Advertisement|Remove ads.

Vans Owner VF Corp Slumps On Q4 Revenue Miss, But Retail’s Turnaround Hopes Rise After Smaller-Than-Feared Loss

VF Corp (VFC) shares dropped nearly 16% on Wednesday after the clothing and shoe brand posted lower-than-expected sales for its fiscal fourth quarter.

The report casts doubt on the effectiveness of VF Corp's ongoing turnaround strategy.

The Vans owner has struggled to regain consumer interest as challenger lifestyle brands gain ground, with sales declining in each of the past three years.

However, pockets of the market, including some Stocktwits users, are watching the efforts for a potential upward movement in the stock.

"The transformation of VF is well underway," CEO Bracken Darrell said.

He said that the company delivered on its promised $300 million cost savings in the bygone fiscal year and pared down debt.

Darrell added that it is on track to achieve a $500 million to $600 million expansion in net operating income.

In recent quarters, VF Corp has implemented a "Reinvent" transformation program, including streamlining its products and businesses.

The company recently sold its streetwear brand Supreme to EssilorLuxottica for $1.5 billion and is reviewing options for its Global Packs business, which includes brands like Kipling, Eastpak, and JanSport.

In Q4, Revenue fell 5% to $2.14 billion in the last quarter, below the LSEG/Reuters analysts' expectations of $2.18 billion.

However, adjusted loss of $0.13 per share was narrower than an expected $0.14 loss per share.

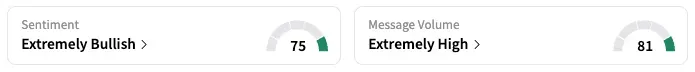

On Stocktwits, the retail sentiment was 'bullish,' while message volume jumped to 'extremely high' from 'normal.'

One user said management is making the right moves to revive its core Vans brand, adding that the stock is attractive for entry.

Other users were, however, dismayed by the performance and made predictions of bankruptcy with a year to more of layoffs.

VFC shares are down 43.4% this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254924041_jpg_892ccf911d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1234736300_jpg_881ee00045.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218899763_jpg_5d8b51f97d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump_golden_dome_resized_jpg_38d699de1f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222922178_jpg_42dd8f319f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/incyte_resized_jpg_4f94b32a2f.webp)