Advertisement|Remove ads.

Hertz Stock Slides Premarket After Best Day In Over 6 Months: Retail Traders Ecstatic On Q3 Print

- Hertz reported a narrower-than-expected revenue decline and adjusted EPS significantly higher than targets for the third quarter.

- The company stated that higher sales of used vehicles and a newer fleet of rental cars helped drive the results.

- Shares fell over 3% in premarket trading, following a nearly 37% surge on Tuesday.

Hertz Global Holdings, Inc. trended on Stocktwits early Wednesday, following upbeat earnings results that sent its shares to their best session in over six months. The stock, however, was under pressure from profit-taking in early premarket trading.

The car rental company posted a net profit after more than two years in the third quarter, reporting a smaller-than-expected decline in revenue and adjusted earnings per share that comfortably beat estimates.

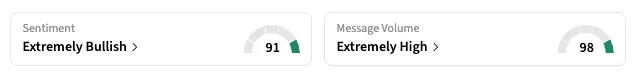

On Stocktwits, the retail sentiment for HTZ climbed higher in the ‘extremely bullish’ zone, with the ticker trending at number two on the charts.

“The stock's floor has been $5 for most of the year, and we think the shares are extremely attractive here, given 45% of the shares are sold short,” a user said. “We think the downside is fairly limited with tremendous upside as shorts are forced to cover.

“$7 then no resistance,” said another.

Hertz, which has been trying to diversify its business, stated that higher used vehicle sales and a newer fleet of rental cars helped drive the results.

“We’ve transformed our fleet from a headwind to a competitive advantage,” CEO Gil West said, adding that the company’s average car age is now under 12 months. A younger fleet reduces the declines in car value that Hertz books on its balance sheet.

Over the past year, the company has expanded into used-car sales, launching an online car-buying marketplace and partnering with Cox Automotive and Amazon Autos to offset the slowdown in vehicle rentals. It also offloaded a majority of its Teslas last year, citing higher repair costs.

In Q3, Hertz’s revenue fell 4% to about $2.5 billion, but topped estimates of $2.4 billion. Adjusted EPS of $0.12 hadidly topped the $0.02 estimate.

As of the last close, Hertz’s stock is up 84% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227231004_jpg_0de480c6f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254924041_jpg_892ccf911d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1234736300_jpg_881ee00045.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218899763_jpg_5d8b51f97d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump_golden_dome_resized_jpg_38d699de1f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222922178_jpg_42dd8f319f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)