Advertisement|Remove ads.

Vijaya Diagnostic Hits Key Resistance Zone: SEBI RA Sees Short-term Selling Pressure, But A Breakout Is Still Possible

Vijaya Diagnostic Centre shares are hovering near a crucial resistance zone, which has historically seen sharp rejections.

On Tuesday, the stock closed 1.25% lower at ₹1,118.35, just below the resistance zone of ₹1,130 - ₹1,155.

Recent price action also shows upper wick formations, indicating short-term selling pressure, according to SEBI-registered analyst Vijay Kumar Gupta. However, a decisive close above ₹1,155 could confirm a breakout continuation, leading towards ₹1,200 and ₹1,245 in the coming weeks.

The stock recently broke out above previous highs, but has since entered a consolidation phase near the top. This minor range could evolve into either a bullish flag or a distribution pattern, Kumar said.

The ₹1,010 level serves as a key Market Structure Break (MSB) and remains a critical pivot for trend confirmation.

On the downside, the stock could find near-term support at the ₹1,050 - ₹1,075 level. Any healthy retracement and bounce from this region would be seen as a continuation signal, the analyst said.

A deeper pullback toward ₹975 - ₹1,000 would still keep the structure intact, offering an attractive risk-reward for fresh entries. For long-term investors, ₹768 is a major support and pre-breakout accumulation zone.

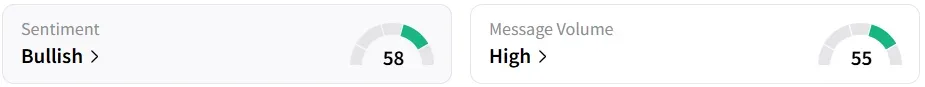

Retail sentiment on Stocktwits turned ‘bullish’, amid ‘high’ message volumes. It was ‘neutral’ a day earlier.

Year-to-date, the stock has gained 6%.

For updates and corrections, email newsroom[at]stocktwits[dot]com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227231004_jpg_0de480c6f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254924041_jpg_892ccf911d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1234736300_jpg_881ee00045.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218899763_jpg_5d8b51f97d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump_golden_dome_resized_jpg_38d699de1f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222922178_jpg_42dd8f319f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)