in circular and could go wrong. So it’s going to take a maestro to pull this off in a way that kind of preserves where we are now in the major asset classes,” he said.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254648547_jpg_a843db78b6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1000648682_jpg_6aa61e3574.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259602028_jpg_5b1a490e64.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259775985_jpg_a06a1e88c3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_dogecoin_OG_2_jpg_304df31f25.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_vitalik_buterin_OG_jpg_7ac8ea93fe.webp)