Advertisement|Remove ads.

Walmart Heads For ‘Clean’ Q3 Print; Margins, Holiday Quarter Forecast In Focus, Analysts Upbeat On Digital Push

- Analysts expect Walmart to report a 4.3% increase in sales and a 3.7% rise in adjusted EPS for the third quarter, with some expecting a slight upward revision to the annual forecast.

- Some brokerages highlight support from Walmart’s digital initiatives, including a greater push in digital advertising and e-commerce.

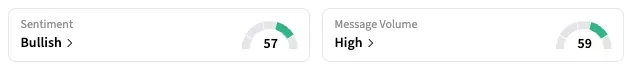

- Stocktwits sentiment for WMT shifted to ‘bullish’ from ‘bearish’ heading into Thursday; Walmart will report results in premarket hours.

Walmart Inc. is expected to deliver steady results for its recently completed fiscal third quarter, with guidance for the crucial holiday period in sharp focus for analysts and investors.

The nation’s largest retailer has navigated a turbulent period of inflation and shifting consumer behavior by keeping prices tight and leveraging its dominant position in essentials like groceries.

Notably, Walmart had raised its full-year sales and profit forecast in August, forecasting net sales growth of 3.75% to 4.75% and adjusted earnings per share (EPS) of $2.52 to $2.62 for its current fiscal year, which ends in January 2026.

Walmart is likely to post a clean Q3 print on stability of its core markets and steady alternative revenue growth, UBS Securities said in a research note last week.

The company benefited from a traffic surge driven by more events in Q3, as well as sustained e-commerce momentum from its advertising growth and marketplace expansion, the research firm said, while reiterating its ‘Buy’ rating on the company’s shares.

Bank of America analysts said this month that Walmart’s advertising momentum, along with easing pressure from general liability claims, should help support margins. The firm also noted two months ago that Walmart is emerging as a leader in applying artificial intelligence within the retail sector.

Oppenheimer analysts said that strength in Walmart’s non-core businesses could prompt the retailer to raise its 2026 outlook, likely by increasing only the lower end of its EPS range.

Consensus View

Analysts expect Walmart’s third-quarter revenue to increase 4.3% to $175.17 billion, according to Koyfin. At that level, it would be the fifth time in the last six quarters that year-over-year topline growth is below 5%. The Q4 growth projection is 4.5%.

Adjusted earnings per share (EPS) are expected to increase by 3.7% to $0.60.

Adjusted earnings before interest and tax (EBIT) margin is expected to be 4.07%, the lowest in the last four quarters, but above the 3.99% in Q3 last year.

The results would follow a critical leadership announcement: Walmart announced last week that John Furner, the CEO of Walmart’s U.S. business, will succeed longtime CEO Doug McMillon in February.

WMT Share Trend

Walmart’s shares hit an all-time high after it announced a partnership with OpenAI that lets users shop Walmart products directly from ChatGPT. They have since declined by about 8%.

In a tumultuous year, particularly for retailers, the WMT stock has emerged resilient. WMT is up 11.4% year-to-date, compared to the 13% gains in the benchmark S&P 500. In comparison, Dollar General’s stock is up over 30%, while Costco’s shares are in the red.

On Stocktwits, the retail sentiment for WMT shifted to ‘bullish’ as of early Thursday, from ‘bearish’ the previous day.

“$WMT With NVDA lifting the market sentiment, tomorrow would be a great day if WMT reports good numbers. With good numbers and positive outlook I smell $110 (or) else $90,” said a user.

Peer Retailers’ Results Show Consumer Hunting For Value

Rival Target on Wednesday posted a drop in third-quarter sales and lowered its full-year profit guidance, citing choppy spending with shoppers hunting for value.

It stuck to its sales forecast for the all-important holiday quarter, expecting a low-single-digit percentage decline compared to Q4 last year. Target is planning a bigger push on new stores and remodels next year, with an outlay of $1 billion.

Home improvement goods retailers Home Depot and Lowe’s Companies also cut their annual profit forecasts after posting mixed results earlier this week.

On the other hand, TJX Cos., which operates discount chains T.J. Maxx, HomeGoods, and Marshalls, raised its FY26 sales and profit forecasts, betting that its value items and a fresh seasonal assortment will drive holiday-season sales.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: WeShop Stock Gains Over 6-Fold, Days After Direct Listing: Retail Ecstatic

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2207049226_jpg_7f1e685123.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218181377_jpg_f2dccc3db9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2245017747_jpg_f783731632.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_China_i_Phone_jpg_bcedab655a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_American_Airlines_Getty_4d3d704837.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_sabre_resized_jpg_fa5aa35db6.webp)