Advertisement|Remove ads.

Spirit Airlines Rejects Frontier Merger Proposal: Retail Turns Extremely Bearish

Frontier Group Holdings Inc (ULCC) and Spirit Airlines Inc (SAVEQ) drew retail attention on Thursday after the latter rejected Frontier's new merger offer.

Frontier’s proposal involved combining with Spirit in a transaction that provides for the issuance of $400 million principal amount of debt by the firm and 19% of its common equity at the closing of the transaction, to be distributed to the holders of senior secured notes, 2025 convertible notes, 2026 convertible notes and existing interests.

Chair of Frontier's Board of Directors Bill Franke said the proposal reflects a compelling opportunity that will result in more value than Spirit's standalone plan by creating a stronger low-fare airline with the long-term viability to compete more effectively and enter new markets at scale.

CEO Barry Biffle also expressed optimism that as a combined airline, the companies would be positioned to offer more options, deeper savings, and an enhanced travel experience with more reliable service.

Spirit, however, pointed out that the proposal is far below the terms agreed in August 2024 on both debt ($580 million) and equity (26.5% of the combined company) consideration. It also requires a $350 million new equity investment by the firm’s bondholders.

Spirit said this is a material funding demand they emphatically reject under the proposal’s current terms.

“While we appreciate your continued interest and share your view of the logic of a potential transaction, your January 7 terms (which have not been improved on in the last three weeks) are both inadequate and unactionable,” Spirit said in an exchange filing.

In November, Spirit filed for bankruptcy protection after years of losses and a failed merger with Frontier Airlines. The airline had entered into a restructuring support agreement supported by most of its convertible bondholders on the terms of a comprehensive balance sheet restructuring.

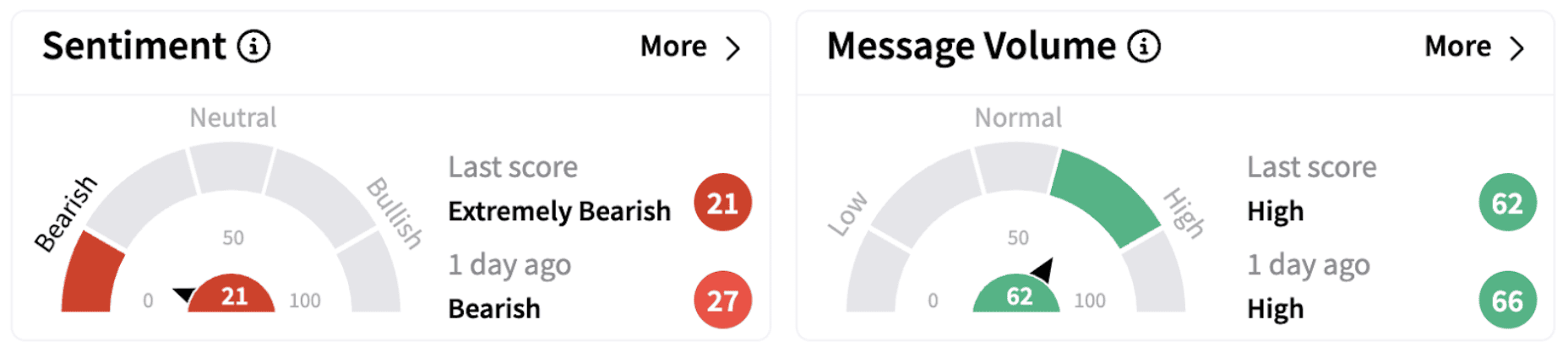

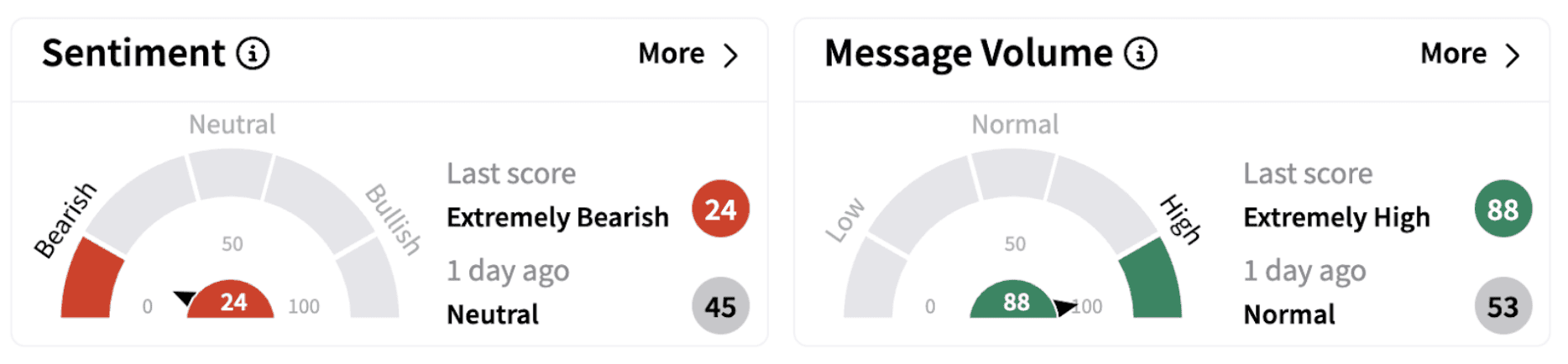

On Stocktwits, retail sentiment surrounding Frontier and Spirit trended in the ‘extremely bearish’ territory.

Retail users on Stocktwits expressed mixed opinions on the stocks.

Spirit Airlines stock has gained over 40% this year on the OTC markets, while Frontier stock has gained over 13% in the same period.

Also See: Federal Reserve Keeps Key Interest Rate Unchanged After Three Consecutive Cuts

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Morgan_Stanley_HQ_logo_5431c7f2ad.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1549425533_jpg_483afd6d69.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)