Advertisement|Remove ads.

Shell Stock Slips After Signaling Lower Q1 Gas Production, Retail Sits On The Fence

Shell’s (SHEL) U.S. shares fell 2.8% on Monday after the oil major flagged weaker first-quarter production due to unplanned maintenance.

The London-based company projected first-quarter integrated gas production between 910,000 and 950,000 barrels of oil equivalent a day, from a previous estimate of 930,000 to 990,000 boepd.

It also cut its liquefied natural gas (LNG) production forecast to 6.4 million and 6.8 million metric tons, compared with the earlier projection of 6.6 million to 7.2 million metric tons.

The company attributed the decline to unplanned maintenance in Australia and the impact of cyclones on its operations.

Shell forecasted refinery utilization between 83% and 87% in the first quarter.

On its Capital Markets day in March, Shell, the world's top LNG producer, had said it expects to grow its LNG sales by 4% to 5% annually through 2030.

The oil and gas major had said it would raise shareholder distributions to 40% to 50% of cash flow from operations from the earlier 30% to 40% range.

Shell also raised the cost reduction target from $2 billion to $3 billion by the end of 2025 to a cumulative $5 billion to $7 billion by the end of 2028, compared to 2022.

Both Shell and its London-listed peer BP have reduced investments in renewables and slashed costs to attract investors amid volatile commodity prices.

Shell on Monday said that LNG trading results are expected to be in line with the fourth-quarter, despite a higher non-cash impact from expiring hedge contracts.

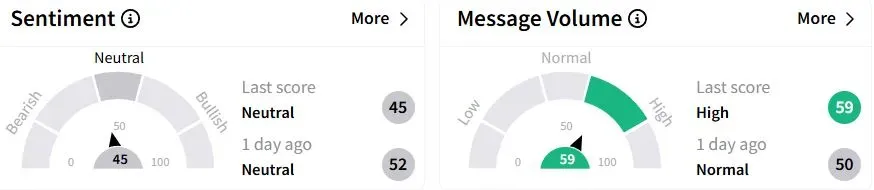

Retail sentiment on Stocktwits remained ‘neutral’ (45/100), albeit with a lower score than a day ago, while retail chatter was ‘high.’

One retail user said that the stock was an ‘absolute steal’ at current prices.

Shell’s U.S. shares have fallen 1.1% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227231004_jpg_0de480c6f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254924041_jpg_892ccf911d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1234736300_jpg_881ee00045.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218899763_jpg_5d8b51f97d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)