Advertisement|Remove ads.

Seagate Q3 Earnings Preview: Analyst Recommends ‘Buy’ Among Hardware Names, But Retail Is Guarded

Data storage devices company Seagate Technology Holdings plc. (STX) is expected to report sharp year-over-year (YoY) increases in earnings and revenue for the third quarter of fiscal year 2025 on Tuesday after the market closes.

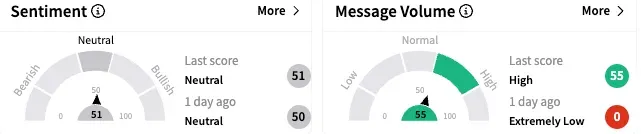

Retail sentiment toward Seagate remained ‘neutral’ (51/100), with the message volume picking up pace to 'high' levels.

A watcher shared data that showed a reduction in implied volatility for the Seagate stock to 0.46 — a bullish signal.

According to the Finchat-compiled consensus estimates, Seagate is expected to report adjusted earnings per share (EPS) of $1.75 and revenue of $2.14 billion. This compares to the year-ago numbers of $0.33 and $1.66 billion, respectively.

A double beat for the second quarter in late January led to a 7% rally in the stock in the session following the results.

Last week, Morgan Stanley analyst Erik Woodring upped the price target for Seagate stock to $89 from $84 and maintained an ‘Overweight’ rating.

Despite market concerns about the hard disk drive (HDD) cycle, Morgan Stanley’s checks revealed relative strength, with HDD demand outpacing supply, like-for-like pricing continuing to grow sequentially and inventories at cloud service providers remaining in check.

Woodring expects March quarter results to exceed estimates and the June quarter guidance to be aligned with estimates.

The analyst said, “Given this positive setup juxtaposed vs. short-interest at 12 month highs, HDD names are some of the few Hardware names we'd be buying into C1Q earnings.”

He also sees both short covering and real buying following the results as confidence builds in the longevity of the HDD cycle.

Seagate stock fell 0.65% to $82.16 on Monday. The stock is down over 4% so far this year.

The Koyfin-compiled consensus estimate is $105.83, implying upside potential of 29% from Monday’s close.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: Palantir Surges Ahead: Retail Optimism Soars As Stock Outpaces Market And Mega-Caps

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1710397990_jpg_c2ac3394d9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2244297865_jpg_34f8b38611.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_circle_stablecoins_original_jpg_b238d12be8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2249860620_jpg_2bd9e54f08.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_2026_OG_2_jpg_f92901a0f5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2231786698_jpg_4d7b65921f.webp)