The Israel-Hamas war that erupted over the weekend inevitably led to a knee-jerk reaction in several assets. Let’s review today’s moves.

First, let’s start with the Finviz futures view, which summarizes the core asset classes well.

Crude oil and other energy-related commodities popped as the market assigned a risk premium due to the region’s instability. Israel did order the shutdown of its Tamar natural gas field over security concerns, but overall, global production has not been significantly impacted so far.

Next, “safe-haven” assets caught a bid as investors initially rushed for protection. Both precious metals and U.S. Treasury bonds caught a bid, reversing the selling they’ve experienced for the last several weeks. The U.S. Dollar Index did not see a big move; however, it did gain against the Israeli shekel as the Bank of Israel worked to stabilize the currency.

And lastly, stocks recovered from their futures-session lows, led by energy, industrials, and technology stocks. For now, it’s too early to tell the impact of this war on equities, so last week’s buying pressure continued as rates declined.

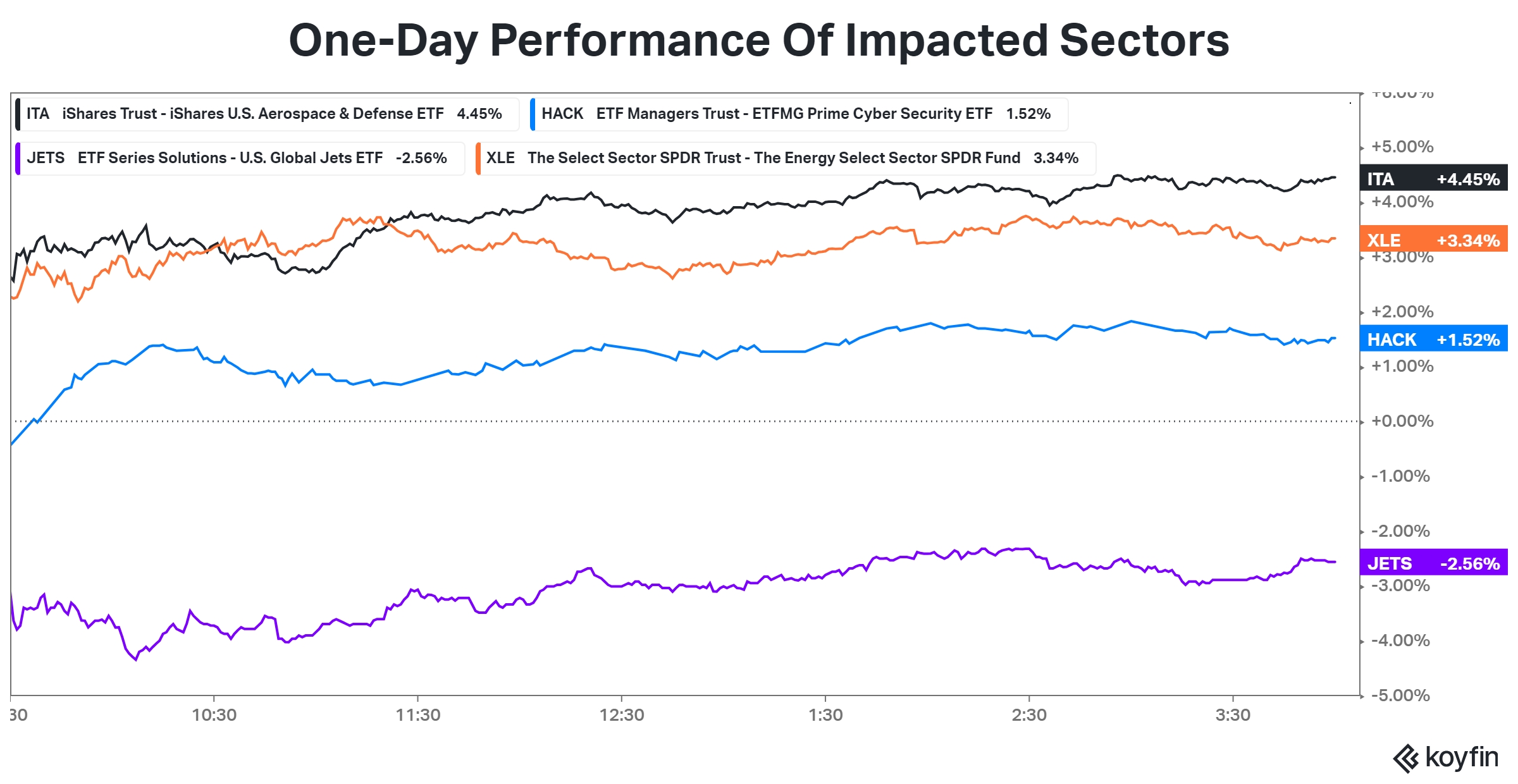

As for the stock market sectors most impacted, the aerospace & defense, energy, and cyber industries all saw strong moves today. Meanwhile, global airlines fell as many suspended flights to and from the region, and the U.S. placed a travel advisory on the region.

Those industry ETFs and their components will likely remain in focus as the situation develops. Some of the top trending tickers on our platform today included Northrop Grumman ($NOC), L3Harris Technologies ($LHX), General Dynamics ($GD), Lockheed Martin ($LMT), Raytheon Technologies ($RTX), Exxon Mobil ($XOM), Chevron ($CVX), Palantir Technologies ($PLTR), ParaZero Technologies ($PRZO), Hub Cyber Security Ltd. ($HUBC), Maris Tech Ltd. ($MTEK), Delta Airlines ($DAL), and American Airlines ($AAL).

So far, the U.S. has ordered the Ford carrier strike group into the Eastern Mediterranean to be ready to assist Israel. And President Joe Biden has condemned the terrorist attacks by Hamas in Israel, offering Prime Minister Netanyahu support, “…standing ready to offer all appropriate means of support to the government and people of Israel.”

What those appropriate means of support look like remains unclear as leaders from the U.S. and around the globe work to identify if and how they should get involved in this escalating conflict.