Yesterday’s artificial intelligence (AI) news propelled Google, AMD, and other tech stocks higher, helping keep the broader market afloat. Let’s see what you missed. 👀

Today’s issue covers Dollar General’s sale situation, Lululemon’s lagging margins, and international markets joining the party. 📰

Here’s today’s heat map:

8 of 11 sectors closed green. Communications (+2.08%) led, & energy (-0.68%) lagged. 💚

China’s exports grew for the first time in six months during November, causing analysts to ask whether improvements on the ground have been masked by fears from sentiment-based surveys that have been largely negative. 📦

Pet care e-commerce company Chewy is falling again after its third-quarter earnings and revenues both missed consensus expectations. Like other pandemic-era growth stocks whose prices are near all-time lows, management is struggling to put its business on a profitable growth path. 🦴

Cerevel Therapeutics shares jumped another 11% on news that AbbVie will acquire the neuroscience drugmaker for about $8.7 billion. This comes just days after it said it would purchase Immunogen for $10.1 billion, as the pharmaceutical company’s shopping spree continues. 💰

Software company Sprinklr Inc. sprung a leak after its fiscal 2025 sales guidance disappointed Wall Street. It also caught a downgrade to neutral by BTIG’s analyst, who is concerned about its topline growth. Shares fell 33% on the day. ✂️

JetBlue shares soared 15% after the low-cost carrier raised its current quarter guidance due to strong holiday travel demand. That reverses its initially cautious guidance, which it issued in late October along with its third-quarter earnings results. 🛫

Alcohol manufacturers continue to struggle with wine-maker Duckhorn Portfolio falling to new all-time lows after its earnings and revenues missed expectations. 🍷

GameStop shares continue to fluctuate, with yesterday’s earnings providing no color on its turnaround plan. Instead, the company made significant changes to its investment policy, essentially allowing CEO and Chairman Ryan Cohen to use company cash to buy other stocks. Bears say this is an admission that management has no plan to turn around the core business’ revenues and will make risky bets with their cash instead. 🤪

Other symbols active on the streams: $AMD (+9.89%), $TRKA (-71.85%), $RH (-8.52%), $SLDB (-68.42%), $BMEA (-18.54%), $GME (+10.24%), $MLGO (-78.60%), & $LKNCY (-4.79%). 🔥

Here are the closing prices:

| S&P 500 | 4,586 | +0.80% |

| Nasdaq | 14,340 | +1.37% |

| Russell 2000 | 1,868 | +0.87% |

| Dow Jones | 36,117 | +0.17% |

Earnings

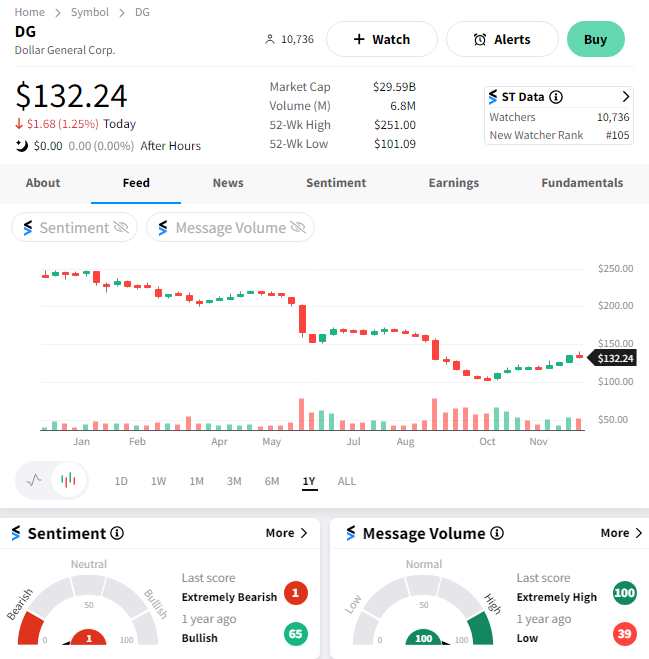

Dollar General’s Sales Situation

Dollar General is back in the news with the same old issues as in June and August. Let’s take a look at today’s earnings report. 👀

The discount retailer’s third-quarter earnings per share of $1.26 topped expectations of $1.20. Unlike previous quarters, its sales beat expectations, reaching $9.694 billion versus the $9.644 billion expected. Same-store sales also fell less than anticipated, 1.3% versus 2.1%. 🔺

In recent quarters, the company has struggled with low-income consumers pulling back on spending due to inflation and an uncertain economy. And when those consumers did spend at its stores, they primarily bought lower-margin necessities rather than higher-margin discretionary items. That continued this quarter, with consumables as the only category seeing positive sales growth and gross margins falling by 81 bps YoY.

Despite the lackluster sales growth, expectations have finally gotten low enough for the company to step over them. 👍

CEO Todd Vasos said, “While we are not satisfied with our financial results for the third quarter, including a significant headwind from inventory shrink, we are pleased with the momentum in some of the underlying sales trends, including positive customer traffic, as well as market share gains in both dollars and units.”

Overall, management believes its business model is relevant in all economic cycles and is working to address the several operational issues that caused it to stumble through the last year or so. As such, they’re charging ahead with their expansion plans, planning 800 new stores, 1500 remodels, and 85 relocations in fiscal 2024. 🏬

With that said, they acknowledged the lackluster stock performance and declared a $0.59 per share quarterly dividend to appease investors. It also has an open $1.4 billion authorized share repurchase program available should it want to support the price of its shares further.

To combat its shrink problem, which has been a roughly 100-basis-point margin headwind for the company, management is increasing staffing in the front of stores near the checkout area. It’s also reallocating labor investments toward store-level inventory-management processes to keep the shelves stocked. 🚨

Lastly, management said they’d seen an uptick in traffic trends during the middle of the quarter, which has continued into December. Should that remain through year-end, the company could be in a solid position to beat its sales guidance for the first time in many quarters.

$DG shares fell about 1% after failing to hold earlier gains. 🔻

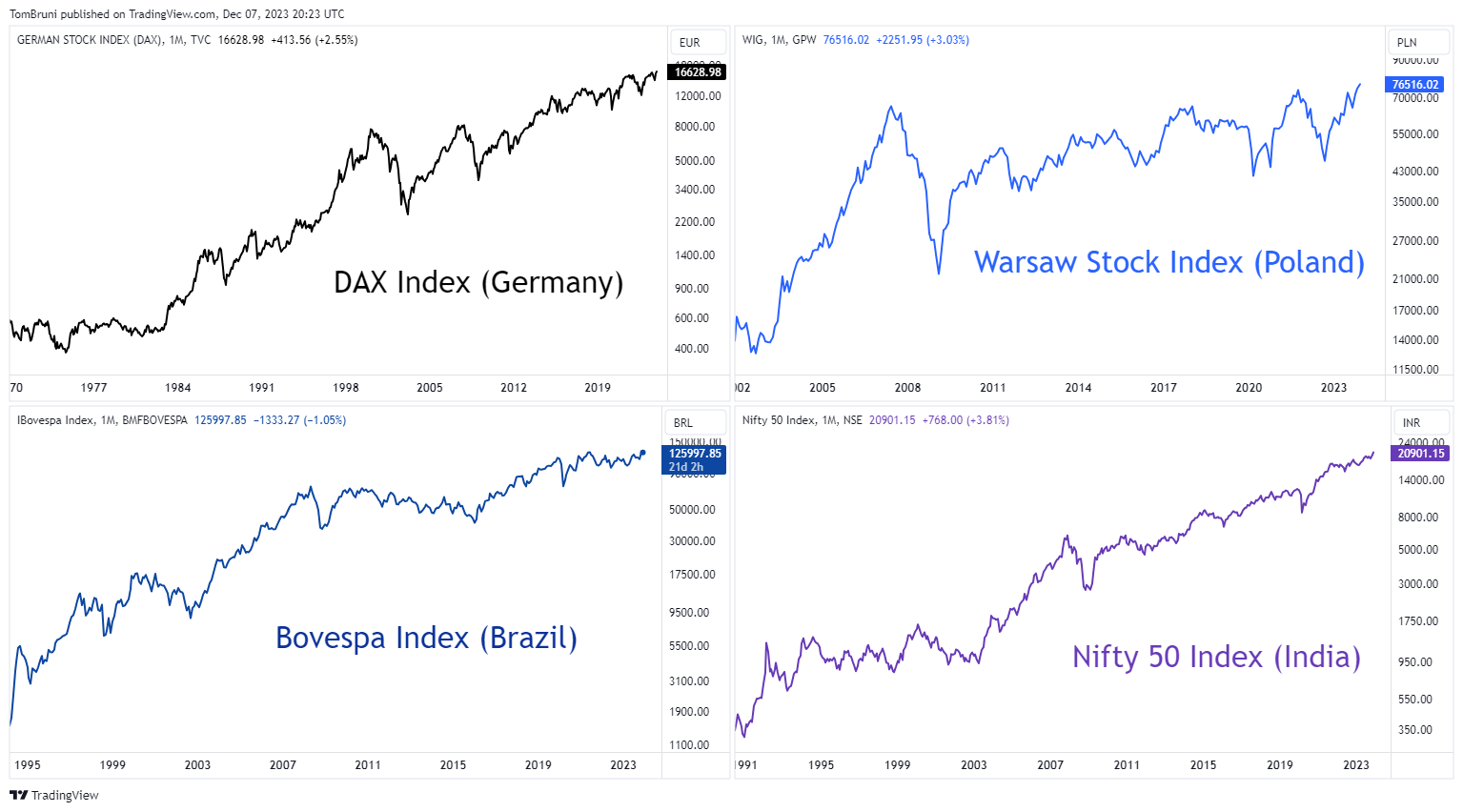

There are plenty of U.S. stocks for investors to focus on. However, occasionally, international stocks will pop up on the radar. And this year is one of those times. ⌚

Below are four examples of international indexes hitting new all-time highs, including Germany’s DAX, Poland’s Warsaw Stock Index, Brazil’s Bovespa, and India’s Nifty 50. It shows a range of both developed and emerging markets seeing strong demand from investors around the globe. 📈

While these charts are impressive, it’s important to note they are in local currency terms. So, U.S. investors have not seen these types of returns, given the strength of the U.S. Dollar. Nonetheless, it shows that there remains global demand for stocks as an asset class, which is an important signal given that different asset classes tend to move in the same direction over time. 🤑

Stock market bulls want to see this list of international indexes hitting new highs continue to expand, arguing that more strength internationally will further support the bull case for U.S. stocks. We’ll have to wait and see. 👀

Earnings

Lululemon’s Margins Lag

Lululemon shares were in focus recently, running hot since mid-October when news broke it would be added to the S&P 500 index. The stock was roughly 5% below all-time highs ahead of today’s earnings results, which were mixed versus expectations.

The athleisure retailer posted $2.20 billion in revenues during the third quarter, topping estimates of $2.19 billion. Driving that was a 12% increase in North American sales and a 49% jump internationally. Comparable sales rose 13%, with store sales rising 9% and direct-to-consumer (DTC) revenues rising 18%. DTC revenues remained at 41% of total sales, flat QoQ. 🛒

Adjusted earnings per share of $2.53 was essentially in line with expectations. Gross margins rose 110 bps YoY to 57%, below the 57.7% expected by Wall Street. The impairment of its Mirror assets weighed on margins this quarter, which is concerning with investors so focused on profitability in a weak(er) sales environment. 🔺

CEO Calvin McDonald said, “As we enter the holiday season, we are pleased with our early performance and are well-positioned to deliver for our guests in the fourth quarter.” Despite that commentary, its fourth-quarter earnings per share guidance of $4.85 to $4.93 was mixed versus estimates of $4.80 to $5.19. That also caused its full-year guidance to be worse than anticipated.

$LULU shares are down about 2% after the bell. Technical analysts continue to focus on the stock’s long-term support and resistance level, which is near 385-400. They suggest that the price’s longer-term breakout remains intact above there and that dip buyers are likely to scoop up shares if prices drift lower. 🧘

Bullets

Bullets From The Day:

🏦 Wall Street CEOs push back on lawmakers’ proposed new capital rules. Leaders from eight of the largest U.S. banks sounded alarms over a sweeping set of higher standards known as the Basel 3 endgame. During an annual Senate oversight hearing, JPMorgan Chase CEO Jamie Dimon said, “The rule would have predictable and harmful outcomes to the economy, markets, businesses of all sizes, and American households.” If unchanged, the regulations would raise the capital requirements of the largest banks by roughly 25%. CNBC has more.

⏪ U.S. retail lobbyists retract “organized retail crime” claims. The National Retail Federation pulled back its claim that “organized retail crime” accounted for nearly half of all inventory losses in 2021. Its retraction comes after it found incorrect data was used in its analysis. It said the inclusion of the claim in its report was taken directly from testimony made by Ben Dugan (former president of the advocacy group Coalition of Law Enforcement and Retail) in 2021, along with the NRF’s survey in the same year. The claim has since been removed from its April report, but the damage may have already been done, given it was heavily circulated since then. More from Reuters.

📵 Facebook and Messenger roll out automatic message encryption. Although the feature has been available for years via opt-in, Meta announced that both app’s chats will be encrypted automatically going forward. The U.K. government and police are among the critics who claim that the move will make it more challenging to detect child sexual abuse (and other crimes) on the apps. The switch means nobody, including Meta, can see what is sent or said unless the user reports it. It’s expected the change will also be rolled out to Instagram in the new year. BBC News has more.

₿ Robinhood continues its European push with the launch of crypto trading. This is the brokerage’s second major international expansion in several weeks, given it opened a waitlist for U.K. customers to join its stock-trading platform in early 2024. The new crypto service launched this week will allow users in the European Union to buy and sell over 25 digital currencies. It’s the latest firm to look abroad for growth opportunities as they pull back from the U.S. market due to regulatory pressure and a lack of overall clarity. More from CNBC.

💳 Amazon delivers another blow to PayPal, dropping Venmo as a payment option. The tech giant will no longer accept Venmo beginning on January 10, 2024, but will still accept Venmo debit and credit cards. This reversal came about a year after adding it in an effort to offer customers payment options that were convenient and easy to use. It raises further concerns that PayPal is falling behind competitors in a crowded payment space. TechCrunch has more.

Links

Links That Don’t Suck:

⚡ New passive income side hustle: selling electricity to neighbors

📝 23andMe changes terms of service to prevent lawsuits after data breach

🪨 Can rocks absorb enough CO2 to fight climate change? These companies think so

🍟 Woman who assaulted Chipotle worker sentenced to fast food job for two months

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.