Advertisement|Remove ads.

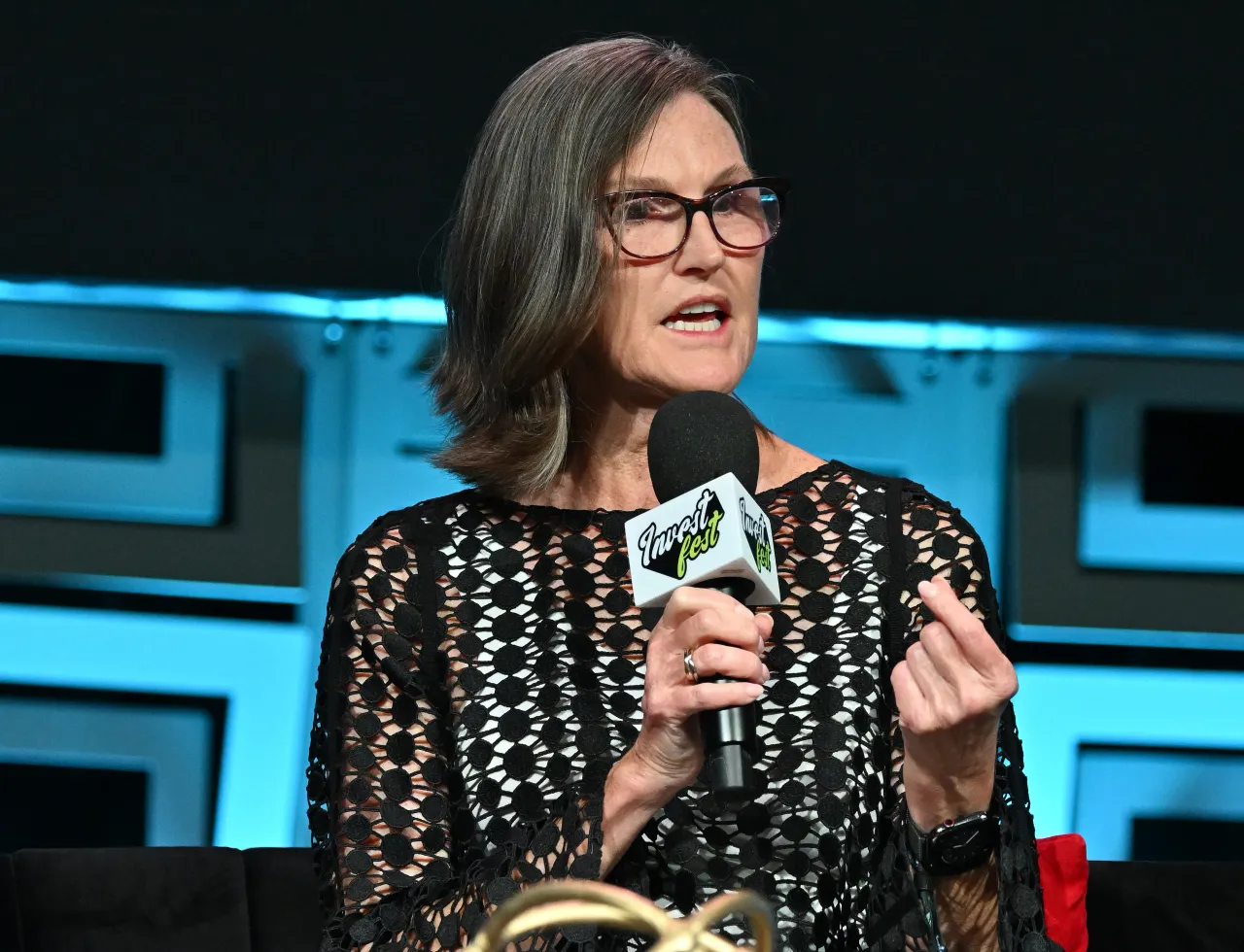

Bullish Set To Snap Five-Day Losing Streak After Cathie Wood Buys More Shares

- On Monday, ARK bought a total of 27,830 shares of Intellia, with 25,565 shares purchased by its ARKK ETF and 2,265 shares purchased by its ARKF ETF.

- Rosenblatt analyst Chris Brendler said the recent weakness in the shares could be attributed to the impending expiry of the initial public offering lock-up rather than fundamentals.

- Retail sentiment on BLSH was in the ‘bullish’ territory compared to ‘neutral’ a week ago, with message volumes at ‘high’ levels, according to data from Stocktwits.

Shares of Bullish were trading 2% higher in premarket trading on Tuesday and are set to snap a five-day losing streak after Cathie Wood’s Ark investment bought nearly 28,000 shares of the company.

On Monday, ARK bought a total of 27,830 shares of Intellia, with 25,565 shares purchased by its ARKK ETF and 2,265 shares purchased by its ARKF ETF, according to the Ark Invest Tracker on X.

The recent buy by Cathie Wood builds on Ark Investment’s Friday purchase of 81,538 shares of Bullish as per the Ark Invest Tracker. Bullish, which owns the CoinDesk media outlet, has seen its stock fall more than 5% so far this year and recorded an 8% decline last week, its worst week since November last year.

Wall Street View

In January, Rosenblatt cut the firm's price target on Bullish to $52 from $55 and maintained a ‘Buy’ rating, according to TheFly. Analyst Chris Brendler said the recent weakness in the shares could be attributed to the impending expiry of the initial public offering lock-up rather than fundamentals.

According to Brendler, Bullish's December trading volumes came in below consensus expectations, but estimates "were likely stale" given publicly available daily volume data. The firm said it believes the company "greatly outperformed" peers as its institutional-only business model insulates it from retail volatility.

How Are Stocktwits Users Reacting?

Retail sentiment on BLSH was in the ‘bullish’ territory compared to ‘neutral’ a week ago, with message volumes at ‘high’ levels, according to data from Stocktwits. In the last seven days, the retail message volumes on the stock jumped 50% on Stocktwits.

A bullish user on Stocktwits said that they expect BLSH to be a long-term player.

Shares of BLSH have declined 34% in the last three months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Also See: JD.com Is Testing Retail Investor Nerves: Wall Street’s 2026 Outlook Turns A Bit Bleaker

/filters:format(webp)https://news.stocktwits-cdn.com/large_iren_OG_jpg_ba842dd11a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_fsd_jpg_f113fd1ea5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Christopher_Giancarlo_OG_jpg_915015c289.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227884296_jpg_f4ab8e4dcf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_hims_stock_logo_resized_jpg_5554a2a2c1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_crypto_atm_OG_jpg_ab7e4567eb.webp)