It was another solid week for U.S. stock market bulls, with technology continuing to lead. 👀

Let’s recap and prep you for the week ahead so you can get back to watching the Super Bowl. 📝

What Happened?

📈 Investors continued to arm their investment portfolios with semiconductor stocks. Nvidia made headlines on Friday by becoming more valuable than the entire Chinese stock market, where sentiment continues to plunge.

🤩 This week’s Stocktwits Top 25 report showed outperformance relative to the indexes.

🚚 In addition to beaten-down tech stocks like Cloudflare and Palantir rebounding, other sectors are also beginning to participate in this bull market. The industrial sector ETF was pushed to new heights with help from the transportation industry.

📺 The advertising environment for smaller platforms remains challenging, with Snap and Pinterest failing to deliver again this earnings season. Meanwhile, Disney jumped after it announced two major content partnerships and shared that its streaming business is nearly profitable.

⚡ Electric vehicle stocks like Tesla are struggling in the current environment, but Toyota Motors has come out on top due to its bet on hybrid vehicles.

🔥 Certain symbols were on the Stocktwits trending tab for most of the week, including $SMCI, $HOLO, $MLGO, $BABA, $PYPL, and $SOL.X.

Here are the closing prices:

| S&P 500 | 5,027 | +1.37% |

| Nasdaq | 15,991 | +2.31% |

| Russell 2000 | 2,010 | +2.41% |

| Dow Jones | 38,672 | +0.04% |

Bullets

Bullets From The Weekend:

😠 Some brands are getting Super Bowl ad attention for all the wrong reasons. Uber Eats wanted to stand out with its Super Bowl commercial but instead is facing backlash after debuting its 60-second commercial earlier in the week. The star-studded commercial attempted to use peanut allergies as humor, but advocates for the more than 33 million Americans who suffer from life-threatening food allergies are pushing back. As a result, the company is now deleting the bit from its commercial in an attempt to stop the bad PR. NBC News more.

🏭 Israel’s Tower proposes $8 billion chip plant in India. Tower Semiconductor is the latest global tech giant attempting to diversify its investments away from China and into India. The company submitted a proposal to build an $8 billion chipmaking facility, looking to capitalize on the incentives the country has put in place to attract foreign investment. However, analysts say Modi’s government has failed to live up to expectations, with several proposals stalled or canceled. More from Reuters.

🤑 Bitcoin ETFs hit the $10 billion milestone in just one month. The new investment vehicles are expected to see additional flows in the coming months as trading firms complete their due diligence and push the products through their distribution networks. The bull case remains that financial advisors and other asset allocators will use these new vehicles to help their clients gain exposure to the crypto market in a way that satisfies regulators. The key question remains how much of an allocation these firms will allocate, as many investment industry leaders still view it as a speculative bet vs. a core asset. Cointelegraph has more.

Your Weekend Watch: “Trends With Friends”

Stocktwits co-founder Howard Lindzon chops it up with pals JC Parets and Phil Pearlman every Thursday on “Trends With Friends.”

In this week’s episode, the friends and special guests discuss:

- Markets: Why seasonality & small-cap weakness has JC ‘shorting everything’ but buying China 😨

- Technology: Apple Vision Pro—Why Apple is uniquely positioned to dominate this new market 🍏

- Howard’s New Toy: How AI tools like FinChat.io help investors identify the trends that matter 🤖

Watch it now on YouTube and Spotify, and subscribe to catch each episode when it goes live!

The Brief

Need a concise summary of what’s going on this week? Look no further. Here’s an overview of important earnings and economic data for the trading week ahead.

Economic Calendar

It’s another light week of economic data, with investors focused on U.S. inflation and housing data. In addition to the above, check out this week’s complete list of economic releases.

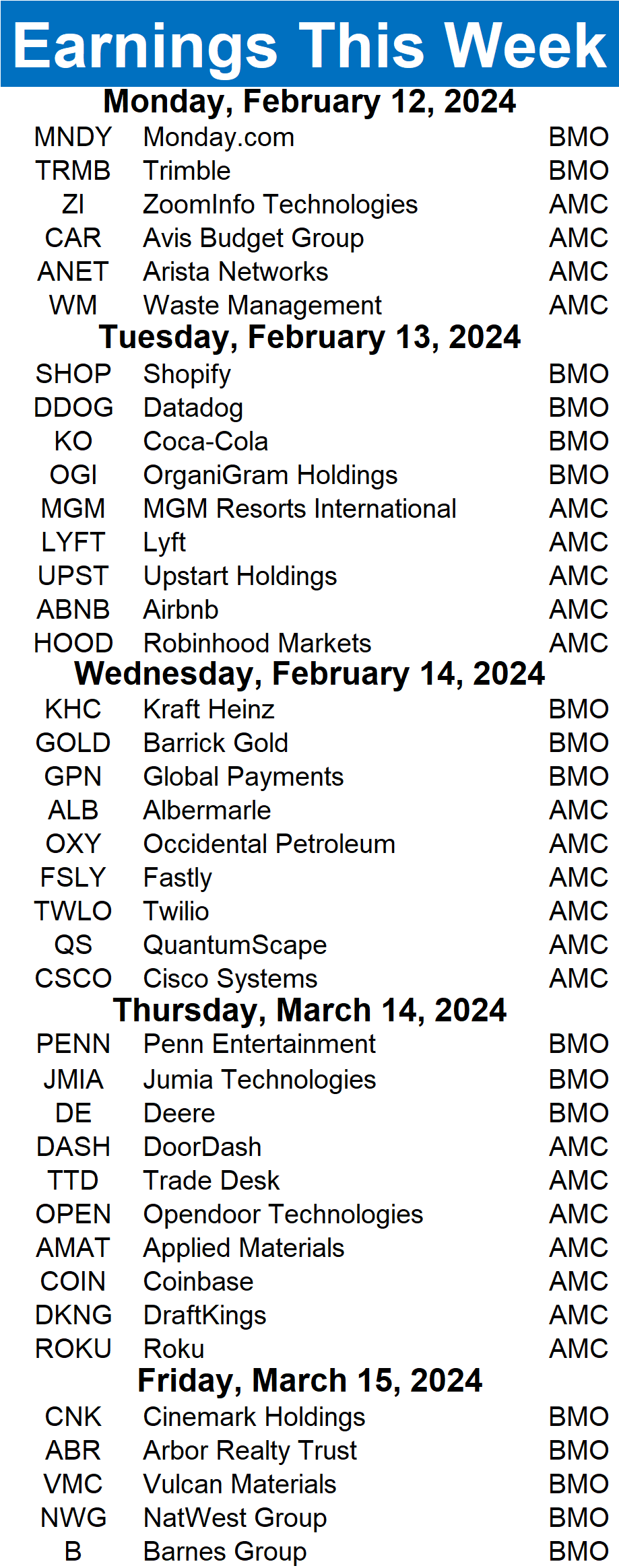

Earnings This Week

Earnings season is in full swing, with 425 total companies reporting this week. Some tickers you may recognize are $SHOP, $ABNB, $LYFT, $UPST, $ALB, $QS, $PENN, $DE, $COIN, and more.

Above is a quick summary. Check out the full Stocktwits earnings calendar for the other names reporting this week.

Stocktwits Spotlight:

On Friday, we discussed industrial and transportation stocks quietly moving higher while everyone was distracted by tech stocks. With the sector breaking out, some investors are finding opportunities in the space. 🕵️♂️

Stocktwits user Clargy shared the JB Hunt Transportation Services chart above, showing the stock breaking out of a multi-year base to all-time highs. One thing to note is that this chart is adjusted for dividends, so the price-only chart is still slightly below its 2022 highs. 📈

Regardless, he sees this breakout as bullish, likely signaling more upside ahead for the transportation giant. So far, the rest of the Stocktwits community hasn’t caught on yet, with only 1,537 people following the stock and its sentiment score sitting marginally in bullish territory.

To track how this develops and see more technical setups, follow Cory Large on Stocktwits! 👀

Links

Links That Don’t Suck:

🚀 Level up your trading with unique social data and an Ad-Free Stocktwits experience

🔥 A crowd destroyed a driverless Waymo car in San Francisco

🚫 Instagram, Threads no longer recommending political content

🐉 Bad economy, nosy relatives: Young Chinese put off by Lunar New Year

💰 Jeff Bezos sells nearly 12 million Amazon shares worth at least $2 billion, with more to come