Advertisement|Remove ads.

Teradyne Stock Crashes To One-Year Low As Q2 Guidance Underwhelms Wall Street – Retail Remains Bullish

Teradyne Inc. (TER) shares plunged as much as 20% in morning trading Tuesday, hitting their lowest level in over a year after the company's second-quarter outlook fell short of Wall Street’s expectations.

On its analyst day, the automated test equipment and robotics company reaffirmed its first-quarter (Q1) outlook but warned that second-quarter (Q2) revenue could be "flat to down 10%" from the prior quarter.

For the full fiscal year 2025, Teradyne expects revenue growth of 5% to 10%, implying a range of $2.96 billion to $3.10 billion – below the $3.23 billion analysts had anticipated, as per Koyfin.

Management attributed the weaker forecast to near-term volatility in its Semiconductor Test business, citing uncertainty surrounding tariffs and trade restrictions.

While the company noted that there had been no outright order cancellations, some customers have delayed purchases and are reassessing capital expenditures.

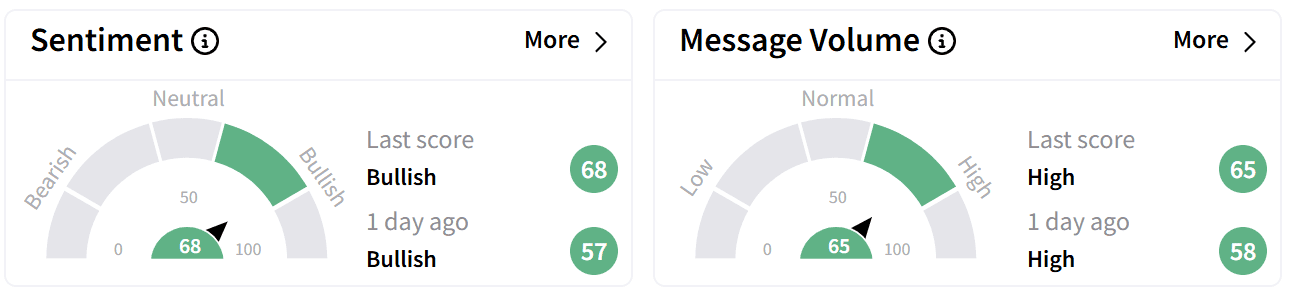

Despite the sell-off, retail sentiment around Teradyne’s stock moved upward within the ‘bullish’ territory, accompanied by ‘high’ levels of chatter.

Teradyne shares have lost 30% year-to-date and are down 18% over the past 12 months.

Teradyne’s analyst day comes just after it announced late Monday that it has signed a definitive agreement to acquire Quantifi Photonics, a privately held firm specializing in photonic integrated circuit (PIC) testing.

The deal, expected to close in the second quarter of 2025, is subject to customary closing conditions and regulatory approvals.

Teradyne said the acquisition will allow it to offer scalable test solutions for photonic chips, which leverage wafer-based manufacturing, multi-die integration, and advanced packaging with high-speed I/O interfaces – critical for high-performance computing (HPC) and artificial intelligence (AI) workloads.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read also: IBM’s Legal Momentum Continues With Supreme Court Victory Over BMC, But Retail Sentiment Is Cooling

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2033244575_jpg_3f112039eb.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_ripple_OG_jpg_b25ab79902.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2196132812_jpg_086f367c0b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263007357_jpg_aff2a32e51.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_XRP_original_jpg_005097c9e8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2261448901_jpg_dec7c2c9b9.webp)