Advertisement|Remove ads.

Tilaknagar Industries: Imperial Blue Buyout Triggers Bullish Calls, SEBI RAs See 40% Potential Upside Ahead

Tilaknagar Industries shares continued their strong run, rising 2% on Thursday after the company announced the acquisition of Imperial Blue whisky from Pernod Ricard India for ₹4,150 crore. For the week, Tilaknagar has clocked in a 22% rally.

Imperial Blue is one of the top three whisky brands in the country by volume. With this move, the company aims to transition from being a brandy-dominated company to a diversified liquor player, noted SEBI-registered analyst Pradeep Carpenter.

He added that this deal brings immense volume, scale, and brand equity to Tilaknagar’s portfolio, aligning with its 2030 Vision to reduce dependence on brandy and capture a broader share of the premium liquor market.

Analyst Prameela Balakkala adds that the Imperial Blue deal could improve topline growth over the medium to long term. The company continues to invest in premiumization and new flavors under its brandy line while venturing into the Ready-to-Drink (RTD) segment. It has consistently reduced its debt while reporting better profits and healthy margins over the last few quarters.

Technical Trends

Carpenter highlighted that Tilaknagar has delivered an impressive 40% rally in just the last 10 trading sessions, backed by strong volumes and bullish sentiment. It recently clocked a lifetime high, showing clear signs of institutional accumulation and aggressive re-rating.

If the price sustains above the ₹490 breakout level, it could see a sharp move toward ₹575, followed by a potential extension up to ₹675 based on Murrey Math levels and continuation patterns, he added. While near-term consolidation or correction can’t be ruled out after such a sharp move, the ₹400 zone appears to be a strong support area. It can act as a strategic accumulation level for positional traders.

Momentum indicators support this bullish outlook. Its Relative Strength Index (RSI) is above 70, indicating a strong trend despite being in overbought territory. PSAR and Supertrend both reflect a confirmed bullish structure.

Carpenter concluded that this combination of fundamental tailwinds and technical strength makes Tilaknagar a stock to keep on the radar for medium-term traders.

Balakkala also added that the strong uptrend was visible on its daily chart, with price action forming higher highs and breaking past recent swing levels. The stock has faced resistance near ₹508 (horizontal level marked), aligning with the upper trendline from previous highs. She identified support near 20-day EMA, with a stronger base at 200-day SMA. A notable increase in volume, along with a price breakout, reflects institutional activity or accumulation.

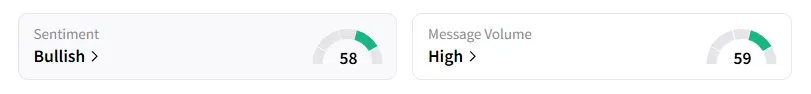

Data on Stocktwits shows that retail sentiment has been ‘bullish’ on this counter for a week amid ‘high’ message volumes.

Tilaknagar Industries shares have risen 12% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_iren_OG_jpg_ba842dd11a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_fsd_jpg_f113fd1ea5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Christopher_Giancarlo_OG_jpg_915015c289.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227884296_jpg_f4ab8e4dcf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_hims_stock_logo_resized_jpg_5554a2a2c1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_crypto_atm_OG_jpg_ab7e4567eb.webp)