Advertisement|Remove ads.

Workday Stock Snags Ratings Downgrade Ahead Of Next Week’s Q4 Report: Retail Stays Downbeat

Pleasanton, California-based Workday, Inc. (WDAY) Shares fell more than 3% on Wednesday after Morgan Stanley downgraded the stock and reduced its price target.

Analyst Keith Weiss downgraded Workday stock to ‘Equal-Weight’ from ‘Overweight’ and reduced the price target to $275 from $330. The analyst attributed his tempered opinion to the company's lack of success in its efforts to boost topline growth through investment in distribution.

“While the company has taken action to better support cash flows, we continue to see risk to the multiple as investors try to assess 'Where Does Growth Bottom?'” the analyst said.

Workday is an enterprise platform company that helps organizations manage money and manpower.

Some of the sore points listed by the analysts include:

- Recent negative revisions and headcount reductions flagging concerns about the growth trajectory

- Go-to-market investments not paying off as expected

- Weak fourth-quarter prints from enterprise software companies

- Eroding partner sentiment and growth expectations

Weiss said he would be more constructive on the stock if growth stabilizes and accelerates back to the management’s 15% target. If growth stalls, Workday should focus on margin expansion, he said.

“Absent these first two, we would need to see the multiple come down to a more attractive level in the low-20s FCF range,” the analyst said.

Workday is due to report its fiscal 2025 fourth-quarter report after the market closes on Feb. 25. According to Finchat, the consensus estimates for adjusted earnings per share and revenue are at $1.77 and $2.182 billion, respectively.

The company has projected quarterly subscription revenue of $2.025 billion and a non-GAAP operating margin of 25%.

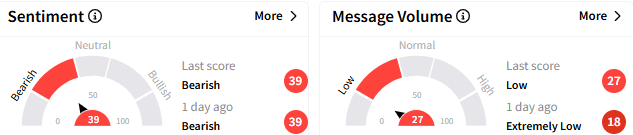

On Stocktwits, sentiment toward Workday stock remained ‘bearish’ (39/100), with the message volume at a ‘low’ level.

Workday stock fell 3.22% to $257.17 by Wednesday’s mid-session. However, it is up about 3% so far this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_trader_stock_chart_resized_861d098b1f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Selig_OG_jpg_096ac42a68.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_rivian_stock_logo_resized_10cce2eb8c.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2246553876_jpg_6597db9167.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2235797357_jpg_2c6f3265ce.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_kevin_o_leary_OG_jpg_2789641a97.webp)