Advertisement|Remove ads.

Trump Reportedly Says Dollar ‘Doing Great’ Even As It Slips To Lowest Level In Nearly Four Years

- As per the report, which cited market observers, the dollar’s weakness comes from risks around Trump’s political polarization, and unpredictable policymaking, among other reasons.

- Trump reportedly implied that he could influence the direction of the U.S. dollar.

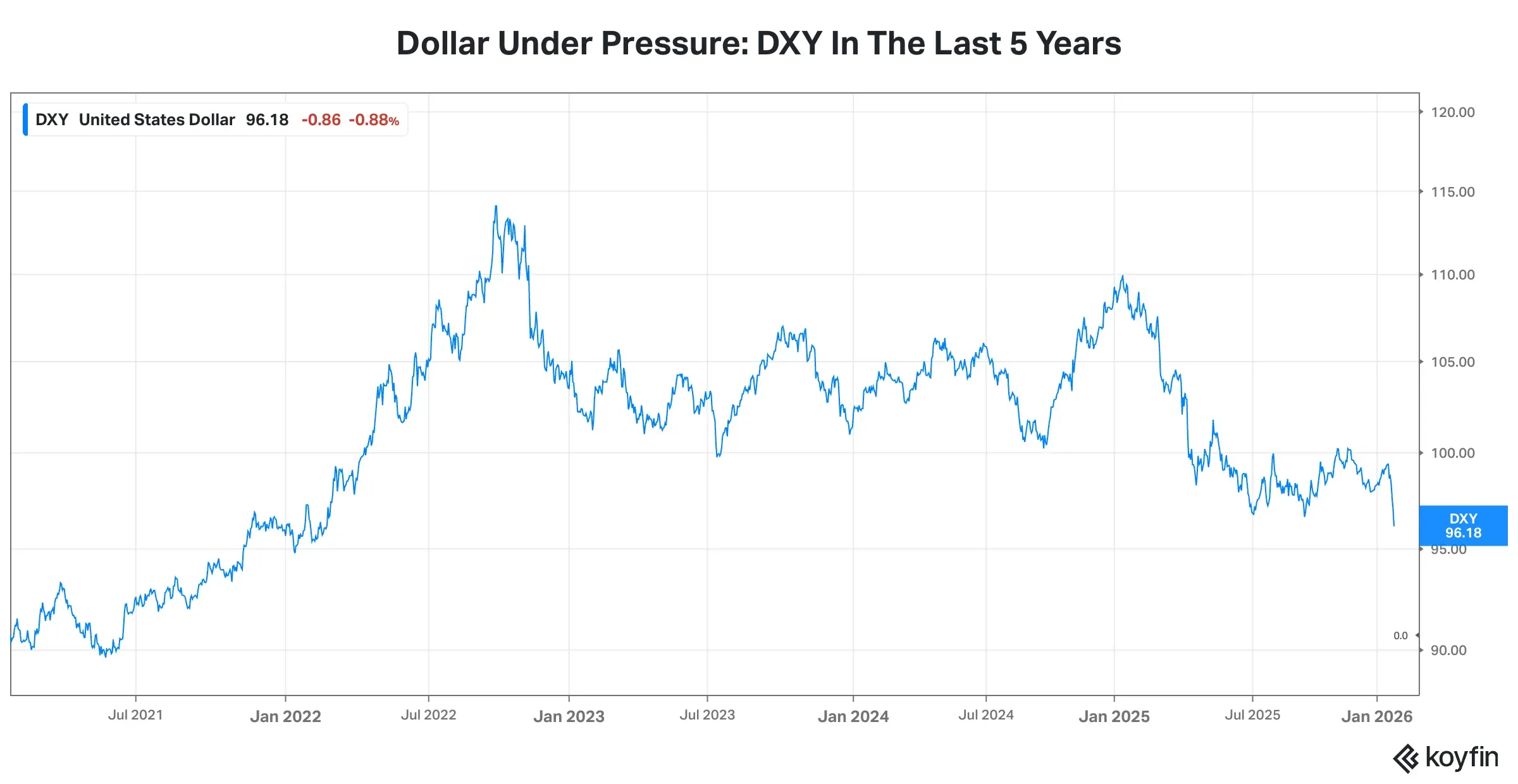

- Meanwhile, the ICE U.S. Dollar Index, which tracks the dollar’s value against a basket of foreign currencies, has been at its lowest level since February 2022.

U.S. President Donald Trump reportedly said on Tuesday that the dollar has not unduly weakened, even as the currency nears four-year lows.

“No, I think it’s great,” Trump said in Iowa, according to a report from Bloomberg. “I think the value of the dollar — look at the business we’re doing. The dollar’s doing great,” the president said in response to a question about whether he was worried about a decline in the currency.

“I want it to be — just seek its own level, which is the fair thing to do,” Trump said, according to Bloomberg.

Meanwhile, the premier currency has been trending lower on the impact of trade tariffs and uncertainty around Trump’s policies.

U.S. Dollar Levels

The U.S. Dollar Index (DXY), which tracks the dollar’s value against a basket of foreign currencies, has been at its lowest level since February 2022, as per data from Koyfin.

At the time of writing, DXY was down 1.29%, trading around 95.79 levels.

According to the Bloomberg report, which cited market observers, the dollar’s weakness comes from risks around Trump’s pressure on the Federal Reserve, concerns over the country’s fiscal outlook and its growing debt load, political polarization, and Trump’s unpredictable policymaking, including threats to take over Greenland.

The sudden resurgence of the Japanese yen since last week may have also contributed to the weakness, the report noted.

Trump’s Dollar Control

Trump reportedly implied that he could influence the direction of the U.S. dollar, saying he could make it “go up or go down like a yo-yo,” though he framed such volatility as undesirable.

The president compared currency manipulation to artificially inflating employment figures and criticized Asian economies for deliberately weakening their currencies.

Pointing to China and Japan, Trump said he frequently clashed with their leaders over what he described as repeated efforts to devalue the yen and the yuan, arguing that such moves made it difficult for U.S. companies to compete.

“If you look at China and Japan, I used to fight like hell with them, because they always wanted to devalue their yen. You know that? The yen and the yuan, and they’d always want to devalue it. They devalue, devalue, devalue,” Trump reportedly said on Tuesday, according to Bloomberg.

“And I said, not fair that you devalue, because it’s hard to compete when they devalue. But they always fought, no our dollar’s great,” Trump added, as per the report.

Market Performance

U.S. equities were mixed in Tuesday’s after-market trade. At the time of writing, the SPDR S&P 500 ETF (SPY), which tracks the S&P 500 index, was up by 0.04%, the Invesco QQQ Trust ETF (QQQ) gained 0.16%, while the SPDR Dow Jones Industrial Average ETF Trust (DIA) edged lower by 0.06%.

Retail sentiment around the S&P 500 ETF on Stocktwits was in the ‘bearish’ territory.

Meanwhile, the iShares 20+ Year Treasury Bond ETF (TLT) was down 0.34% at the time of writing, while the iShares 7-10 Year Treasury Bond ETF (IEF) traded 0.07% lower.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Also Read: What Jim Cramer Thinks Is A Big Part Of Nvidia’s Appeal

/filters:format(webp)https://news.stocktwits-cdn.com/large_brian_armstrong_OG_jpg_3ac8291bf2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2227994915_jpg_357c625963.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_paramount_skydance_warner_bros_discovery_jpg_709742214d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2258839311_jpg_35f0914ce1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2238737789_jpg_eca1ed4bd9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259293616_jpg_38a91a25a8.webp)