Advertisement|Remove ads.

Vaalco Energy Stock Rises Aftermarket On Q4 Sales Beat, Yet Retail’s Bearish

Vaalco Energy (EGY) stock gained 2.4% in extended trading on Thursday after the company’s fourth-quarter sales topped Wall Street’s estimates.

The oil producer posted quarterly revenue of $121.7 million, while analysts expected the company to post $107.8 million in revenue, according to FinChat data.

Vaalco posted a net income of $11.7 million, or $0.11 per share, for the three months ended Dec. 31, 2024, compared to $44 million, or $0.41 per share, a year earlier.

Its average sales price fell to $64.48 per barrel of oil equivalent for the reported quarter from $73.89 in the year earlier.

Global crude oil prices had declined during the fourth quarter amid concerns over demand and OPEC’s plans to raise production.

The company’s sales also declined due to the timing of offshore cargoes. It has a diverse portfolio of production, development, and exploration assets in Gabon, Egypt, Côte d’Ivoire, Equatorial Guinea, Nigeria, and Canada.

“As we look forward to 2025, we are excited about the major projects that we have planned which are expected to deliver a step-change in organic growth across our portfolio in the coming years,” said CEO George Maxwell.

The Houston-based company’s fourth-quarter production rose 15% to 20,775 barrels of oil equivalent per day.

Vaalco projected a capital budget of $270 million to $330 million for 2025 and said it expects to return $25 million to shareholders through dividends.

The company invested $3 million to acquire a 70% interest in an oil-producing block in Côte d’Ivoire earlier this year.

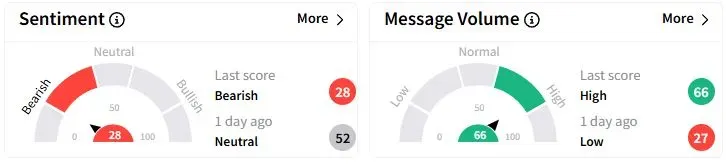

Retail sentiment on Stocktwits fell to ‘bearish’ (28/100) territory from ‘neutral’(52/100) a day ago, while retail chatter remained ‘high.

Over the past year, Vaalco stock has fallen 13.3%.

Also See: AvidXchange Reportedly Weighing A Sale After Takeover Interest, Retail Chatter Spikes

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Big_Bear_jpg_8fce0f24aa.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1242030871_jpg_12741b089b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_kevin_warsh_jpg_0c2cd19926.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Robotaxi_Tesla_jpg_209f017098.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2207049226_jpg_7f1e685123.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tariffs_jpg_d7661eb31a.webp)