Advertisement|Remove ads.

VinFast Stock Sells Off Before Earnings — Wall Street Still Expects Revenue Jump And Sees 73% Upside Potential

- Analysts expect VinFast to post stronger quarterly revenue and narrower losses.

- The company is expanding across Europe and Asia with electric buses and new VF6 and VF7 SUVs.

- VinFast continues to target global growth despite delays at its U.S. factory and a broader shift away from North America driven by high logistics costs.

Shares of VinFast Auto Ltd. marked their biggest drop in nearly a month on Friday, ahead of the company’s quarterly results on Tuesday, with Wall Street expecting stronger revenue and slightly narrower losses as the Vietnamese EV maker leans on expansion in Asia and Europe and ramps up new product lines.

The stock ended 3.2% lower on Wednesday before easing 0.3% further in after-hours trading.

Wall Street Expectations

Koyfin estimates revenue of $823.36 million, up 23% from the prior quarter, while EBITDA is forecast to improve to a loss of $372.46 million from a loss of $420.69 million. EBIT is projected at a loss of $480.95 million, compared with a loss of $528.67 million last quarter. GAAP and adjusted EPS are both expected at a loss of $0.29, compared with a loss of $0.35.

Koyfin data shows four analysts cover the stock, with a consensus ‘Strong Buy’ rating. The 12-month average price target is $5.83, with individual targets ranging from $5.5 to $6. With the stock currently trading at $3.46, analysts see about 73% upside.

Expanding EV Footprint In Europe

The earnings come as VinFast deepens its presence in Europe’s commercial transport market. In October, the company introduced its first electric buses on the continent, which are the EB8 and EB12, to be sold in Germany, Belgium, the Netherlands, and Sweden, with first deliveries expected in 2026. The EB8 carries 60 passengers with a 290-km range, while the EB12 carries 90 passengers and can travel up to 400 km, both charging fully in roughly three hours.

The move marks an attempt to broaden VinFast’s global presence after slower consumer traction in North America and Europe. The company already operates hundreds of e-buses in Vietnam and sees the European public-transport market as a way to build credibility and visibility for its EV technology.

India Push With New VF6 And VF7

In September, VinFast also introduced electric SUVs in India, including the VF6 and VF7. Prices begin at ₹16.49 lakh ($19,800) for the VF6 and ₹20.89 lakh ($25,000) for the VF7. Both come with free charging and maintenance through 2028, panoramic sunroofs, and warranties of up to 10 years. The electric SUVs will be assembled at the automaker’s new factory in Tamil Nadu, which will also serve as an export hub for South Asia.

Manufacturing Shift

VinFast has continued to pivot back towards Asian markets, as soaring logistics costs and softening demand in Western markets have squeezed the company. The opening of its North Carolina plant was pushed back to 2028, and near-term growth is expected to be powered by India and Indonesia, where the company is upscaling new facilities.

VinFast sold 72,167 EVs in the first half of 2025, up 223% year-on-year, and delivered 114,484 e-scooters and e-bikes, up 447%.

Stocktwits Users Lean Bullish

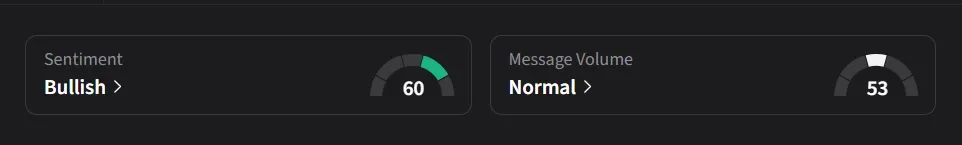

On Stocktwits, retail sentiment for VinFast was ‘bullish’ amid ‘normal’ message volume.

VinFast’s stock has declined 14% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_price_bitcoin_OG_jpg_d43a7edd5e.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_wall_street_resized1_jpg_7f200ce842.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_credo_technology_resized_cdb4311141.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_changpeng_zhao_binance_CEO_OG_jpg_1f2a158765.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_iran_natanz_nuclear_facility_jpg_ca08028936.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2234618957_jpg_1c670c00ef.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)