Advertisement|Remove ads.

Why Is Silver Beating Gold In A Year of Economic And Geopolitical Uncertainty?

- Gold and silver delivered standout gains this year, handily outperforming equities.

- Geopolitical shocks, tariff-driven volatility, Fed policy uncertainty, and a weaker dollar reinforced their appeal as safe-haven assets.

- Silver’s outperformance was fueled by its dual roles as a safe-haven and an industrial metal, benefiting from AI, green energy, and technology-driven demand.

Gold and silver have emerged as among the best-performing financial assets this year, outperforming equities, which, incidentally, held up well despite the prevailing uncertainties. It comes as no surprise that the precious metals outperformed, riding on their “safe-haven” credentials, and among them, silver outperformed.

The Gold-Silver Rally

The prospect of further rate cuts has helped precious metals hit new highs this week. Gold futures breached the $4,400 barrier on Monday, hitting an intraday high past the $4,450 level.

Chart courtesy of TradingView

Chart courtesy of TradingView

The Silver rally has outperformed gold this year, with the white metal also perched at a new peak. After breaking above the $69-an-ounce barrier early Monday, silver futures traded slightly below the level.

Chart courtesy of TradingView

Chart courtesy of TradingView

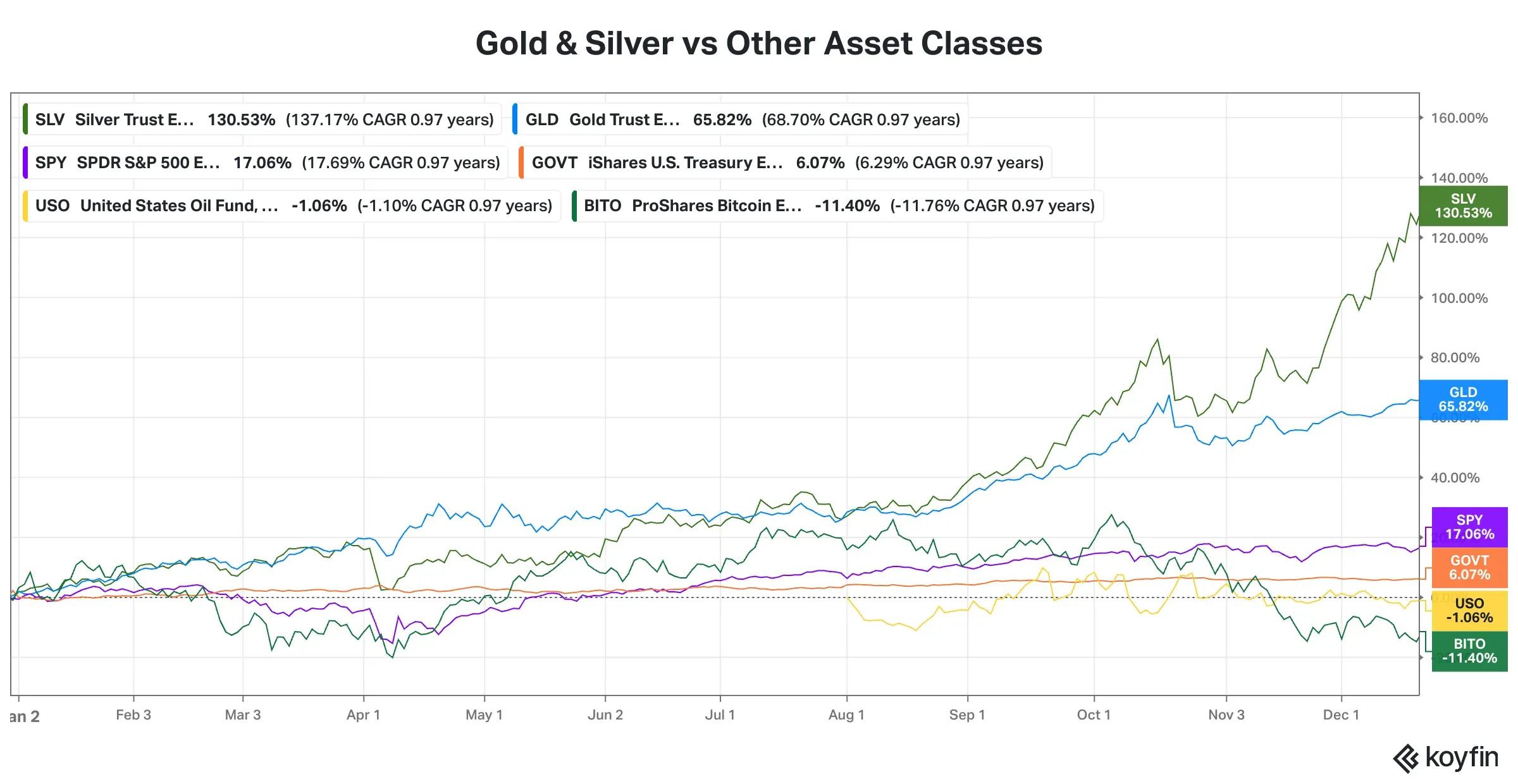

Taking the SPDR Gold Shares (GLD), an ETF that tracks the performance of gold bullion prices, and the iShares Silver Trust (SLV), which reflects silver prices, as proxies for these two precious metals, here is how they performed against various asset classes.

Source: Koyfin

Source: Koyfin

An astute investor could have pocketed returns of 130% if they had invested in silver, while gold would have generated a return of more than 65%.

What Drove The Precious Metal Rally?

A combination of geopolitical and macroeconomic challenges underpinned the precious metal rally seen this year. Republicans reclaimed power, and President Donald Trump’s headline-grabbing remarks and executive orders, including the infamous tariffs, frequently rattled markets.

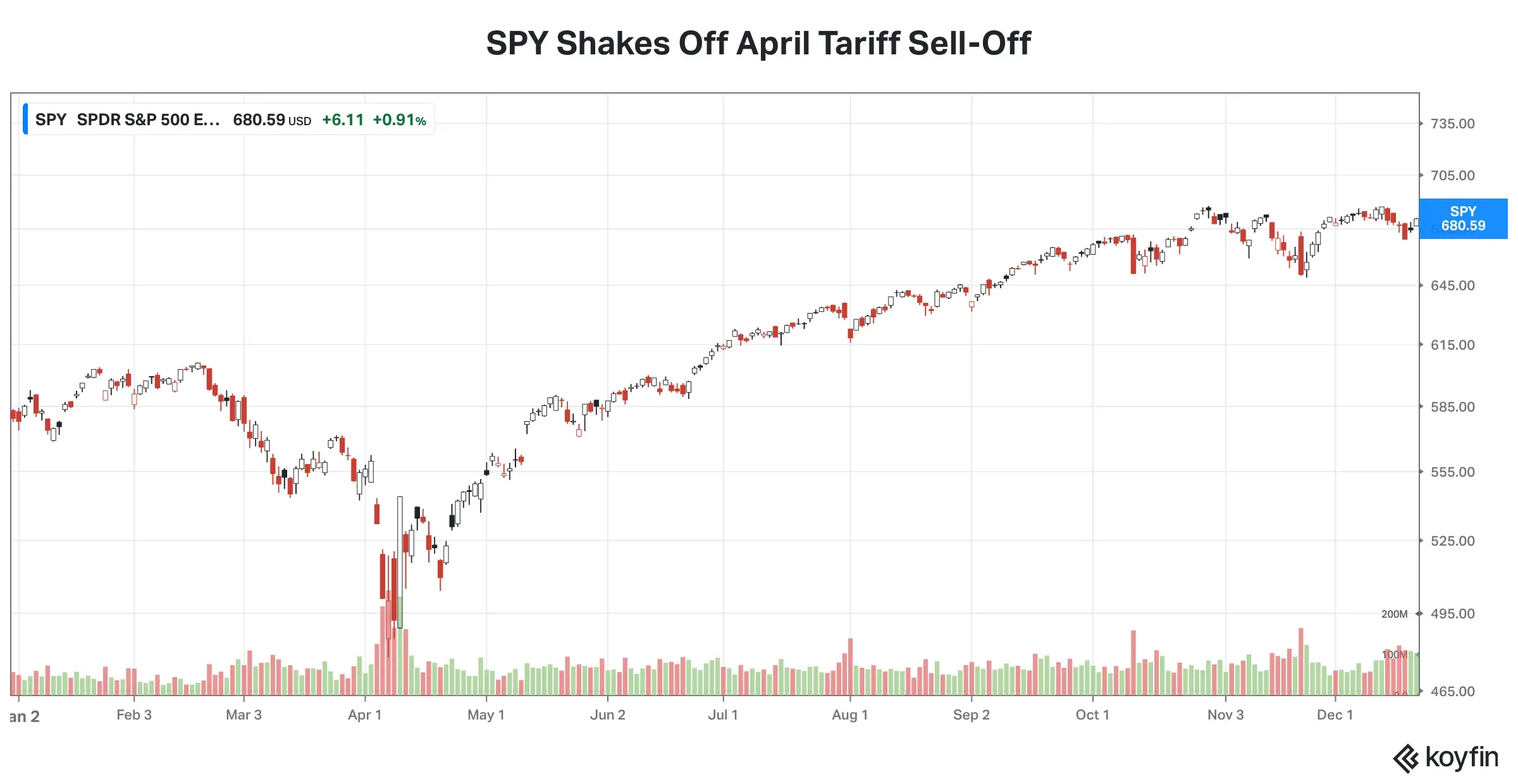

The sweeping “Liberation Day” announcements in early April triggered a market collapse, with the sell-off proving all-pervasive. The SPDR S&P 500 ETF (SPY), an exchange-traded fund (ETF) that tracks the broader S&P 500 Index, went into a tailspin immediately after the tariff announcements but has since staged a strong recovery.

Source: Koyfin

Source: Koyfin

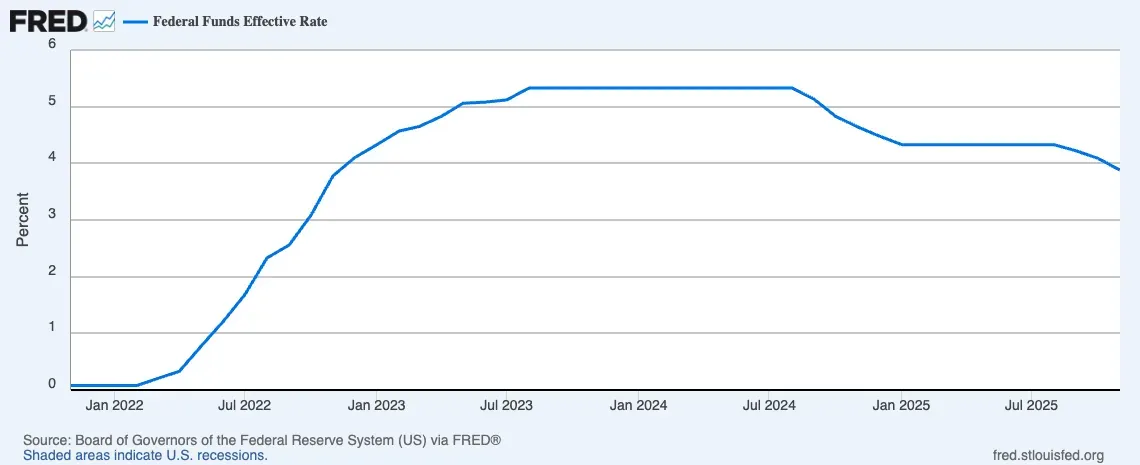

Federal Reserve President Jerome Powell and his rate-setting team were markedly hawkish this year as inflation remained stubbornly above the central bank's target, triggering unease regarding the monetary policy outlook. Trump and his administration, on their part, heightened investor anxiety with repeated, very public attacks on Powell.

Another source of strength for the precious metals is the weaker dollar. These commodities are denominated in dollars, and their moves are inversely correlated with the greenback. After keeping policy unchanged earlier, the Fed implemented three rate cuts this year.

Source: St. Louis Fed

JPMorgan attributes the gold rally to the Trump tariff uncertainty, strong demand from ETFs and central banks.

Silver Metal’s Edge

Silver is a better bet than gold for investors seeking higher growth potential. Silver is an industrial metal with extensive applications, and its demand is tied to the economy’s fortunes. More than half of silver’s demand comes from heavy industry and high technology, including smartphones, tablets, automobile electrical systems, solar-panel cells etc, a Morgan Stanley report stated, citing a World Silver Survey.

Highlighted the new demand avenues for silver, another report stated:

“The AI boom and green technologies are major new drivers of this industrial demand, and the metal has even been designated as a U.S. critical mineral.”

The volatility in silver tends to be two to three times greater than that of gold on any given day. Silver is more affordable for investors, including retail investors, due to their sharply lower per-unit pricing.

Although gold and silver are both called safe havens, gold is preferred as a “powerful” diversifier over silver. As it has fewer industrial uses and is often held as a reserve currency, it is less immune to the economy’s vagaries. Gold is usually considered a long-term wealth preserver.

The Gold-Silver Outlook

JPMorgan forecasts gold prices to reach $5,055 per ounce by 2026, rising further to $5,400 per ounce by the end of 2027. Natasha Kaneva, head of Global Commodities Strategy at J.P. Morgan, said:

“While this rally in gold has not, and will not, be linear, we believe the trends driving this rebasing higher in gold prices are not exhausted. The long-term trend of official reserve and investor diversification into gold has further to run.”

Morgan Stanley’s forecast, however, suggests silver could lag gold’s performance in 2026, with a likely fall in solar installations likely trimming demand.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: Apple Heads For Its Softest Year In Three — Is AI The Missing Catalyst Wall Street’s Waiting For?

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)