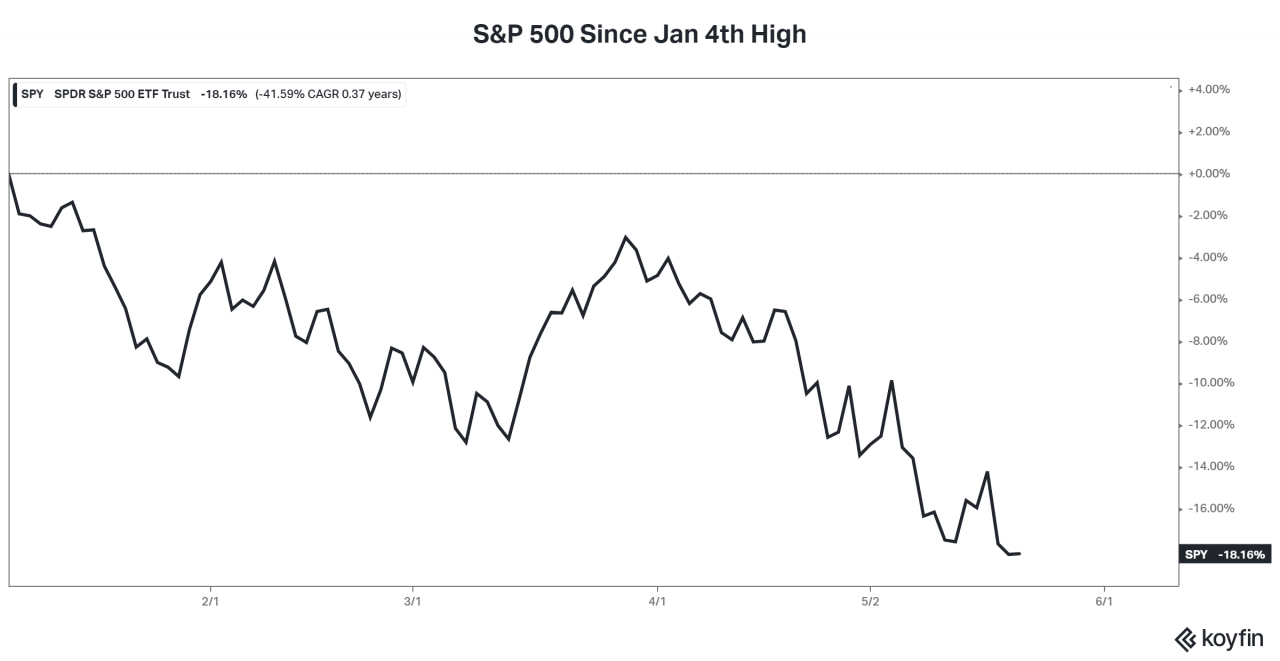

Today’s primary focus in the markets was the S&P 500 *almost* entering bear market territory. 🐻

For those who are unfamiliar, Wall Street likes to define a bear market as anything which has fallen more than 20% (on a closing basis) from its former highs.

In the case of the S&P 500, it’s fallen nearly 21% since its January 4th all-time highs, but it’s only down by 18.16% on a closing basis. Thus, no bear market just yet, right? 😆

Those of you who think that’s a silly way of looking at things. We think so too. 🙃

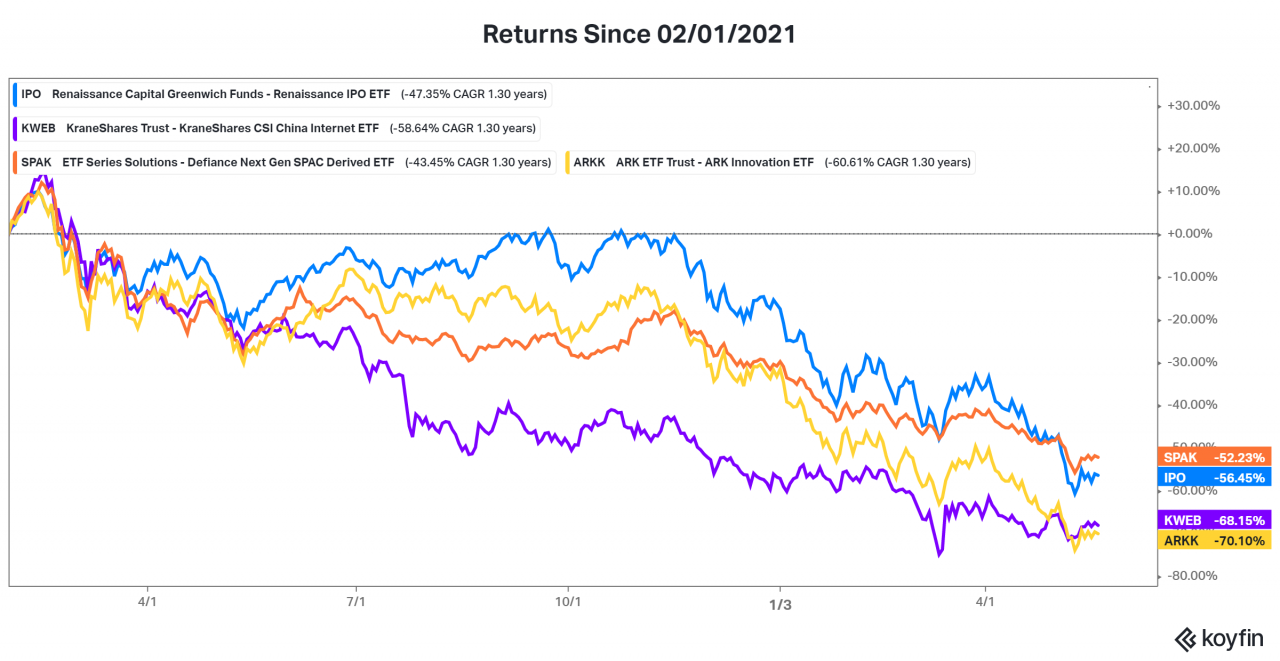

Anyone trading individual stocks knows it’s been a rough market for about a year.

Look no further than the highly speculative market areas that peaked in February 2021. $ARKK, $SPAK, $IPO, $KWEB, all down bigly. Broader indexes like the Emerging Markets also peaked due to the index’s exposure to the technology sector. 📉

So far this year, the median S&P 500 stock is down 15%, 25% in the tech-heavy Nasdaq 100, and 24% in the broader Russell 2000 index.

The bear market is here…and has been for a while. 📅

The strategies that had worked well in the past are not the same ones working today. If you’re struggling in this environment, know that this is all part of the game.

Focus on the things that matter to your investment plan and not headlines about an arbitrary 20% decline. 📰

Nobody knows when the bear market will end, but history tells us there will be tremendous opportunities for patient market participants coming out of this.

There always are! 👍