Advertisement|Remove ads.

Why Is Bitcoin Miner Terawulf’s Stock Slipping Premarket Today?

Terawulf stock (WULF) fell nearly 0.7% in premarket trading on Friday, reversing early gains, after the company revealed it is planning to raise $3 billion in debt financing, backed by Alphabet’s Google, in a bid to expand its data center operations.

According to a Bloomberg News report, citing Terawulf's Chief Financial Officer, Patrick Fleury, Morgan Stanley is arranging a potential transaction for the Bitcoin miner. The deal, which will be in either the high-yield bond or leveraged loan markets, could launch as soon as October.

The report stated that credit rating firms are evaluating where to rank the debt, between the scale of BB and CCC ratings that typically apply to junk-rated offerings. However, Google is expected to backstop the deal, which could boost its credit rating.

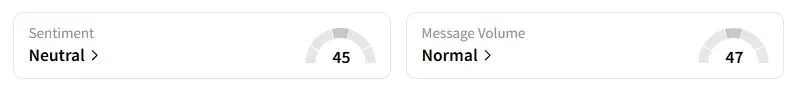

Retail sentiment on Stocktwits about Terawulf was in the ‘neutral’ territory at the time of writing.

The terms of the transaction are still under negotiation, and there is no certainty that the offering will take place, the report stated.

Last month, Google already deepened its involvement in the company’s Lake Mariner data center project by providing an additional $1.4 billion in financial backing, bringing its total backstop commitment to $3.2 billion. This came alongside the move by an artificial intelligence cloud platform provider, Fluidstack, to expand its usage of Terawulf data centers.

Terawulf and its peers are rapidly expanding their data center capacity to capitalize on the surging demand for artificial intelligence applications. On Thursday, peer Cipher Mining entered into a ten-year agreement with Fluidstack to supply 168 megawatts (MW) of dedicated IT power from its Barber Lake facility.

Google agreed to guarantee $1.4 billion of Fluidstack’s lease commitments and got millions of Cipher warrants, which raised its stake in the company to 5.4%.

Terawulf stock has gained over 88% this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_x_0d62438a6d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Circle_Internet_jpg_add0182c9c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1227710498_jpg_fbb12d04bf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)