Advertisement|Remove ads.

Marathon, Riot See Bullish Retail Bets As Crypto Miners Chase AI-HPC Growth Amid Bitcoin Price Uncertainty

While Bitcoin’s (BTC) price action remains uncertain, retail traders are cautiously optimistic about crypto mining stocks.

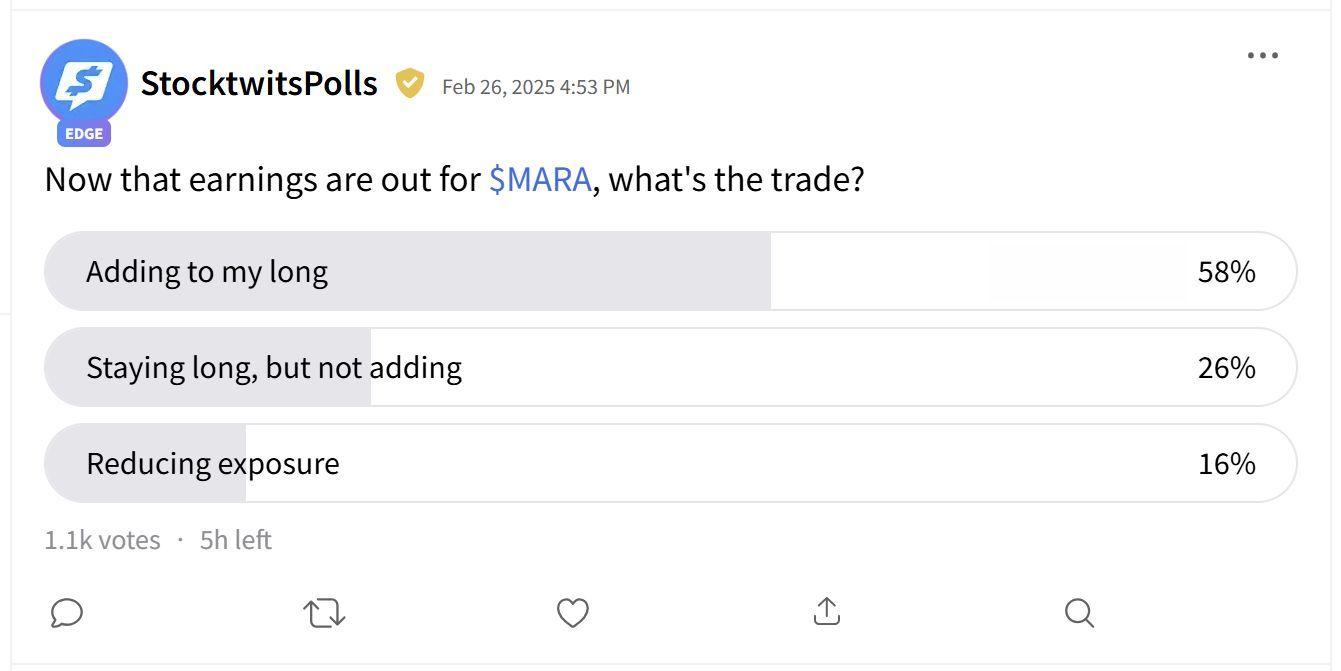

Following earnings reports from Marathon Digital (MARA) and Riot Platforms (RIOT) earlier this week, Stocktwits polls indicate that retail sentiment is bullish.

Investor polls on the platform indicate that 58% of Marathon shareholders are adding to their positions, while 26% are holding steady. The remaining 16% are cutting exposure following the earnings release.

Marathon’s stock was up 6.8% in afternoon trade on Friday.

Riot stock saw similar enthusiasm, with 47% of investors increasing their holdings and 22% maintaining their positions. However, caution is creeping in as 18% of respondents believe it’s time to get out, and 13% are steering clear due to volatility concerns.

Riot’s stock was up around 5% in afternoon trade on Friday.

Marathon and Riot, two of the largest publicly traded Bitcoin mining firms, reported earnings highlighting revenue growth and expanding mining capacity.

Marathon saw record fourth-quarter (Q4) revenue, marking a 36% increase compared to the previous year. The company said it's looking to become the ‘Cisco of Crypto’ as it pushes further into artificial intelligence (AI) infrastructure.

Riot delivered an unexpected profit, reporting earnings of $1.95 per share, beating Wall Street projections for a $0.18 per share loss.

Like Marathon, Riot is pivoting toward AI and high-performance computing (HPC). It recently expanded its board to bring in expertise in AI-HPC investment banking, data centers, and real estate.

The shift toward AI-HPC is gaining momentum among crypto miners. In a research note, VanEck analysts noted that companies are diversifying as transaction fee revenue remains inconsistent.

Terawulf (WULF) announced a new billion-dollar deal with Core42 for 72.5 megawatts (MW) of capacity, a move expected to generate $1 billion in revenue over an initial 10-year period.

Bitfarms (BITF) has engaged AI-HPC consultants to explore development across North America, while Bitdeer (BTDR) is in talks with AI-HPC development partners after completing a data center feasibility study.

Cipher Mining (CIFR) secured a $50 million SoftBank investment in January to expand its HPC operations and HIVE Digital Technologies (HIVE) appointed Craig Tavares as President and COO of Buzz HPC to lead its GPU cloud services expansion.

VanEck noted that while network congestion can cause fee spikes, long-term on-chain revenue growth remains uncertain due to the rise of off-chain solutions such as exchange-traded funds (ETFs), futures markets, layer-2 (L2) solutions, and centralized exchanges.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_American_Express_resized_d6044f410d.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_axsome_resized_jpg_09f7c99fb1.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1238223992_jpg_be616a7919.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_ibm_signage_mwc_resized_28f91e1a63.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2229019912_jpg_3e9bff3d29.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_crowdstrike_resized_jpg_6549f7641a.webp)