Advertisement|Remove ads.

Lucid Stock Hits Record Low As Air Sedan Recall Piles On Worries Over Trump’s EV Policy: Retail Stays ‘Bearish’

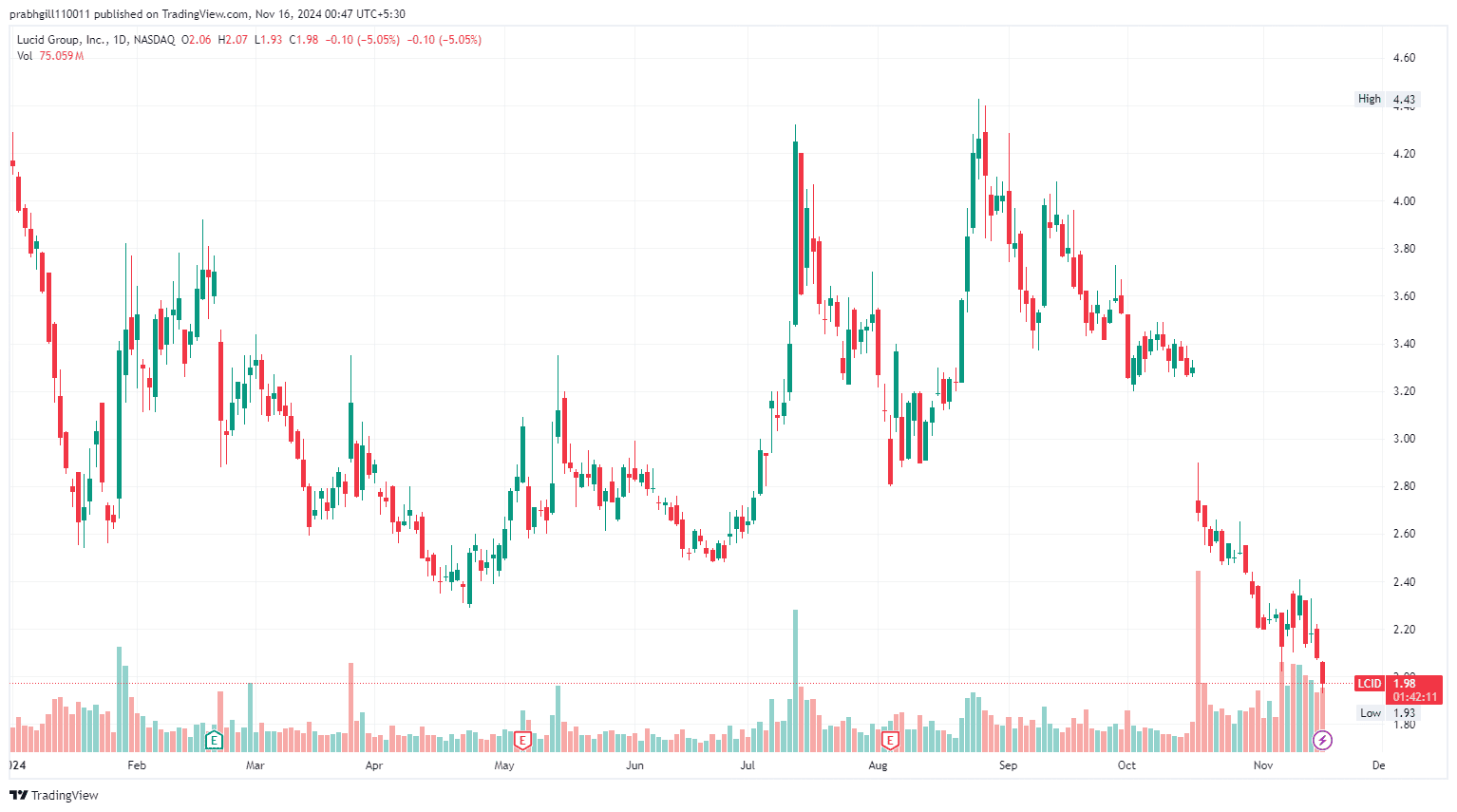

Shares of Lucid Group Inc. ($LCID) fell over 6% in midday trading on Friday, hitting an all-time low of $1.93, following a recall of more than 1,500 Air Pure sedans due to drive power loss issues.

“Certain 2024 and 2025 Lucid Air models were manufactured with an RDU subframe wiring harness design that was shorter than the original design length,” the company said in its filing with the U.S. National Highway Traffic Safety Administration (NHTSA).

This recall adds to the mounting pressure on EV stocks, which are already grappling with concerns about a potential rollback of electric vehicle incentives.

Reports suggest President-elect Donald Trump plans to eliminate the $7,500 consumer tax credit for electric vehicle purchases as part of a broader tax-reform effort.

Throughout his 2024 election campaign, Trump criticized electric vehicles, claiming they were being imposed on consumers through unfair regulations, and pledged to end what he called the "electric vehicle mandate."

The broader EV sector is also facing headwinds, with global sales momentum slowing for electric vehicles. Rivian ($RIVN), fellow U.S. EV maker, dropped to a six-month low of $9.55 on Friday.

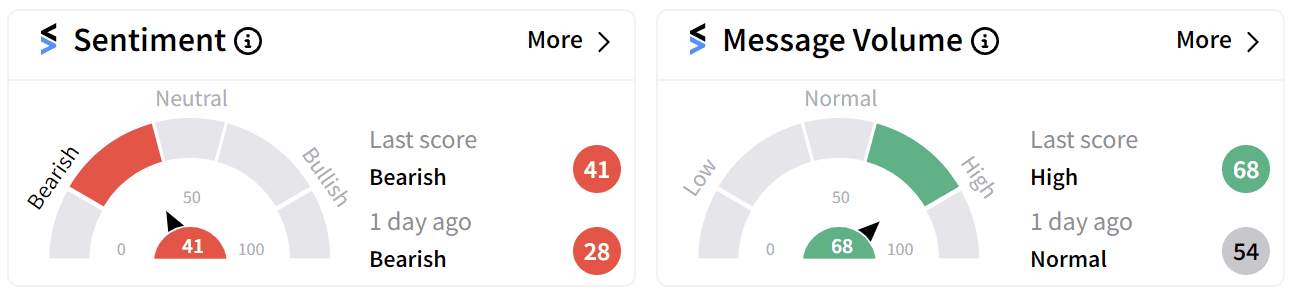

Retail sentiment around Lucid on Stocktwits continued to remain ‘bearish’ with a slight uptick in chatter to ‘high’ from ‘normal’ a day ago.

Users on the platform are frustrated with CEO Peter Rawlinson, especially given his appearance on Bloomberg Friday morning failing to allay concerns about the company’s cash burn and future funding, coinciding with the announcement of recalls.

The potential removal of EV subsidies could also harm the electric vehicle plans of major automakers like Ford ($F), General Motors ($GM), and Stellantis ($STLA), especially if they shift focus to more profitable gas-powered vehicles.

Lucid’s stock has lost more than half its value this year, falling 52% so far in 2024.

For updates and corrections email newsroom@stocktwits.com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250993932_jpg_77e7b26c88.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Deere_resized_a913c16f0a.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_b2gold_jpg_2d344842dd.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_whitehouse_OG_jpg_2cc16854dc.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Vanda_jpg_943c16fa4f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_brian_armstrong_OG_jpg_3ac8291bf2.webp)