Advertisement|Remove ads.

Wells Fargo, NU Holdings Garner Heavy Retail Buzz Over Past Week — Here’s Why

Wells Fargo (WFC) and Nu Holdings (NU) stocks drew retail attention among financial equities over the past week.

Retail chatter on Wells Fargo jumped 600% over the previous week.

The Wall Street lender announced a new share buyback plan worth $40 billion.

The lender said the new stock repurchase program would take effect after its current plan expires.

Wells Fargo’s previous share buyback program, worth $30 billion, was launched two and a half years ago.

The bank also cleared its twelfth consent order since 2019 earlier last week in its latest bid to lift a $1.95 trillion asset cap imposed on the bank by the Federal Reserve in 2018 due to its compliance issues.

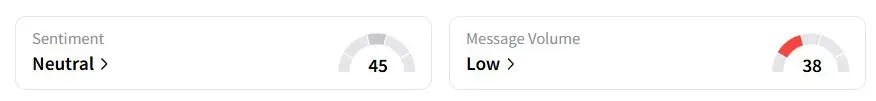

Retail sentiment on Stocktwits was in the ‘neutral’ territory, while retail chatter was ‘low’ on Friday.

One retail investor noted that the bank would be smart to deploy the buyback before the asset cap is lifted.

On the other hand, retail chatter on Nu Holdings rose 400% over the past week.

Nu Mexico, the Mexican arm of the Brazilian fintech firm, secured a banking license from the National Banking and Securities Commission (CNBV), enabling its transition from a Popular Financial Society (SOFIPO) to a full-service bank.

This milestone would allow Nu Mexico to expand its range of financial products, starting with the introduction of a payroll account.

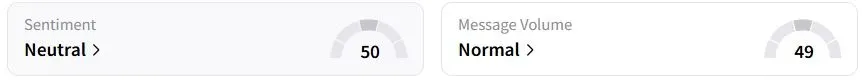

Retail sentiment on Stocktwits was in the ‘neutral’ territory, while retail chatter was ‘normal’ on Friday.

One retail trader said the stock would reach between $16 and $18 after its earnings report, which is expected next week.

Wells Fargo and Nu Holdings stocks have gained 4.7% and 20.1%, respectively.

Also See: Coterra Energy Q1 Preview: Oil And Gas Output In Spotlight; Macroeconomic Factors To Drive Chatter

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228736233_jpg_f3ebe80a4c.webp)