Falling interest rates continue to provide stock market bulls with the tailwind to battle back, as many tech stocks pop despite mixed earnings results. Let’s see what else you missed. 👀

Today’s issue covers the “but” of Apple’s earnings beat, bulls digging in at support, and Cathie Wood-type stocks catching a break. 📰

Here’s today’s heat map:

11 of 11 sectors closed green. Real estate (+3.10%) led, & consumer staples (+1.30%) lagged. 💚

Internationally, the Bank of England voted 6-3 to keep rates at 5.25% for the second straight meeting. Like in the U.S., inflation is still elevated, but the committee believes policy may be restrictive enough to bring it down. Meanwhile, Brazil cut its interest rate for the third straight meeting to 12.25% as it looks to balance inflation and economic growth. ⏯️

U.S. labor costs experienced a surprise decline during the third quarter as the labor market slowly softens. Factory orders posted their sharpest rise since early 2021, up 2.8% in September. 🔺

Six Flags Entertainment jumped after lining up $3.1 billion in debt financing to back its all-stock merger with Cedar Fair Entertainment. Live Nation shares rose 5% after Taylor Swift and Beyonce concerts drove stronger-than-expected earnings and revenues. 🎢

Uber and Lyft shares both popped after the companies agreed to pay a combined $328 million in New York for withholding money from drivers. DoorDash also rallied 16% today after posting a better-than-expected loss and revenues. 🚗

Peloton soared 13% despite reporting a wider-than-expected first-quarter loss as it continues struggling to convert new users into paid subscribers. Its holiday forecast was also weak. ✂️

Novo Nordisk shares popped after saying that its blockbuster weight-loss drug Wegovy could receive expanded U.S. FDA approval within six months. Meanwhile, Moderna fell 7% due to a sharp third-quarter loss due to a write-down of its unused Covid vaccines. 💊

Electric truck maker Nikola shares jumped 11% despite reporting a wider-than-anticipated quarterly loss due to its recent recall. It’s estimated to spend $61.8 million to replace battery packs on the trucks but has more cash than last quarter and nearly 300 orders for its latest model. ⚡

Other symbols active on the streams: $CCJ (+4.36%), $EXPE (+10.82%), $SBUX (+9.48%), $DOCN (+24.94%), $CFLT (-42.13%), $PARA (+18.42%), and $ADA.X (+10.22%). 🔥

Here are the closing prices:

| S&P 500 | 4,318 | +1.89% |

| Nasdaq | 13,294 | +1.78% |

| Russell 2000 | 1,714 | +2.67% |

| Dow Jones | 33,839 | +1.70% |

Earnings

The “But” Of Apple’s Beat

Apple is the latest tech giant to report results. But despite beating on most metrics, the stock is falling after hours. Let’s take a look at why. 👇

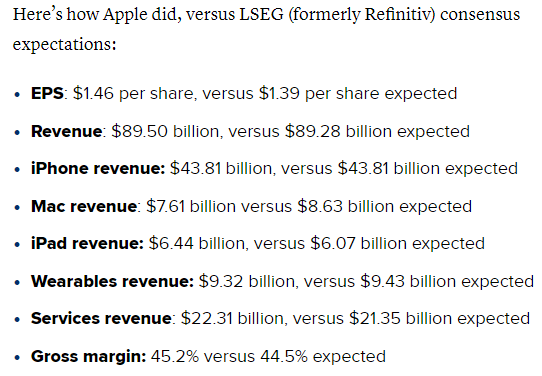

First, let’s start with this CNBC chart that summarizes actuals vs. estimates for the main metrics:

As we can see, the company topped earnings and revenue estimates, driven by strength in its iPhone and services businesses. Gross margin also expanded in the quarter, more than 70 bps above Wall Street’s outlook. However, the company’s Mac and Wearables divisions missed as discretionary spending on these items remains soft among consumers. 🔺

Within services, Tim Cook said that “every main service hit a record,” which is great to hear about its higher-margin business. It’s also sitting on a $162.1 billion cash pile, will pay a $0.24 per share dividend this month, and returned $25 billion to shareholders during the quarter by repurchasing shares and paying dividends. 💰

But things weren’t all great for the business. For example, the Greater China area (its third largest market) is seeing increased competition and revenues essentially flat YoY at $15.08 billion. Additionally, its Mac and iPad businesses remain under pressure vs. strong 2022 comparables. Analysts are unsure if the release of M3 chips and a product refresh will be enough to grow again. ⚠️

Looking ahead, the company did not provide formal guidance but expects total revenues to be flat YoY during its holiday quarter. Analysts had expected 4.5% YoY growth, though its gross profit margin and EBIT forecasts exceeded analyst expectations. Nonetheless, with the company experiencing its fourth straight quarter of YoY revenue declines, investors remain concerned about its ability to grow at its size and in the current economic environment. 😬

$AAPL shares initially popped but are now down about 3% after the bell as investors digest the news.

Earnings

Cathie Catches A Break

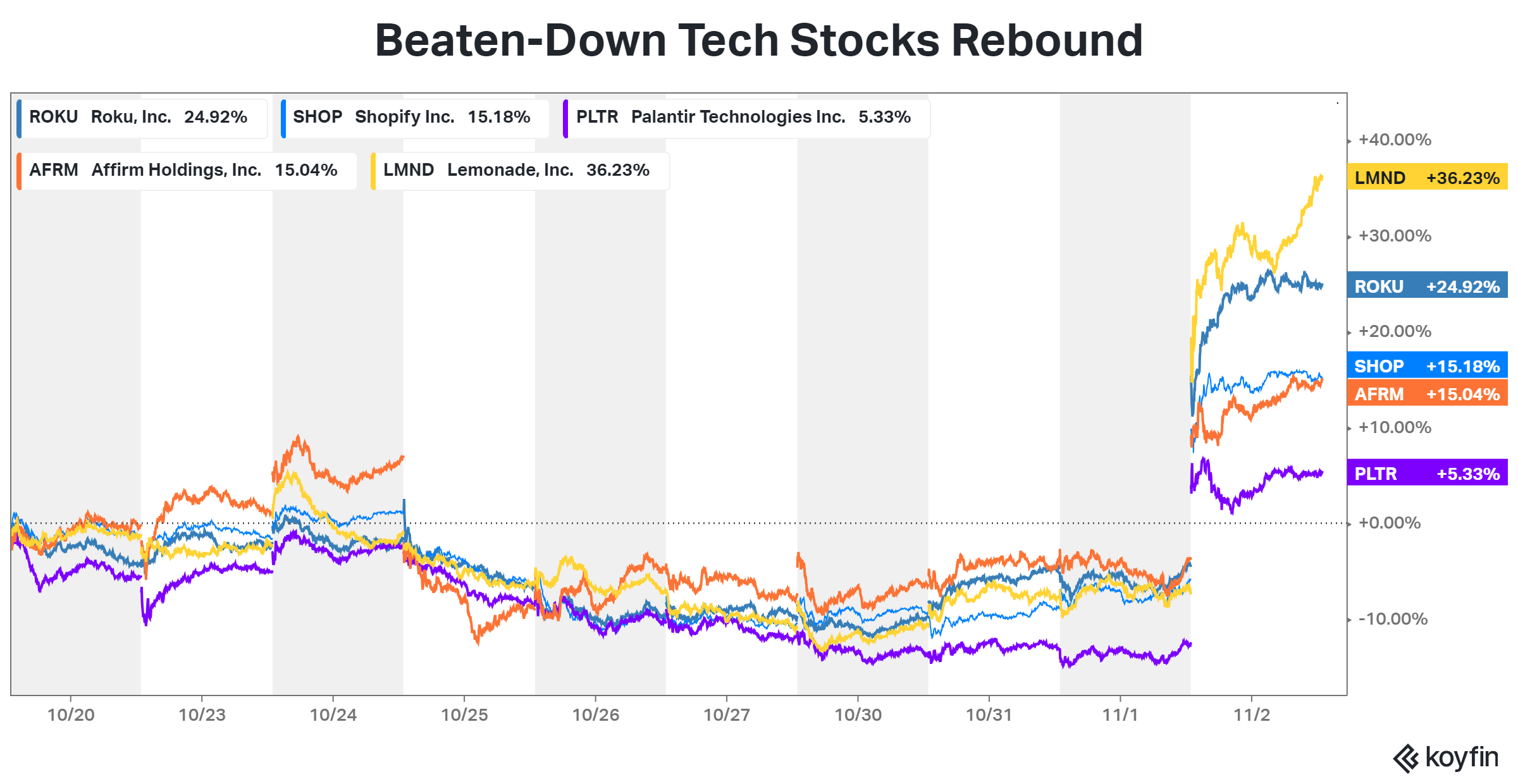

Cathie Wood and her ARK funds are experiencing some relief as beaten-down technology stocks they’ve bet on rebound. 😌

So what’s causing these stocks to catch such a strong bid recently? Most analysts believe it’s a combination of several factors:

- The bond market stabilizing (rates pulling back)

- Earnings results going from “very bad” to just “bad”

- Positioning in the stocks being extremely pessimistic

- Portfolio managers looking for “catch-up” plays into year-end

The ten-day performance chart shows several of $ARKK’s most significant holdings jumping sharply today following their earnings reports. However, it also shows the extent of their recent declines and overall volatility. 📊

Other positive earnings reactions included Coinbase, Block, and DraftKings, which all soared after the bell. However, not every stock in this category is seeing a bounce. For example, $BILL plunged 35% and $FTNT fell 18% following their weaker-than-expected results, as volatility among growth stocks continues. 😬

We’ll have to wait and see if these conditions persist. But for now, Cathie Wood and investors and traders following similar strategies are feeling relief. 👍

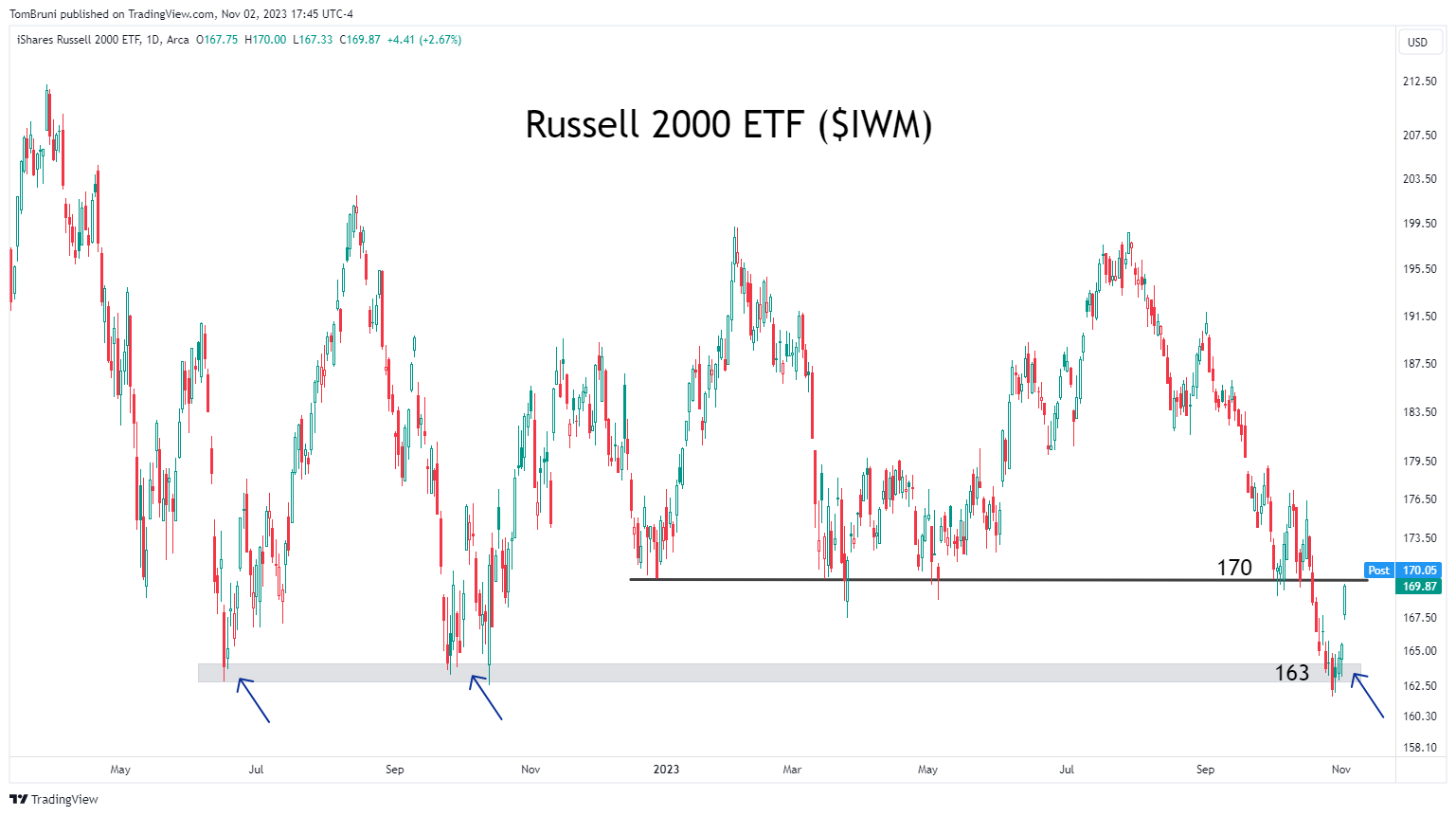

Two weeks ago, we updated the roadmap many technical analysts are using to navigate the current market as the S&P 500 and other major indexes looked for support. Since then, prices breached several key levels before popping back above them this week, so it’s worth an update. 👀

Below, we can see the S&P 500 ETF $SPY briefly breaking below several key levels, including the May breakout level, VWAPs from its ’22 high and low, and the 200-day moving average. With sentiment stretched and Powell giving the bond market a breather, prices have quickly reclaimed all those levels. Now, traders are watching how high prices get before seeing sellers step back in again. 🧭

The same thing happened in the small-cap Russell 2000 ETF $IWM, which made three-year lows before quickly reversing back above its previous lows. Whether it can get back up to the top of its range from the last 15 or 18 months remains to be seen. But buyers once again saved themselves right where many expected. 😮💨

Investors and traders will be watching these charts closely into year-end. It got a little shifty there, but for now, the bulls are doing their best to move the ball forward. 🐂

Bullets

Bullets From The Day:

🛒 Target CEO says shoppers continue to pull back, even on necessities. The retailer is doubling down on its cautious outlook ahead of the holiday shopping season, with CEO Brian Cornell telling CNBC that shippers are pulling back on everything, including groceries. Like other retailers, it’s taking a more conservative approach to its inventory plan, given last year’s large glut diminished profits. Volumes remain challenged, even if retailers have been able to buoy revenues with higher prices. CNBC has more.

🛰️ Starlink is now running at breakeven cash-flow levels. SpaceX CEO Elon Musk confirmed this week that the rocket company’s satellite internet unit has reached the financial milestone. In 2021, Musk said that SpaceX would spin off Starlink as a public company once it had “reasonably predictable” cash flows. Last year, Starlink’s revenues rose more than 500% to $1.4 billion, owning most of all active satellites in space (as well as future launches). More from Reuters.

👛 Intuit shuts down Mint and pushes users towards Credit Karma. The fintech giant has shut down its popular budgeting app, Mint, at the end of the year despite it having more than 3.6 million users. In the interim, it’s pushing users to Credit Karma, which offers similar features like the ability to view transactions, track spending, aggregate financial accounts, and more. However, users have pushed back on the decision, saying it no longer fits their needs and will force them to look for alternatives in the space. The Verge has more.

💰 Amazon’s pricing scheme netted it $1.4 billion. The tech giant’s “Project Nessie” is an algorithmic pricing scheme that allegedly raised prices where it could safely do so, netting hundreds of millions of dollars in additional profits during its operation. The Federal Trade Commission’s (FTC) allegations of anti-competitive behavior cover a variety of practices, but this “secret” project of Amazon’s has become the poster child for its campaign against the company. More from TechCrunch.

📊 Lawsuit alleges big landlords collude to raise rents. A lawsuit filed in D.C. this week alleges several of the city’s most prominent property managers worked together to artificially raise rents, raising a debate that could be taken nationwide if this case is successful. It alleges that landlords outsource pricing decisions to an algorithm that uses data from the industry’s largest players, making it so they don’t have to compete on price. The software in question is RealPage, which allegedly estimates the supply and demand for housing and generates a price that maximizes landlord revenue. Axios has more.

Links

Links That Don’t Suck:

📈 Cybin Announces Unprecedented Positive Phase 2 Interim Efficacy Data for CYB003*

📝 New Google trial docs may explain why search sucks so bad now

📺 Disney to acquire remaining stake in Hulu for expected $8.6 billion

🤑 Americans’ average credit score at every age — see how you compare

🏘️ 15 major U.S. cities where starter homes can be found for less than $230,000

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.