Here is a quick look at how the Technology Services sector in the Nasdaq performed for 2022.

Everything is in the red YTD in this sector, except for one company.

Like Kate Winslet floating on a door frame amongst an ocean of the deceased, Activision Blizzard is the only survivor YTD. 🛳️

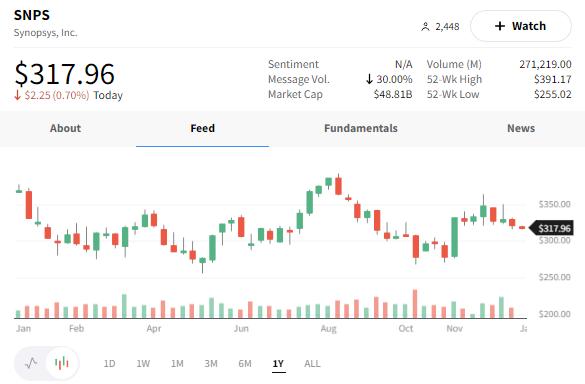

The fifth-best performer, Synopsys, is down double-digit percentage points.

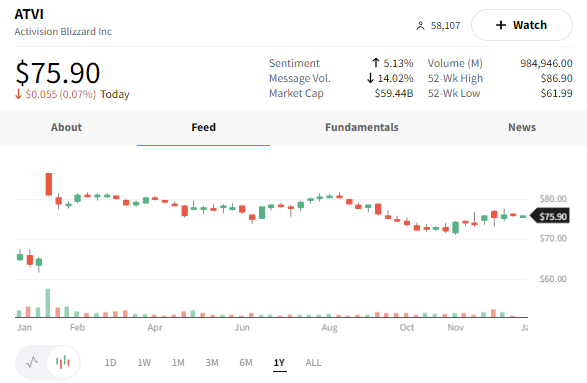

$ATVI YTD +14.28%

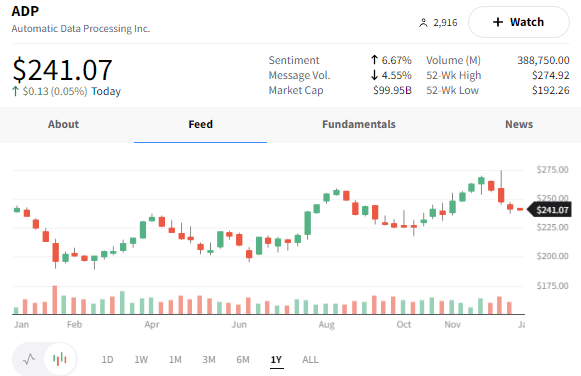

$ADP YTD -1.71%

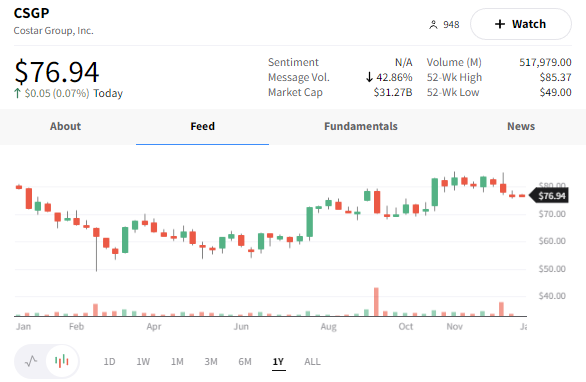

$CSGP YTD -3.18

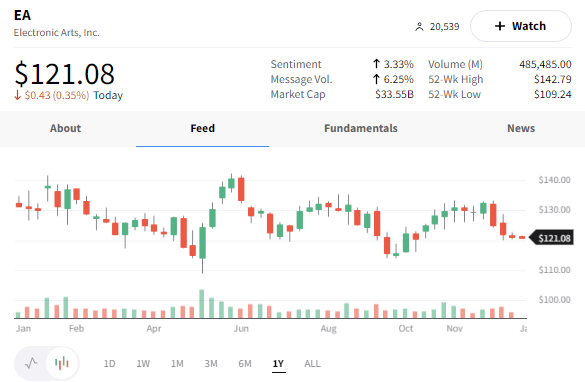

$EA YTD -8.29%

$SNPS YTD -13.59%

Knowing the five best performers begs the question: what stock was the biggest loser in this sector?

There’s no ‘I’ in TEAM, but there’s an ‘A’ in failed.

Answer: $TEAM YTD -67.11% 🤦