Advertisement|Remove ads.

Rolls-Royce Retail Frenzy Erupts As New Orders Pour In And Profit Outlook Holds Firm — Bulls Call It A Long-Term Wealth Builder

- Civil Aerospace demand strengthened with rising large-engine orders and engine flying hours climbing above pre-pandemic levels.

- Defence and Power Systems added momentum through new Eurofighter activity, microreactor progress, and strong data-centre-driven engine demand.

- Retail traders highlighted the company’s stable fundamentals, cash flow improvements, and upcoming catalysts across nuclear, defence, and wide-body platforms.

Rolls-Royce drew heavy retail interest on Wednesday after reporting strong momentum in its Civil Aerospace division despite persistent supply chain constraints. The company said demand remained robust, supported by major large-engine orders from IndiGo, Malaysia Airlines and Avolon. Interest in the Trent XWB-97–powered Airbus A350F also continued to build, with new commitments from Air China Cargo and Korean Air.

Large engine flying hours rose 8% year over year and reached 109% of 2019 levels. Rolls-Royce said durability upgrades for the Trent 1000 and Trent 7000 remain on track for certification by the end of 2025, adding that time-on-wing initiatives are progressing across its maintenance network.

Defence Sees Strong Demand

The Defence business reported further momentum, highlighted by progress under the Global Combat Air Programme (GCAP) consortium and the UK’s agreement to export 20 Eurofighter Typhoon aircraft to Turkiye, powered by EJ200 engines.

Rolls-Royce also highlighted advances on Project Pele, the U.S. government’s transportable microreactor initiative, which the company said remains on schedule as part of its expanding nuclear collaboration in the United States.

Power Systems Benefits From Data Centre Boom

Power Systems delivered continued order growth driven by data centres and government customers. Rolls-Royce has said its next-generation engine for high power density, reduced emissions and better fuel consumption was on track for entry into service in 2028.

The company also said the first 100% methanol high-speed marine engine had completed testing and a fast-start gas generator for data centres was launched for availability in 2026.

Guidance Reaffirmed

Despite ongoing global supply chain hurdles, Rolls-Royce reaffirmed its full-year 2025 guidance of £3.1 billion to £3.2 billion in underlying operating profit and £3 billion to £3.1 billion in free cash flow.

Stocktwits Users Flag ‘Healthy’ Fundamentals

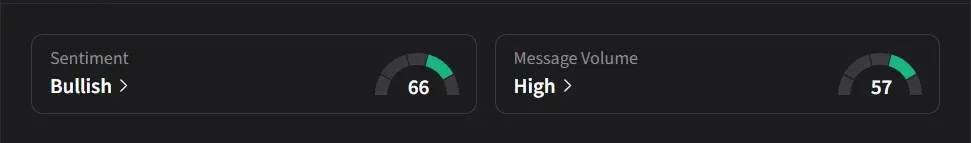

On Stocktwits, retail sentiment for Rolls-Royce was ‘bullish’ amid ‘high’ message volume.

One user said the update stood out for avoiding “over-exaggerated promises,” adding that the company’s fundamentals and cash flow signaled a “healthy” business with more progress ahead. They said Rolls-Royce “delivers” without relying on promotional language, and added that they were continuing to buy shares monthly as a long-term holding.

Another user described the trading update as “very positive” and said it provided enough momentum for holders to remain patient ahead of the full-year results in February 2026. They identified potential catalysts over the next few months, including Sweden’s decision on small modular reactors, additional orders for wide-body engines, further Eurofighter activity, and the possibility of defense developments involving India.

Rolls-Royce’s U.S.-listed stock has surged 120% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)