Advertisement. Remove ads.

Boeing Eyes $15B Capital Raise Amid Strike And Credit Concerns: Retail On The Fence

Boeing Inc.’s ($BA) shares were trading down marginally in premarket trading on Monday even as reports suggested the aerospace giant could raise $15 billion in capital as early as today, lifting retail sentiment slightly.

Sources cited by Bloomberg indicate that Boeing’s advisors have been actively working to secure investors for an offering that would likely include both shares and convertible debt. The amount could surpass $15 billion depending on demand, though Boeing has yet to confirm these plans.

The capital raise follows Boeing’s recent filing with the SEC to raise up to $25 billion through a mixed securities offering, approved on Oct. 23.

This effort aims to avoid a downgrade to junk status amid increasing financial strain. Boeing also secured a $10 billion credit agreement to provide immediate liquidity on Oct. 14.

According to Bloomberg’s data, a $15 billion share sale would be the largest equity offering since SoftBank Group Corp. sold part of its stake in T-Mobile US Inc. in 2020.

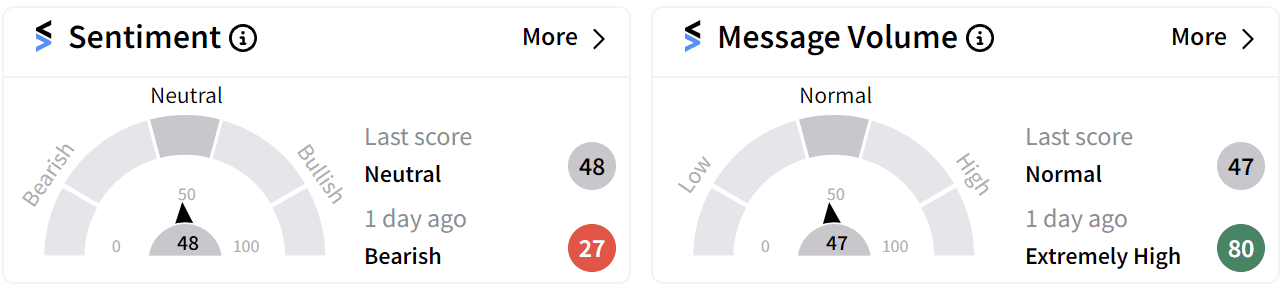

Retail sentiment on Stocktwits has marginally improved to ‘neutral’ (48/100), up from ‘bearish’ (47/100) a day ago even though chatter around the stock has dipped to ‘normal’ from ‘extremely high’.

Investors and Wall Street are watching closely as the company’s ongoing union strike, now in its seventh week, has halted 737 MAX production and created a significant cash drain.

Analysts estimate that the strike has led to $7.6 billion in economic losses, with Boeing absorbing $4.35 billion. Boeing recently offered workers a 35% wage increase over four years, incentive bonuses, and a $7,000 ratification bonus, which was rejected last week.

To further address its financial pressures, Boeing is reportedly considering selling its space business. Sources told the Wall Street Journal that the sale is part of CEO Kelly Ortberg’s efforts to streamline operations and cut down on its financial losses.

“It will take time to return Boeing to its former legacy but, with the right focus and culture, we can be an iconic company and aerospace leader once again,” stated Boeing CEO Kelly Ortberg In a message to employees regarding third-quarter results.

The stock has lost 39% of its value so far in 2024.

For updates and corrections email newsroom@stocktwits.com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_new_b2128e67d9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2228236200_jpg_4e01019dfd.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_abbvie_logo_resized_2b8fc4a175.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2149589805_jpg_ceec7778b8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227884296_jpg_f4ab8e4dcf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Uber_July_8874a038f1.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)