Advertisement. Remove ads.

SoFi Shares Gain Ground After LendingClub's Impressive Results: Retail Remains Upbeat

Shares of SoFi Technologies Inc. ($SOFI) rose by as much as 2% on Thursday morning following the positive quarterly earnings from LendingClub Corp. ($LC) on Wednesday.

LendingClub, a fintech and personal finance company, reported earnings of $0.13 per share, nearly doubling Wall Street's estimate of $0.07. The company also reported a total net revenue of $201.9 million, surpassing the consensus estimate of $190.4 million.

Mizuho analyst Dan Dolev highlighted that LendingClub stands out as a key competitor for SoFi, as both companies cater to similar customer demographics, particularly in terms of credit scores and household income.

Despite SoFi's recent uptick, Dolev points out that LendingClub's stock has been on a winning streak. He suggests that these positive trends could pave the way for a revaluation of SoFi's stock in the near future.

Additionally, Dolev has noticed a broader improvement in consumer credit trends across major domestic banks. For instance, he referenced Citigroup's optimistic remarks regarding delinquencies, indicating a healthier financial landscape.

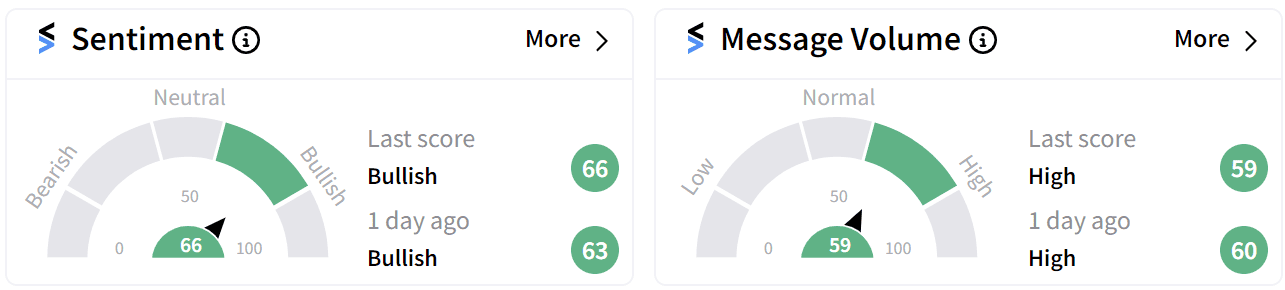

Retail sentiment on Stocktwits remained ‘bullish’ (66/100) accompanied by high chatter (59/100).

Fintech peers Upstart Holdings Inc. ($UPST) and Affirm Holdings Inc. ($AFRM) were also in the green during early morning trading on Thursday.

Earlier this month, SoFi shares rallied after announcing an agreement with Fortress Investment Group, a deal aimed at expanding SoFi’s personal loan capabilities.

The company’s third-quarter earnings are expected on Oct. 29. Its stock has gained 15% so far in 2024 and surged 56% in the last 12 months.

For updates and corrections email newsroom@stocktwits.com.

Read more: LendingClub Stock In Focus Ahead of Q3 Earnings: Retail Cautious

/filters:format(webp)https://images.cnbctv18.com/uploads/2023/10/biogas.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/cnbctv18logo.png)

/filters:format(webp)https://images.cnbctv18.com/uploads/2024/11/air-india-a350-900-2024-11-2a018689c22e8e313593c4b76845dbc8.jpg)

/filters:format(webp)https://images.cnbctv18.com/uploads/2024/11/swiggy-zomato-2024-11-abc7dc409c45ae64aa63306af7904262.jpg)

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/08/shutterstock-2162617539-2025-08-b6396e634f55857935c2208abb72fdf6-scaled.jpg)

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/01/piramal-aranya-arav-2025-01-9ca6001c2614d6f431d1dde76b7bdeeb.jpg)

/filters:format(webp)https://images.cnbctv18.com/uploads/2023/08/adani.jpg)