Advertisement|Remove ads.

Terawulf Stock Surges Despite Q4 Earnings Miss On Billion-Dollar AI Hosting Deal – Retail Remains Uncertain Amid Bitcoin Weakness

Terawulf surged more than 13% in morning trade on Friday, recovering from early losses, after the Bitcoin miner announced an expansion into AI-focused high-performance computing (HPC) hosting. The rally came despite the company missing fourth-quarter earnings and revenue expectations.

Shares initially dipped in premarket trading, tracking declines in tech stocks and Bitcoin’s drop below $80,000.

However, a rebound in the broader market, driven by favorable inflation data, helped turn sentiment around.

Terawulf reported a quarterly loss of $0.09 per share, wider than the expected $0.03 loss, according to Stocktwits data.

Revenue fell short at $34.95 million versus the projected $37.81 million.

Despite the quarterly miss, full-year revenue doubled to $140.1 million.

The company expanded its self-mining capacity by 94% to 9.7 exahashes per second (EH/s), up from 5.0 EH/s in 2023.

It also strengthened its balance sheet, reporting $274.1 million in cash and Bitcoin holdings, eliminating legacy term loan debt, and raising $150 million via 2.75% convertible notes due 2030.

Additionally, Terawulf has repurchased over $150 million of shares from its authorized $200 million share buyback program.

In line with industry peers like Marathon Holdings (MARA) and Riot Platforms (RIOT), Terawulf is diversifying into AI-driven HPC hosting.

It has signed long-term data center lease agreements with Core42 for 72.5 megawatts (MW) of capacity, a move expected to generate $1 billion in revenue over an initial 10-year period.

Management said this shift reduces exposure to Bitcoin’s price cycles while capitalizing on the company’s expertise in power-intensive infrastructure.

The company aims to scale HPC hosting by 100-150 MW annually.

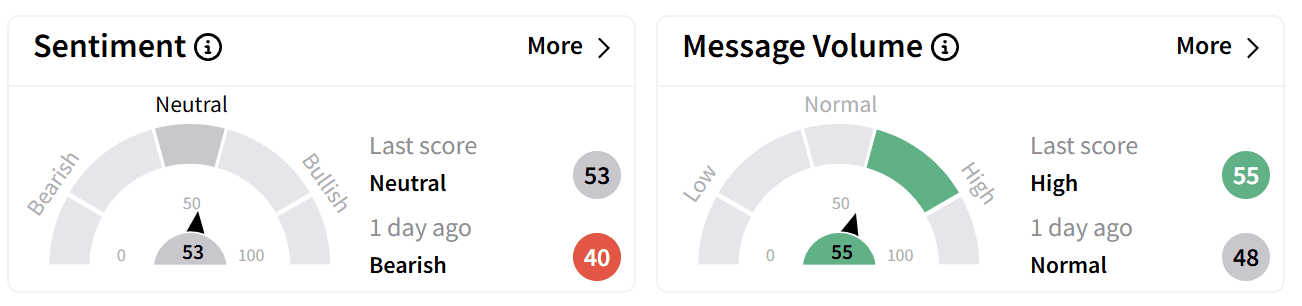

Retail sentiment on Stocktwits climbed into the ‘neutral’ zone from ‘bearish’ a day earlier, accompanied by an increase in chatter to ‘high’ levels.

Some users forecast that the stock won’t be able to hold its gains till market closing.

Others viewed the rally as a positive development despite Bitcoin’s weakness.

Terawulf's stock remains down 30% in 2025 but is up 72% over the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_140648412_jpg_05552b4117.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_912727778_jpg_3bd44c57ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943608_jpg_91702ef0ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)