Advertisement|Remove ads.

GitLab Stock Slides Premarket As Lackluster Guidance Overshadows Q4 Beat: Retail’s Divided

GitLab, Inc. (GTLB) stock moved lower in Tuesday’s premarket trading despite the software development platform provider announcing better-than-expected quarterly results as slowdown in key operating metrics and lackluster guidance dented investor sentiment.

The San Francisco, California-based company reported adjusted earnings per share (EPS) of $0.33 for the fourth quarter of the fiscal year 2025. This marked an improvement from the year-ago quarter’s $0.15 and exceeded the Finchat-compiled consensus of $0.23.

Revenue climbed 29% year over year (YoY) to $211.4 million, beating the average analysts’ estimate of $206.48 million. However, the topline growth slowed from the previous quarter’s 31%.

Brian Robins, GitLab Chief Financial Officer, said, “In particular, we saw significant demand from our enterprise customers who see GitLab as their trusted DevSecOps partner, helping them to deliver on some of their most complex software demands.”

The non-GAAP gross margin fell a percentage point YoY to 91% but the non-GAAP operating margin expanded to 18% from 8%.

Among the other operational metrics, customers with more than $5,000 in annual recurring revenue (ARR) climbed 15% YoY to 9,893, with the growth slowing slightly from the third quarter’s 16%.

The growth in customers with more than $100,000 in ARR slowed to 29% from 31%. Customers with over $1 million in ARR rose 28% to $ 123.

The dollar-based net retention rate was123%, almost unchanged from the previous quarter.

Total remaining performance obligations (RPO) jumped 40% to $945 million, slower than the third quarter’s 48% surge. Current RPO grew 35% to $579.2 million.

Guidance

GitLab expects first quarter adjusted EPS and revenue of $0.14 to $0.15 and $212 million to $213 million, respectively. This compares to the consensus estimates of $0.15 and $212.45 million, respectively.

For the fiscal year 2026, the company projected an adjusted EPS of $0.68-$0.67 and a revenue of $936 million to $942 million. Analysts, on average, estimate $0.70 and $941.77 million, respectively.

Management/Board Changes

GitLab said it has appointed Ian Steward as Chief Revenue Officer (CRO), effective May 3. He will take over from interim CRO and Chief Marketing and Strategy Officer Ashley Kramer, who has decided to pursue an opportunity outside.

The company also announced the appointment of ex-Citrix Systems CEO David Henshall to its board on March 3.

Retail Sentiment

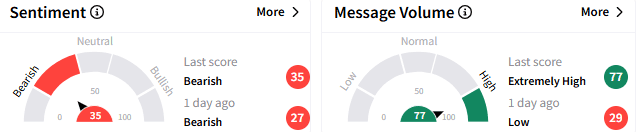

On Stocktwits, sentiment toward GitLab stock remained 'bearish' (35/100), but the message volume perked up to an ‘extremely high’ level.

A watcher questioned the viability of GitLab and its solutions for the future as artificial intelligence (AI) becomes more prominent.

However, another user believes GitLab stock is “criminally underappreciated.”

In Tuesday’s premarket session, GitLab stock fell over 5% to $53.30. The stock trades marginally in the red for the year-to-date period.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_altcoins_5a22b361ff.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)