Advertisement|Remove ads.

Retail Bearish On Apple As Stock Retreats Amid Rumors Of China Probing App Store Policies

Apple, Inc. (AAPL) stock came under selling pressure on Wednesday after reports said the company could be under the scanner of Chinese regulators, denting retail sentiment.

A Bloomberg report said China’s antitrust regulator, the State Administration for Market Regulation (SAMR), is mulling a probe into Apple’s App Store fees, amounting to as much as 30% on in-app purchases, and the company’s policy of barring external payment services and stores.

SAMR has been in conversation with Apple and app developers since last year as domestic app developers such as Tencent Holdings Limited (TCEHY) and TikTok parent ByteDance have taken exception to the tech giant’s policies.

The report comes after China resolved to retaliate against President Donald Trump’s 10% additional tariffs on imports from the country.

Commenting on the development, Wedbush analyst Daniel Ives said China’s rumored scrutiny of Apple is less about revenue impact and more about the company's overall tone in China.

The analyst estimates that Apple’s App Store gets around $5 billion in revenue per year from China, relatively less than the other regions, due to the developer economics in the region and a smaller App Store presence.

Ives sees this as a “game of high stakes poker between Trump and China and Apple is clearly a chip on the table.”

However, he said many of these tensions have been worked out behind the scenes by Apple. The next step would be announcing a Chinese partner to roll out Apple Intelligence features in the country, he added.

Apple’s December quarter results released last week showed a setback for the company in China.

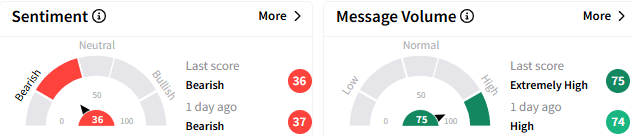

On Stocktwits, retail sentiment toward the Apple stock stayed ‘bearish’ (36/100), with message volume perking to ‘extremely high’ levels.

A stock watcher said the stock might need a big retail push to break out of its recent trading range.

Another user blamed the weakness squarely on Chinese President Xi Jinping’s retaliatory trade war.

Apple stock has been locked in the $220-$240 range since early 2025. It has shed about 7% so far this year after soaring by 31% in 2024.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2249860620_jpg_2bd9e54f08.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_2026_OG_2_jpg_f92901a0f5.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2231786698_jpg_4d7b65921f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Shift4_logo_jpg_jpg_1845f04c23.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Oil_drill_06147e8349.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Stock_chart_image_d3ebab70ec.webp)