Advertisement|Remove ads.

Big Tech’s AI Gold Rush Heads East: Why India Is Becoming The New Battleground For Microsoft, Google And Amazon

- India’s data-center capacity is projected to jump from 1.5 GW to 10 GW by 2030 amid rising data generation and a major compute shortfall.

- Amazon, Microsoft, Google and others unveil multiyear, multibillion-dollar plans to expand cloud and AI infrastructure across key Indian cities.

- Reliance, TCS, Adani and new operators are accelerating domestic buildout, reinforcing India’s emergence as a critical global AI infrastructure node.

In the scramble for AI supremacy, hyperscalers and data-center companies are investing at a breakneck pace — enough to draw skepticism over whether such massive capital spending will ever deliver adequate returns. Against this backdrop, headlines of megacap hyperscalers pouring billions into India have been steadily trickling in.

India Beckons

E-commerce giant Amazon (AMZN), which has a thriving cloud computing business, became the latest to announce a multi-year, multibillion-dollar commitment in India to advance AI innovation. The Amazon news comes close on the heels of Microsoft’s announcement regarding $17.5 billion investment in the country over four years ending 2029.

While Amazon stated that the $35 billion will be spent on expanding all of its businesses and on three strategic pillars, namely AI-driven digitization, export growth and job creation, Microsoft’s largesse was set to be splurged primarily on cloud and AI infrastructure.

The software giant said this marked its largest investment in Asia and that it hoped to have the largest hyperscale presence in Indian when the new data center goes live in mid-2026.

Not long ago, Alphabet, Inc.’s (GOOGL) (GOOG) Google made a $15 billion push in India, meant to build an AI hub in the port city of Visakhapatnam situated in the southern state of Andhra Pradesh. Delving into the investment, CEO Sundar Pichai said, “This hub combines gigawatt-scale compute capacity, a new international subsea gateway, and large-scale energy infrastructure.” Google said the AI hub with house a purpose-built data center campus capable of gigawatt-scale compute capacity.

Meta is also rumored to be considering building datacenter infrastructure in the subcontinent. An Economic Times report stated in late November that the Mark Zuckerberg-led company is looking to partner with India’s Sify Technologies to build a 500-megawatt data center in Visakhapatnam. Sify will reportedly spend $1.7 billion on the project and lease it to Meta. The social-media giant will also implement its ambitious subsea cable project ‘Waterworth’ at Sify’s landing station in the area.

India Raking In AI Windfall

| Investment Size | Time Horizon | Data Center Location | Data Center Capacity | |

| $15B | Through 2030 | Visakhapatnam | gigawatt-scale | |

| Microsoft | $17.5B | Through 2029 | Hyderabad | |

| Amazon | $35B | Through 2030 | Expansion, New facilities in Telangana & Maharashtra | |

| Meta (unconfirmed) | to lease from Sify | - | Visakhapatnam | 500-megawatt |

Incidentally, Sam Altman-led OpenAI, the maker of the ChatGPT large-language model, is also looking the India way. A Bloomberg report in August stated that the company was scouting for partners to set up data centers with at least 1 gigawatt of capacity.

Domestic Players Join The Party

India’s top business groups, as well as newer data center operators, are also deepening their commitments. These include:

-Billionaire Mukesh Ambani-owned Reliance Industries’ planned data center in Jamnagar to be built for $20 billion to $30 billion; Once operational, it is expected to exceed the capacity of the world’s largest data center (600-MW capacity), operated by Microsoft in Virginia

-Indian IT services giant TCS recently announced a strategic partnership with private-equity firm TPG for its AI data center business, which it calls HyperVault. The project involves a cost of $2 billion, with TPG contributing roughly 50% of the investment.

-Adani Group’s proposed 48 MW AI green data center in Telangana

The Adani Group will also reportedly invest $5 billion in Google’s AI data center project.

Pull Behind India’s Data Center Surge

Consulting firm McKinsey estimates that datacenters equipped to handle AI processing loads would require $5.2 trillion in Capital expenditure (Capex) by 2030, and that for traditional IT applications would need another $1.5 trillion, taking the total to $7 trillion in capital outlays by 2030.

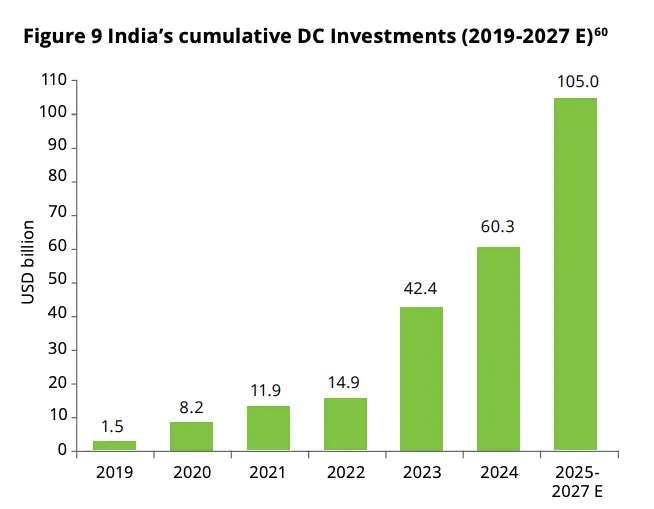

India currently has 1.5 GW of data center capacity, which is expected to increase to 10 GW by 2030, according to TCS. Citing estimates, the company said the Indian data center market has attracted about $94 billion in investment since 2019.

Deloitte’s estimates put India’s cumulative data center investments at $105 billion by 2025-07.

Source: Deloitte

The firm opines that there is a mismatch between India’s data center capacity and the data it hosts. The country hosts about 20% of the world’s data, yet accounts for less than 3% of global data center capacity.

"The gap between India’s AI aspirations and compute infrastructure presents a strategic opportunity and a national imperative to build AI data centres at scale."

How Hyperscalers’ Stocks Performed This Year

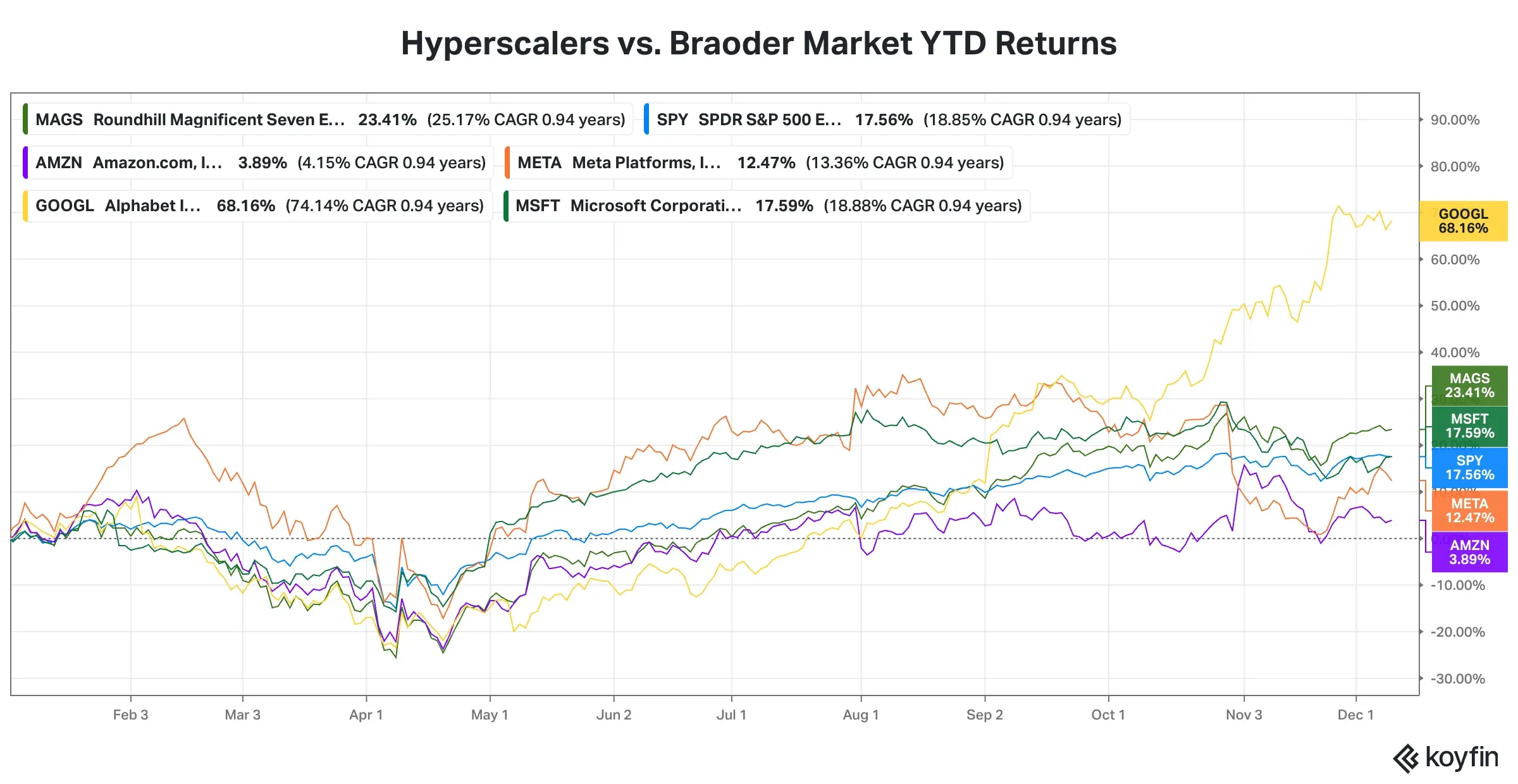

The “Magnificent Seven” group, of which the hyperscalers are part, has outperformed the broader U.S. market this year. The Roundhill Magnificent Seven ETF (MAGS), an exchange-traded fund that tracks the Mag 7s, has risen 23% this year compared to the SPDR S&P 500 ETF (SPY)’s 18% gain.

The Alphabet stock (+68%) has been the outperformer in the group, Microsoft (+18%), Meta (+13%), and Amazon (+4%) trailing it.

Source: Koyfin

On Stocktwits, retail sentiment toward Alphabet was ‘bearish’ as of early Wednesday, while that toward Microsoft, Amazon, and Meta was ‘neutral.’ According to Koyin, the maximum upside potential among the four stocks is for Amazon (+30%).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: The Best AI Trades Of The Year Weren’t Nvidia Or AMD — They Were 2 Old-School Storage Giants

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263711678_jpg_7dcbe85e4f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_2026_jpg_f51342601b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2202237165_jpg_188d67bdb5.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_us_iran_2_jpg_0c6789db95.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263736058_jpg_2b8f901978.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2244298120_jpg_ceb8c90666.webp)