Advertisement|Remove ads.

Super Micro Computer Stock Soars On Liquid-Cooling And GPU News, But Retail Stays Cautious

Shares of Super Micro Computer, Inc. (SMCI) surged over 16% on Monday, buoyed by the company’s latest liquid-cooling and GPU deployment updates.

Super Micro announced that it recently deployed more than 100,000 GPUs with its complete liquid-cooling solution, designed for some of the “largest AI data centers ever built.”

The liquid-cooling system, according to the company, offers substantial advantages, including up to 40% energy savings and 80% space savings compared to traditional air-cooling systems.

The solution also includes coolant distribution units, cold plates, coolant distribution manifolds, cooling towers, and end-to-end management software, all of which help reduce ongoing power and infrastructure costs.

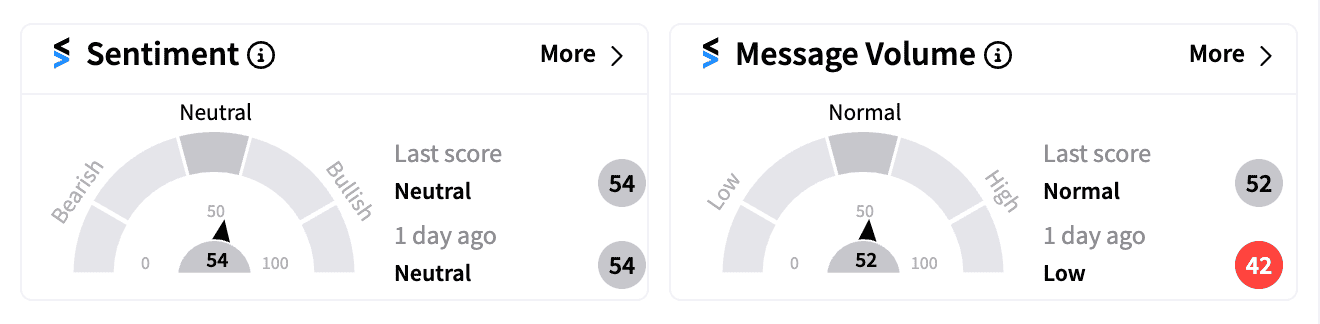

Despite the strong rally, retail sentiment on Stocktwits remained cautious, with many investors still concerned about recent challenges faced by the company.

SMCI’s Stocktwits sentiment hovered in ‘neutral’ territory, with users pointing out lingering skepticism, mainly over the delayed 10-K annual report.

The stock has faced significant hurdles this year, plunging 65% from its all-time high in March, dragged by increased competition, aggressive pricing strategies, and a short-seller report in August that raised concerns about the company’s accounting practices.

Super Micro later announced it would delay its annual filing while reviewing its financial controls, contributing to a hesitant retail reaction.

However, the latest news surrounding the company’s liquid-cooling technology seems to have somewhat reassured the market, given the growing power demands of AI-related workloads.

Liquid-cooling solutions are gaining traction in the AI space, as they help keep servers from overheating and allow them to run more efficiently.

Morgan Stanley projects that the data-center cooling market could reach $4.8 billion by 2027, suggesting future growth opportunities for Super Micro.

SMCI stock is up more than 67% this year, outperforming broader indices by a wide margin.

Read next: Apple Stock Slips As Jefferies Downplays AI iPhone Hype: Retail Investors Get Jittery

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2215390052_jpg_84ddd1faac.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/corescientific_ff43030093.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Royal_Caribbean_jpg_b85e38f7a0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2231279747_jpg_9150b71435.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Nvidia_jpg_90354aa51a.webp)

/filters:format(webp)https://images.cnbctv18.com/uploads/2024/12/mobile-2024-12-b6a62138d9f7795a8368c0835ce9f4eb.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/cnbctv18logo.png)