Advertisement|Remove ads.

Beacon Roofing Supply Stock Rises After QXO Extends Deadline For $11B Offer: Retail Stays Bullish

Shares of Beacon Roofing Supply (BECN) rose more than 2% in after hours trading on Monday following announcement from QXO that it is extending its all-cash tender buyout offer.

QXO, a building-products distribution company headed by billionaire Brad Jacobs, has also secured $830 million in a fresh equity raise in connection to the buyout, WSJ reported.

The closing of the equity raise is contingent upon the closure of the outstanding all-cash tender offer that was scheduled to expire on Friday. The extension gives it until March 18 for requisite approvals.

According to a QXO statement, about 11,293,572 shares have been validly tendered and not withdrawn, representing about 18.34% of the issued and outstanding shares of Beacon Roofing.

IQXO had launched a tender offer to purchase all outstanding shares of Beacon for $124.25 per share in cash for about $11 billion, which represented a 37% premium to Beacon's 90-day unaffected volume-weighted average price per share as of Nov. 15, 2024.

Beacon’s board has repeatedly rejected the bid contending it wasn’t in the best interest of its shareholders.

QXO has previously said it had received clearance in both the U.S. and Canada for the transaction, along with plans to nominate independent directors at the company’s forthcoming annual investor meeting.

Last month, Stifel downgraded Beacon to ‘Hold’ from ‘Buy’ with a price target of $122.55, down from $131 after its board rejected the $124.25 per share tender offer.

According to the analyst firm, its scenario analysis favors QXO successfully acquiring Beacon at $124.25 per share.

Beacon distributes specialty building products, including roofing materials and complementary products, such as siding and waterproofing.

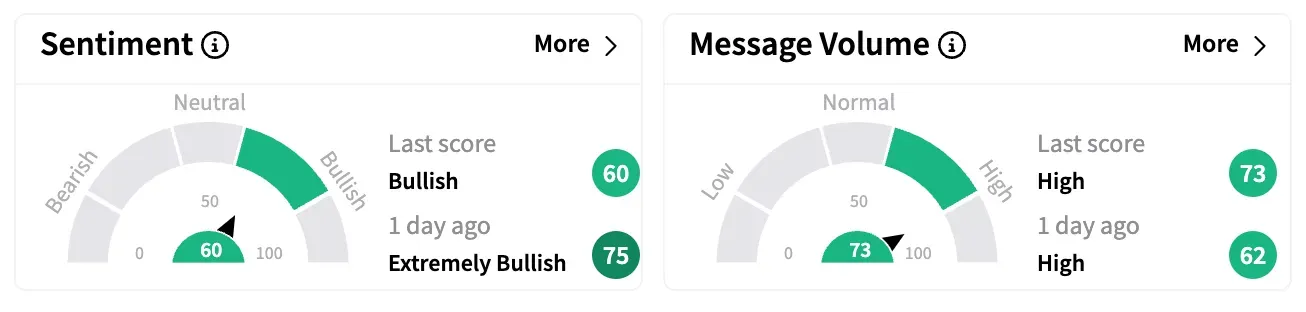

Sentiment on Stocktwits ended Monday on a ‘bullish’ note. Message volume remained in the ‘high’ zone.

Beacon stock is up 18% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_iren_OG_jpg_ba842dd11a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_fsd_jpg_f113fd1ea5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Christopher_Giancarlo_OG_jpg_915015c289.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227884296_jpg_f4ab8e4dcf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_hims_stock_logo_resized_jpg_5554a2a2c1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_crypto_atm_OG_jpg_ab7e4567eb.webp)