Advertisement|Remove ads.

Why Is Gevo Stock Jumping Nearly 10% Premarket Today?

Gevo stock (GEVO) gained nearly 10% in early premarket trading on Wednesday after the company revealed that it has earned an extension from the U.S. Department of Energy on the conditional commitment for the $1.46 billion loan for its sustainable aviation fuel production facility in South Dakota.

The company stated that the DOE has given GEVO until April 16, 2026, to evaluate potential modifications to the project scope under the conditional commitment to address energy policies and priorities. The ATJ-60 project in Lake Preston, South Dakota, is expected to produce 60 gallons of jet fuel per year.

Gevo said the potential scope modifications include constructing a lower-cost 30-million-gallon-per-year jet fuel production facility at its existing ethanol and carbon capture, utilization, and storage facility in North Dakota, as well as the optimal use of captured carbon dioxide for enhanced oil recovery.

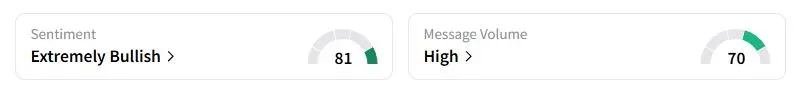

Retail sentiment on Stocktwits about Gevo was in the ‘extremely bullish’ territory at the time of writing.

Last year, Gevo and Calumet Inc. secured loan guarantees from the DOE to bolster sustainable jet fuel production in the U.S. However, concerns had risen about the future of the loans after the Trump administration dialed back on many of the commitments of the Biden administration.

U.S. jet fuel consumption is expected to grow by more than 2 billion gallons per year in the next decade, according to data from the U.S. Energy Information Administration. Gevo intends to produce jet fuel from ethanol, as opposed to the more common source of cooking oil.

“This trade war and the surplus of domestic agricultural products will give birth to the largest domestic SAF production boom in the world. Gevo’s business model checks all the boxes,” one user said.

Gevo stock has gained 23.7% this year.

Also See: Bitcoin Moves Above $112,000 As US Fed Rate-Cut Hopes Rise

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227231004_jpg_0de480c6f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254924041_jpg_892ccf911d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1234736300_jpg_881ee00045.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218899763_jpg_5d8b51f97d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump_golden_dome_resized_jpg_38d699de1f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222922178_jpg_42dd8f319f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)