Advertisement|Remove ads.

Trump Victory: Greenlight Capital’s David Einhorn Reportedly Raises Bets On Inflation

Greenlight Capital’s David Einhorn reportedly said that he has increased the bets on inflation following Republican candidate Donald Trump’s victory in the recently concluded Presidential elections.

“We will have another inflection up in inflation,” he said at CNBC's Delivering Alpha investor summit on Wednesday. “The policy mix being proposed is inflationary and we will see more of that over the next few years.”

Einhorn expressed concerns over the potential tax cuts proposed by Trump and worries that some of these reductions coupled with the new administration’s stand on immigration could lead to an inflationary environment.

“What they chose to do about that, I don’t know. There is an argument for tolerating it and trying to run the economy as hot as possible. I don’t really know what they will do,” he said, according to the CNBC report.

Notably, a slew of economists and market experts too have expressed skepticism on the impact of potential increase in tariffs and mass deportations that could stoke inflation and reduce the pool of cheap labor.

For instance, Minneapolis Federal Reserve President Neel Kashkari reportedly said on Sunday that retaliatory tariff increases by other countries in response to potential tariff raises by Trump will create a lot of uncertainty.

“…if somebody imposed a 1% tariff or a 10% tariff, you would think that that would increase prices of those goods either 1% or 10%. That's pretty easy to model, and it shouldn't have an effect [in the] long run on inflation. The challenge becomes, if there's a tit for tat,” Kashkari said on “Face the Nation” on CBS.

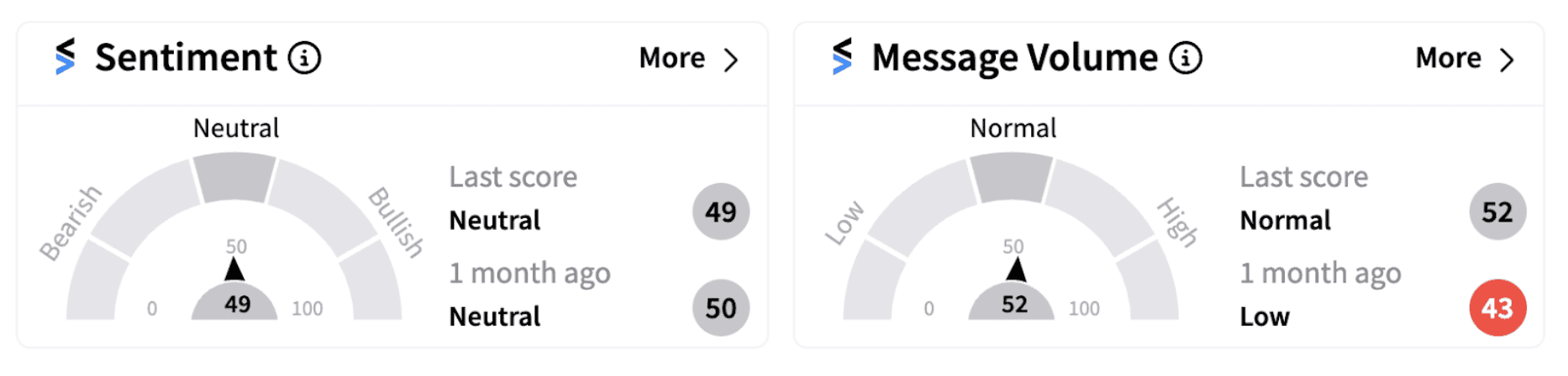

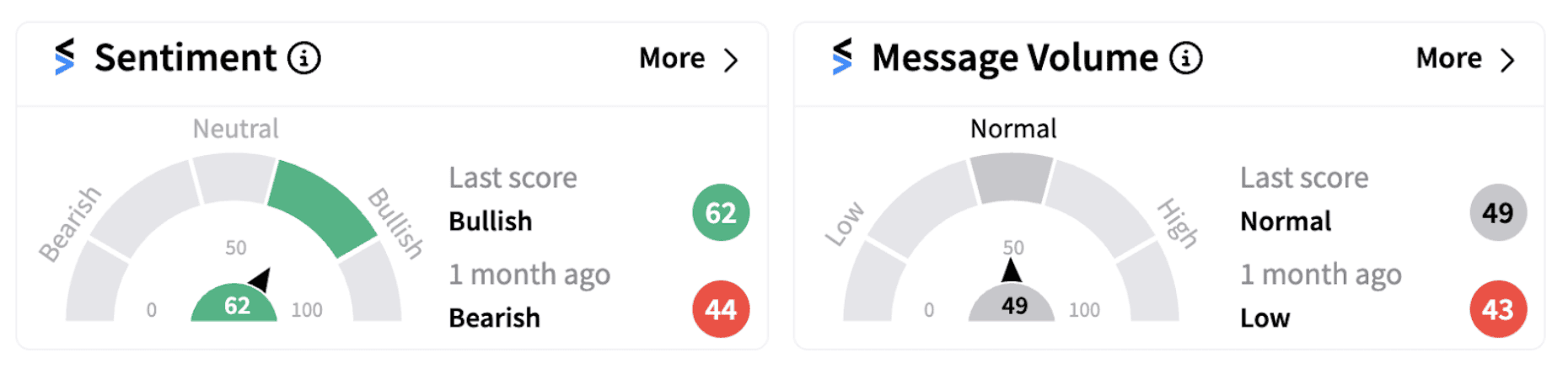

Meanwhile, after hitting record highs, the benchmark U.S. indices are taking a breather. The SPDR S&P 500 ETF Trust ($SPY) and the Invesco QQQ Trust, Series 1 ($QQQ) were trading nearly 0.25% lower on Thursday. However, retail sentiment trended in the ‘neutral’ to bearish’ territories for these assets.

For updates and corrections email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_price_bitcoin_OG_jpg_d43a7edd5e.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2227994915_jpg_357c625963.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1470886126_jpg_f11dd80298.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262161352_jpg_832967dbca.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_OG_oct23_jpg_588046d0a9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_patrick_soon_shiong_jpg_5f4d6bc18d.webp)