Advertisement|Remove ads.

Transocean, Valaris To Form $17 Billion Offshore Drilling Firm – VAL Stock Jumps 13%, RIG Slumps 6% In Pre-Market

- Transocean shareholders will own around 53% of the new entity, while Valaris investors will hold the remaining 47%.

- The deal is expected to close in the second half of 2026.

- The board of the combined firm will include nine existing Transocean directors and two from Valaris.

Transocean Ltd. (RIG) announced on Monday that it has signed an agreement to acquire Valaris (VAL) in an all-stock transaction valued at about $5.8 billion. The deal will create a combined company with an enterprise value of roughly $17 billion.

RIG stock was down around 3% in pre-market trading while VAL shares jumped more than 21%.

Terms Of The Agreement

Upon completion, Transocean shareholders will own around 53% of the new entity, while Valaris investors will hold the remaining 47%. Valaris shareholders will receive a fixed exchange ratio of 15.235 Transocean shares for each Valaris share.

The deal is expected to close in the second half of 2026, after which Keelan Adamson will become the chief executive officer of the merged company, and Jeremy Thigpen will serve as executive chairman.

The board will include nine existing Transocean directors and two from Valaris, while the company will stay incorporated in Switzerland and maintain its main administrative office in Houston.

Details Of The Merged Firm

The merger will establish an offshore drilling firm with a fleet of 73 rigs, including ultra-deepwater drillships, semisubmersibles, and modern jackups. According to Valaris’ latest fleet status report, its contract backlog is around $4.5 billion as of Oct. 23, 2025.

“We have identified more than $200 million in cost synergies that will complement our ongoing efforts to safely lower costs. The strong pro forma cash flow enables us to accelerate debt reduction, resulting in an expected leverage ratio of about 1.5x within 24 months of the transaction closing,” said Keelan Adamson, Transocean President and Chief Executive Officer.

How Did Stocktwits Users React?

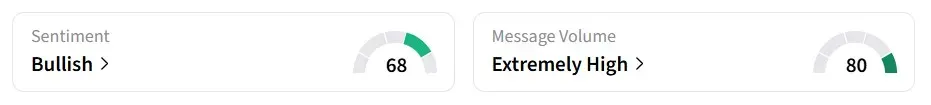

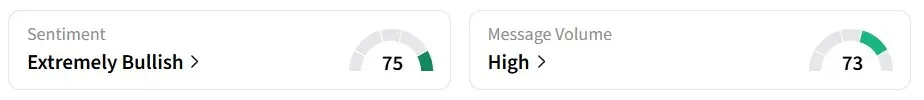

Retail sentiment for VAL on Stoktwits turned ‘bullish’ from ‘neutral’ a day earlier, amid ‘high’ message volumes, while sentiment for RIG remained ‘bullish’ over the past 24 hours. RIG was also among the top trending tickers on the platform at the time of writing.

One user said the deal reduces RIG’s debt and essentially enables a monopoly.

Another user expects RIG’s stock to climb to $8, over 50% upside to its current price of $5.2.

RIG stock has gained nearly 30% so far in 2026, while VAL shares have gained around 24%.

Read also: LLY Stock Climbs Pre-Market On $2.4 Deal To Acquire Orna Therapeutics

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1813801150_jpg_9e452258fa.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2190302521_jpg_796f64970e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194612888_1_jpg_5f7b7f6186.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1384896168_jpg_87fab3f04d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263571605_jpg_f769289486.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233719278_jpg_46dfac21ee.webp)